India

Stay informed about India’s immigration policies, visa requirements, and legal aspects of moving to or from India. This section provides up-to-date information essential for navigating the complexities of Indian immigration law and procedures.

Spicejet Starts 4 Fujairah Repatriation Flights to India. Here’s How to Book

SpiceJet operated 12 special repatriation flights from Fujairah to India on March 3-4, 2024, while resuming regular schedules to Delhi and Mumbai.

Canada Pledges $100 Million for Indian Students in Talent and Innovation Strategy

Canada launches a major Talent Strategy with India, featuring $100M for scholarships, 13 university partnerships, and streamlined visa…

Vestas CEO Warns €1 Billion Investment May Leave Denmark Over Social Democrats’ Wealth Tax

Vestas and other business leaders threaten to leave Denmark over a proposed 0.5% wealth tax targeting fortunes over…

Air India Halts Flights to Gulf and Israel, Stranding Indian Workers. Now What?

Air India extends Middle East flight suspensions through March 4, 2026, as the U.S. issues 'DEPART NOW' orders…

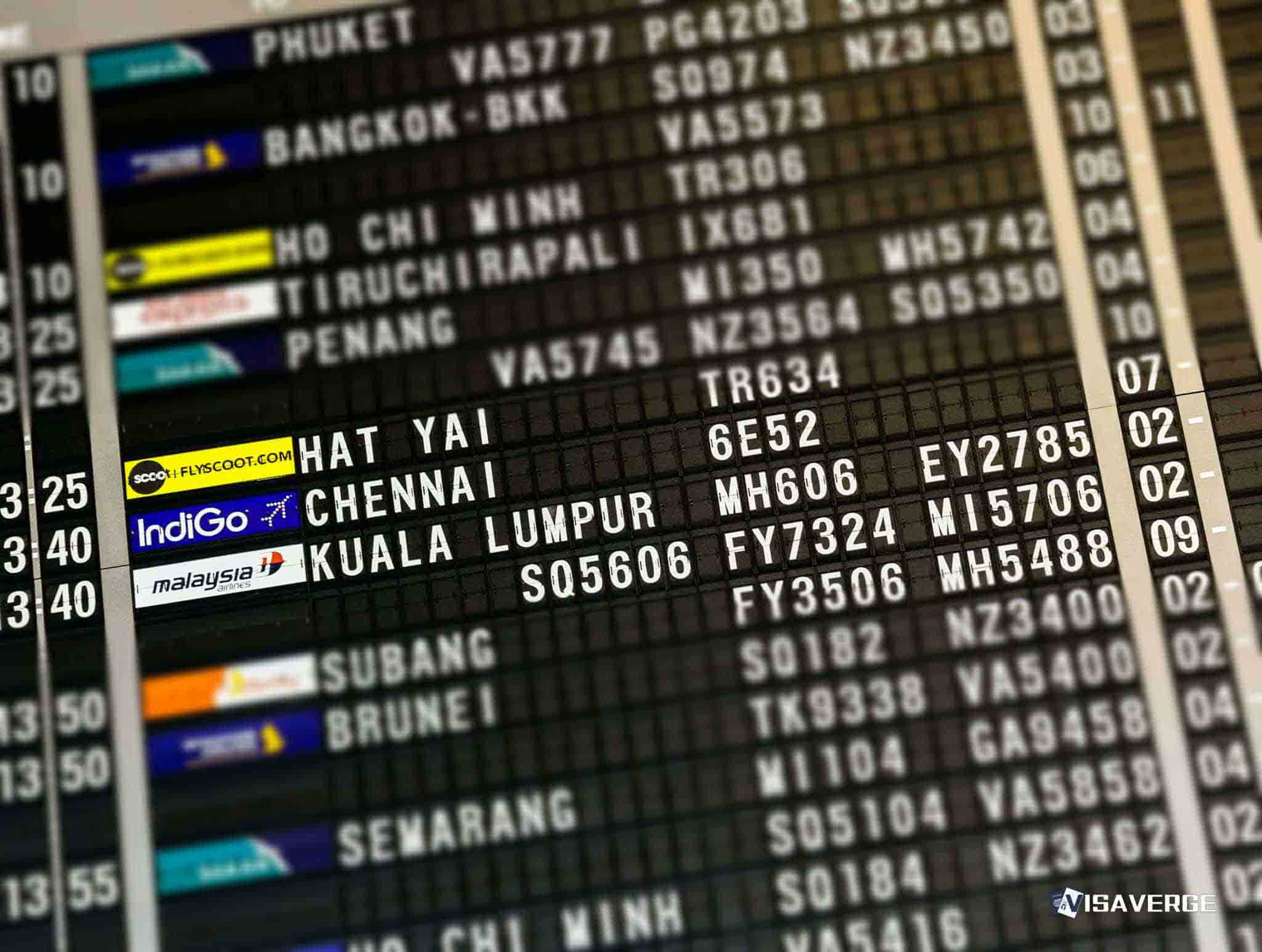

Indigo Restarts Jeddah Flights, Air India Express Returns to Muscat. UAE Still Blocked

Indian airlines resume limited Middle East flights via Muscat and Jeddah while major Gulf hubs remain suspended due…

Oman Remains the Last Gateway to the UAE as India and Asia Routes Shift

(MUSCAT, OMAN) Oman has become the main workable gateway for many travelers trying to reach the UAE while…

Indian Expats Take 400km Road Trip from Muscat to Dubai, Avoid Hatta Border and Airport Disruptions

(MUSCAT, OMAN) — With airport disruptions still rippling through Muscat and Dubai, more Indian expats in Oman are…

Air India Extends UAE and Middle East Airspace Closures, Delays Return

Air India extends flight suspensions to the UAE, Saudi Arabia, Israel, and Qatar through March 3, 2026, amid…

Indian High Commissioner Urges Canada to Add 60 Million People of Indian Origin

India's envoy urges Canada to reach 100M residents as PM Carney secures trade deals and U.S. visa dates…

India Has Most Nationals Stranded in Dubai. Embassy Offers Contacts and Rights Guidance

Iran-Israel conflict triggers Gulf airspace closures, stranding thousands of Indians. Embassies activate emergency helplines as flight cancellations hit…