(UNITED ARAB EMIRATES) Choosing between the UAE Golden Visa and Saudi Premium Residency has become one of the biggest long-stay decisions in the Gulf for investors, founders, and skilled workers who want a stable base without the stress of short renewals. Based on the provided 2025 comparison data, the UAE option fits more people because it combines a renewable 10-year stay, no minimum stay rule, zero personal income tax, and unusually wide family sponsorship rights. Saudi’s offer is different: it can give true lifetime residence through a one-off payment, but it comes with higher entry costs, tighter family age rules, and—depending on the track—an annual stay expectation that can be hard for frequent travelers.

Interest in Saudi’s program is rising fast. The source material says Saudi Premium Residency leads rose 83.4% since early 2025, a sign that applicants see upside in the country’s reforms and in Vision 2030 projects. Still, many applicants pick the UAE because the expat system is older, daily life is more predictable, and the rules are built around flexibility for globally mobile families.

The core trade-off: flexibility versus permanence

If you want the simplest way to keep long-term status while spending time outside the region, the UAE Golden Visa is built for that: no minimum stay requirement and the ability to remain outside the country without losing the visa, as described in the source. If you want a “done once” status and are ready to tie your life more closely to a single market, Saudi Premium Residency stands out because the main offer is lifetime.

A practical way to frame the choice is:

- Pick the UAE if you want mobility, broad family coverage, and a proven expat ecosystem.

- Pick Saudi Arabia if you want permanence and plan to build a long-term base that matches the country’s reform push under Vision 2030.

According to analysis by VisaVerge.com, most long-stay applicants should start by mapping family needs and travel patterns before they compare costs, because these two factors usually decide the outcome faster than marketing perks.

Key takeaway: choose flexibility (UAE) if you travel or sponsor older dependents; choose permanence (Saudi) if you want a one-time, long-term commitment and will base yourself mainly in Saudi.

Side-by-side: length of stay, renewal rules, and time outside

Both programs give long stays, but they “feel” very different in real life.

UAE Golden Visa (renewable long stay)

- Duration: 5–10 years, renewable automatically if conditions are met, such as continuing to meet the qualifying basis like property ownership (per the provided content).

- Minimum stay: None, with “unlimited time outside UAE” stated in the source material.

- Practical effect: You can keep a UAE base while working across several countries or while spending long periods back home with family.

Saudi Premium Residency (permanent or annual)

- Duration: Lifetime (one-off SAR 800,000, shown as about USD 212,800–215,000) or annual (SAR 100,000 per year, shown as about USD 26,600/year).

- Minimum stay: 180 days/year for some tracks, while the source also notes “none official for lifetime,” and flags conflicting reporting across sources.

- Practical effect: The lifetime path removes renewal anxiety, but applicants should be ready for tighter compliance expectations if they pick a track tied to time-in-country.

Family sponsorship rules that change the whole calculation

For many households, family rules matter more than the main applicant’s rights.

UAE Golden Visa family coverage (wide)

- The source says the UAE allows sponsorship of spouse, children of any age, parents, and also mentions unlimited domestic staff.

- That “children any age” point is a major divider for families with university students, adult children with disabilities, or adult children who still live at home.

Saudi Premium Residency family coverage (more limited)

- The source describes sponsorship for spouse, children under 25/21, and dependent parents, with visitor visas used for others.

- The age cap can be the deciding factor for families with older children, especially if the goal is to keep everyone on one long-term status.

Cost and eligibility: property thresholds, investor routes, and upfront cash

This is where the programs move far apart.

Key eligibility thresholds and costs

| Program | Typical entry route | Minimum / fee (as cited) |

|---|---|---|

| UAE Golden Visa (real estate route) | Property ownership | AED 2M (about USD 545K) |

| Saudi Premium Residency (investor route) | Investor + jobs | SAR 7M (about USD 1.87M) plus 10 jobs (per source for that investor track) |

| Saudi Premium Residency (lifetime fee) | One-off payment | SAR 800,000 (~USD 212,800–215,000) |

| Saudi Premium Residency (annual) | Year-by-year option | SAR 100,000/year (~USD 26,600/year) |

- The UAE lower property minimum makes the route feel more reachable for mid-career professionals and small-business owners.

- The Saudi investor track (if the “10 jobs” condition applies) can be both a wealth and operational commitment.

If you expect to relocate again, the UAE’s lower entry point and renewability can reduce regret. If you plan to stay for decades, Saudi’s lifetime fee can look cleaner on paper, even if it’s steep at the start.

Work, business ownership, and daily freedom

Both programs aim to reduce dependence on local sponsors, but they do it in different settings.

- UAE Golden Visa (as stated):

- 100% ownership (mainland) and no sponsor needed.

- Ability to work and study more freely without the usual short visa churn.

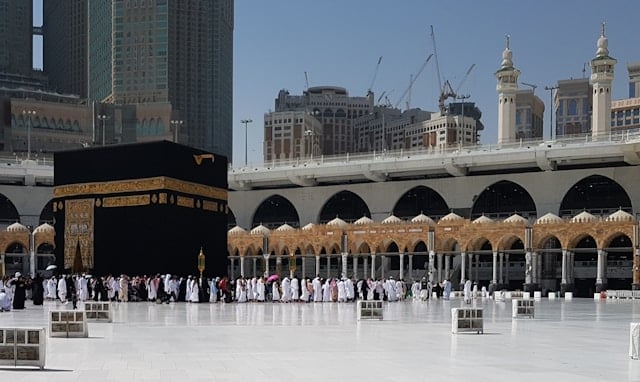

- Saudi Premium Residency (as stated):

- Full ownership rights “except Mecca/Medina”, and “no kafala sponsor.”

- The source also says job changes can happen freely, which matters for talent who want to move between employers.

In practice, the UAE’s long-established free-zone and mainland business environment can feel simpler for first-time founders. Saudi’s environment is moving fast, but for some people it still feels like a newer system with more policy-change risk.

Taxes, fees, and what “savings” really means

The source material is clear on the UAE side and more limited on the Saudi side.

- UAE Golden Visa tax position (as listed):

- Zero personal income tax, plus zero capital gains and inheritance tax, and access to double taxation treaties.

- Saudi Premium Residency cost relief (as listed):

- Exemption from “annual expat/dependent fees,” with no claim in the source about a personal income tax position for residents.

For applicants who earn high salaries, dividends, or capital gains, the UAE’s tax setup can be a deciding point because it is spelled out clearly in the source comparison.

Travel and lifestyle: passports aren’t the only story

The source points to travel convenience and lifestyle discounts as real perks.

- UAE benefits (as listed):

- Multiple-entry access, plus “visa-free to 133 countries + 47 on arrival.”

- Esaad/Fazaa discounts: “7,000+ UAE businesses + 92 countries,” with access to healthcare and education.

- Saudi benefits (as listed):

- Free exit and re-entry without permits, plus “priority airport lanes.”

- Access to banking, healthcare, utilities, and expanding transport links such as airports and rail.

These perks matter most for families who travel often and for professionals who need fast, predictable entry and exit.

Decision framework for common real-life profiles

Use these questions to pick a direction quickly:

- Do you need to spend long periods outside the country?

- If yes, the UAE’s no minimum stay rule fits better.

- Do you need to sponsor adult children or parents long-term?

- If yes, the UAE’s “children any age” and parent coverage may be the safer fit.

- Is your goal a single permanent base tied to big national projects?

- If yes, Saudi’s lifetime path can match a long bet on Vision 2030 and the new economy it aims to build.

- Are you buying property mainly to qualify?

- Compare AED 2M versus SAR 7M (plus the “10 jobs” condition in the cited investor track) before you fall in love with a location.

Practical next steps and resources

- Map family composition, travel patterns, and long-term plans first — these often decide the outcome faster than marketing.

- Compare cash flow (upfront lifetime fee vs. renewals) and exit flexibility (minimum-stay rules).

- For official UAE requirements and application channels, start with the government portal at ICP – The Federal Authority for Identity, Citizenship, Customs and Port Security, then confirm which Golden Visa category fits your case (property, entrepreneur, or talent) and what proof the authority expects this year.

If you’d like, I can:

– Create a one-page comparison checklist tailored to your family and travel patterns.

– Estimate the break-even point between Saudi’s lifetime fee and UAE renewal costs given a time horizon you choose.

The UAE Golden Visa emphasizes mobility: renewable 5–10 year terms, no minimum stay, wide family sponsorship, and clear tax benefits. Saudi Premium Residency offers permanence through a lifetime fee (SAR 800,000) or annual option (SAR 100,000), but has higher entry thresholds, family age limits, and potential stay expectations. Choice depends on family composition, travel habits, and willingness to commit financially and geographically to Vision 2030 projects.