The American retirement savings landscape stands at a crossroads. For decades, the Traditional IRA served as the cornerstone of middle-class wealth accumulation—a reliable vehicle for pre-tax savings that grew tax-deferred until retirement. That era is quietly drawing to a close.

The confluence of persistent inflation, the staggered implementation of the SECURE 2.0 Act, and the structural mechanics of income phaseouts has created an environment where the deductible Traditional IRA is becoming an increasingly exclusive benefit.

Key Takeaway

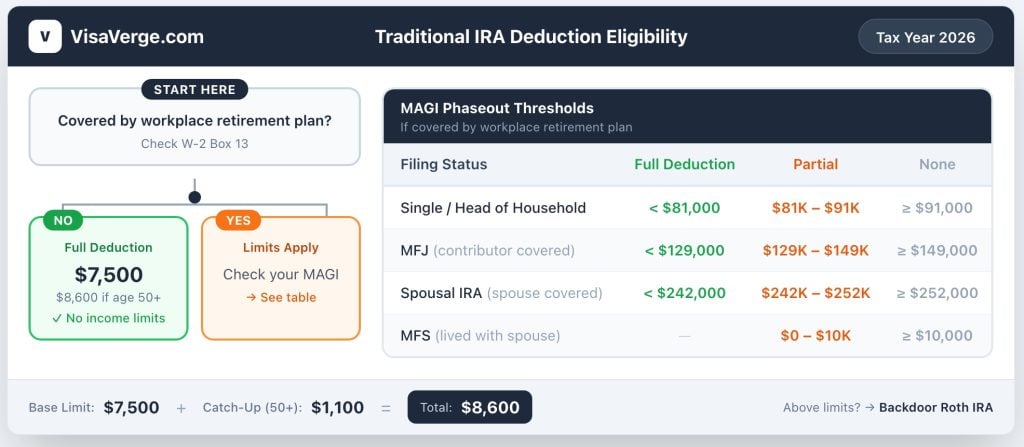

For a Single filer in 2026, the window for a full IRA deduction closes at just $81,000 MAGI—a threshold that effectively excludes a vast segment of mid-career professionals in major metropolitan areas. For Married Filing Jointly, the ceiling is $129,000—easily exceeded by dual-income professional households.

Part I: The Legal Architecture of IRA Deductibility

Before examining specific numbers, practitioners and savers must understand the fundamental legal framework governing IRA deductibility. The Internal Revenue Code does not grant the IRA deduction as a universal right; rather, it frames it as a conditional benefit.

The Active Participant Doctrine

The foundational statute governing IRA deductions is IRC Section 219. This section allows an individual to deduct contributions made to a qualified retirement plan, up to the lesser of their taxable compensation or the statutory limit. However, this deduction is heavily qualified by Section 219(g), which introduces the concept of the “Active Participant.”

Critical Definition: Active Participant

If a taxpayer—or their spouse—is an active participant in an employer-sponsored plan (401(k), 403(b), 457(b), or defined benefit pension), their ability to deduct IRA contributions becomes subject to income testing.

How to Check: Look at Form W-2, Box 13. A checkmark in the “Retirement Plan” box means you are subject to MAGI phaseout limits.

How Active Participation is Determined

| Plan Type | You Are an Active Participant If… |

|---|---|

| 401(k), 403(b) | Any contribution is made to your account—including employer contributions like profit-sharing, even if you contribute nothing yourself |

| Defined Benefit Pension | You are merely eligible to participate, even if you decline or accrue no benefit |

| SEP IRA | Any employer contribution is made for the year |

| SIMPLE IRA | Any contribution (yours or employer’s) is made |

The Mechanics of Inflation Adjustments

The specific dollar amounts for contributions and phaseouts are determined by formulas in IRC Section 415(d), adjusted annually using Chained CPI-U (since the Tax Cuts and Jobs Act of 2017).

| Limit Type | Rounding Rule |

|---|---|

| 401(k) Contribution Limit | Nearest $500 (rounded down) |

| IRA Contribution Limit | Nearest $500 (rounded down) |

| IRA Catch-Up Limit | Nearest $100 (rounded down) — newly indexed under SECURE 2.0 |

| Phaseout Ranges | Nearest $1,000 (rounded down) |

This “step function” growth explains why IRA limits stagnated at $6,000 from 2019–2022, then jumped to $6,500 (2023), $7,000 (2024), and $7,500 (2026).

IRA Deduction Calculator

| Parameter | 2025 | 2026 |

|---|---|---|

| IRA Base Limit | $7,000 | $7,500 |

| Catch-Up (Age 50+) | $1,000 | $1,100 |

| Total (50+) | $8,000 | $8,600 |

| Filing Status | Full Deduction | Partial | No Deduction |

|---|---|---|---|

| Single / HoH | < $79,000 | $79k – $89k | ≥ $89,000 |

| MFJ (Covered) | < $126,000 | $126k – $146k | ≥ $146,000 |

| Spousal IRA | < $236,000 | $236k – $246k | ≥ $246,000 |

| MFS (lived together) | — | $0 – $10k | ≥ $10,000 |

| Category | 2025 | 2026 | Change |

|---|---|---|---|

| IRA Base Limit | $7,000 | $7,500 | +$500 |

| Catch-Up (50+) | $1,000 | $1,100 | +$100 |

| Single Phaseout Start | $79,000 | $81,000 | +$2,000 |

| MFJ Phaseout Start | $126,000 | $129,000 | +$3,000 |

| Spousal Phaseout Start | $236,000 | $242,000 | +$6,000 |

Above the phaseout limits? Consider the Backdoor Roth IRA: make a non-deductible Traditional IRA contribution, then immediately convert to Roth. Consult a tax professional about the pro-rata rule if you have existing pre-tax IRA balances.

Part II: The 2025 Tax Year — Baseline Numbers

The 2025 tax year represents a stabilization period following the high-inflation shocks of 2022–2023.

2025 Contribution Limits

| Parameter | 2025 Limit | Statutory Reference |

|---|---|---|

| Traditional IRA Base Limit | $7,000 | IRC § 219(b)(5)(A) |

| Catch-Up Contribution (Age 50+) | $1,000 | IRC § 219(b)(5)(B) |

| Total Capacity (Age 50+) | $8,000 | — |

Important Note: 2025 Catch-Up Stagnation

The catch-up contribution remained at $1,000 for 2025 despite high inflation. The SECURE 2.0 indexing mechanism had not yet accumulated enough inflation to trigger the $100 rounding increment. This is the final year of the static $1,000 catch-up.

2025 Deduction Phaseout Ranges

Single Filers & Heads of Household (Active Participants)

| Income Level | Deduction Allowed |

|---|---|

| MAGI < $79,000 | ✅ Full deduction |

| MAGI $79,000 – $89,000 | ⚠️ Partial deduction (phases out) |

| MAGI ≥ $89,000 | ❌ No deduction |

The Cliff Effect: The $10,000 phaseout corridor means you lose 10% of your deduction for every $1,000 of income above $79,000.

Married Filing Jointly (Contributor is Active Participant)

| Income Level | Deduction Allowed |

|---|---|

| MAGI < $126,000 | ✅ Full deduction |

| MAGI $126,000 – $146,000 | ⚠️ Partial deduction (phases out) |

| MAGI ≥ $146,000 | ❌ No deduction |

Analysis: The $20,000 phaseout span creates a gentler 5% reduction per $1,000—but the $126,000 floor is low for dual-income professional households.

Spousal IRA (Non-Participant Spouse)

| Income Level | Deduction Allowed |

|---|---|

| MAGI < $236,000 | ✅ Full deduction |

| MAGI $236,000 – $246,000 | ⚠️ Partial deduction (phases out) |

| MAGI ≥ $246,000 | ❌ No deduction |

Strategic Opportunity: Spousal IRA

If one spouse has a workplace retirement plan but the other doesn’t, the non-covered spouse can deduct their full IRA contribution even at household incomes up to $236,000. This is often overlooked by tax software that treats both spouses identically.

Married Filing Separately

| Income Level | Deduction Allowed |

|---|---|

| MAGI $0 – $10,000 | ⚠️ Partial deduction (phases out) |

| MAGI ≥ $10,000 | ❌ No deduction |

Exception: Spouses who lived apart the entire year may use Single filer limits ($79,000–$89,000).

Part III: The 2026 Pivot — SECURE 2.0 Takes Effect

The 2026 tax year marks a structural turning point. Major changes include the first-ever indexed IRA catch-up and activation of the Roth Catch-Up Mandate.

2026 Contribution Limits

| Parameter | 2025 | 2026 | Change |

|---|---|---|---|

| Traditional IRA Base Limit | $7,000 | $7,500 | +$500 |

| Catch-Up Contribution (Age 50+) | $1,000 | $1,100 | +$100 |

| Total Capacity (Age 50+) | $8,000 | $8,600 | +$600 |

Historic Change: Indexed Catch-Up

The $1,100 catch-up contribution marks the first indexation in nearly 20 years. The $1,000 limit had been frozen since the early 2000s, losing over 40% of its purchasing power to inflation. Going forward, this limit will track Chained CPI annually.

2026 Deduction Phaseout Ranges

Single Filers & Heads of Household (Active Participants)

| Income Level | Deduction Allowed |

|---|---|

| MAGI < $81,000 | ✅ Full deduction |

| MAGI $81,000 – $91,000 | ⚠️ Partial deduction |

| MAGI ≥ $91,000 | ❌ No deduction |

Married Filing Jointly (Contributor is Active Participant)

| Income Level | Deduction Allowed |

|---|---|

| MAGI < $129,000 | ✅ Full deduction |

| MAGI $129,000 – $149,000 | ⚠️ Partial deduction |

| MAGI ≥ $149,000 | ❌ No deduction |

Reality Check

If each spouse earns $75,000 (median professional salary in many regions), their combined income of $150,000 completely disqualifies them from any IRA deduction. They must rely entirely on 401(k)s or Backdoor Roth strategies.

Spousal IRA (Non-Participant Spouse)

| Income Level | Deduction Allowed |

|---|---|

| MAGI < $242,000 | ✅ Full deduction |

| MAGI $242,000 – $252,000 | ⚠️ Partial deduction |

| MAGI ≥ $252,000 | ❌ No deduction |

Complete 2025 vs. 2026 Comparison Table

| Category | 2025 | 2026 | Change |

|---|---|---|---|

| Contribution Limits | |||

| IRA Base Limit | $7,000 | $7,500 | +$500 |

| Catch-Up (50+) | $1,000 | $1,100 | +$100 |

| Total (50+) | $8,000 | $8,600 | +$600 |

| Single Filer Phaseouts | |||

| Full Deduction Below | $79,000 | $81,000 | +$2,000 |

| No Deduction Above | $89,000 | $91,000 | +$2,000 |

| MFJ Phaseouts (Covered) | |||

| Full Deduction Below | $126,000 | $129,000 | +$3,000 |

| No Deduction Above | $146,000 | $149,000 | +$3,000 |

| Spousal IRA Phaseouts | |||

| Full Deduction Below | $236,000 | $242,000 | +$6,000 |

| No Deduction Above | $246,000 | $252,000 | +$6,000 |

| MFS Phaseouts | |||

| Phaseout Range | $0–$10,000 | $0–$10,000 | No change |

Part IV: The SECURE 2.0 Roth Catch-Up Mandate

What Changes in 2026

Starting January 1, 2026, Section 603 of SECURE 2.0 fundamentally changes catch-up contributions for high earners.

The New Rule

If your FICA wages from the prior year exceed $145,000 (indexed—projected ~$150,000 for 2026), all catch-up contributions to your 401(k), 403(b), or 457(b) must be Roth (after-tax).

Impact: High earners can no longer defer taxes on catch-up contributions. They must pay tax now.

The Closed Loop: No Escape to Traditional IRAs

Some might think: “If I can’t make pre-tax catch-ups to my 401(k), I’ll just do it in a Traditional IRA instead.”

This doesn’t work. Here’s why:

| Scenario | 401(k) Catch-Up | Traditional IRA Deduction |

|---|---|---|

| Single, $160,000 income | ❌ Must be Roth | ❌ Above $91,000 phaseout |

| MFJ, $160,000 income | ❌ Must be Roth | ❌ Above $149,000 phaseout |

The tax code has aligned the Roth mandate threshold (~$150k) with IRA phaseout ceilings, effectively closing all avenues for pre-tax catch-up contributions for high earners.

Clarifying the “Super Catch-Up” for Ages 60–63

| Plan Type | Standard Catch-Up (50+) | Super Catch-Up (60–63) |

|---|---|---|

| 401(k), 403(b), 457(b) | $7,500 | $11,250 |

| Traditional/Roth IRA | $1,100 | $1,100 (no super catch-up) |

| SIMPLE IRA | $3,500 | $5,250 |

Common Misconception

There is NO “Super Catch-Up” for IRAs. The $11,250 enhanced limit applies only to employer-sponsored plans. IRA catch-ups remain at $1,100 for all ages 50+.

Part V: The Marriage Penalty Analysis

The tax code creates structural inequities that penalize married dual-income couples.

Side-by-Side Comparison (2026)

| Scenario | Partner 1 | Partner 2 | Total Deduction |

|---|---|---|---|

| Unmarried (each earns $80k) | $7,500 ✅ | $7,500 ✅ | $15,000 |

| Married (combined $160k) | $0 ❌ | $0 ❌ | $0 |

The Cost of Marriage

Item Value Lost Deduction $15,000 Federal Tax (22% bracket) $3,300 State Tax (5% average) $750 Annual Cash Cost $4,050

Growth Rate Disparity

| Category | 2024 | 2026 | 2-Year Growth |

|---|---|---|---|

| IRA Contribution Limit | $7,000 | $7,500 | +7.1% |

| Single Phaseout Floor | $77,000 | $81,000 | +5.2% |

| MFJ Phaseout Floor | $123,000 | $129,000 | +4.9% |

Insight: Contribution limits are growing faster than phaseout thresholds. The government allows you to save more but is tightening who qualifies for the deduction.

Part VI: Strategic Planning Framework

Strategy 1: The Backdoor Roth

For clients above the phaseout limits, the Traditional IRA becomes a conduit, not a deduction vehicle.

| Step | Action |

|---|---|

| 1 | Make non-deductible contribution to Traditional IRA ($7,500/$8,600) |

| 2 | Report on IRS Form 8606 to establish basis |

| 3 | Immediately convert to Roth IRA |

| 4 | Result: Tax-free growth forever, bypassing Roth income limits |

Warning: The Pro-Rata Trap

The IRS treats ALL your Traditional, SEP, and SIMPLE IRAs as one account.

Situation Tax Consequence $90,000 in old Rollover IRA + $10,000 new non-deductible contribution = $100,000 total Only 10% is non-taxable Convert $10,000 $9,000 is taxable (90%) Solution: Roll pre-tax IRA funds into your current 401(k) before attempting Backdoor Roth.

Strategy 2: Spousal Income Splitting

For households earning $150,000–$240,000:

| Spouse | Strategy | Outcome |

|---|---|---|

| Active Participant | Max 401(k) ($24,500) + Backdoor Roth IRA | Reduces MAGI; no IRA deduction anyway |

| Non-Participant | Traditional IRA contribution | Full $7,500 deduction (under $242k limit) |

Strategy 3: Timing Optimization

| Situation | Recommended Action |

|---|---|

| Income dropping in 2026 (sabbatical, retirement) | Delay contribution to use higher 2026 limits |

| Income increasing in 2026 | Accelerate contribution into 2025 while still eligible |

| Near phaseout threshold | Max 401(k) first to reduce MAGI below phaseout |

Reminder: You have until April 15, 2026 to make 2025 contributions.

Quick Reference: Who Can Deduct in 2026?

Decision Tree

Are you (or spouse) covered by workplace retirement plan?

│

├── NO → Full deduction allowed (no income limit)

│

└── YES → Check your filing status and MAGI:

│

├── SINGLE

│ ├── MAGI < $81,000 → Full deduction

│ ├── MAGI $81k–$91k → Partial deduction

│ └── MAGI ≥ $91,000 → No deduction (use Backdoor Roth)

│

├── MARRIED FILING JOINTLY (you're covered)

│ ├── MAGI < $129,000 → Full deduction

│ ├── MAGI $129k–$149k → Partial deduction

│ └── MAGI ≥ $149,000 → No deduction (use Backdoor Roth)

│

├── MARRIED FILING JOINTLY (spouse covered, you're not)

│ ├── MAGI < $242,000 → Full deduction

│ ├── MAGI $242k–$252k → Partial deduction

│ └── MAGI ≥ $252,000 → No deduction

│

└── MARRIED FILING SEPARATELY

└── MAGI ≥ $10,000 → No deduction

Conclusion: The New Reality

The regulatory landscape for Traditional IRAs in 2025 and 2026 is defined by a fundamental tension:

| Expanding | Contracting |

|---|---|

| Contribution limits (+7.1%) | Deduction eligibility (+4.9%) |

| Catch-up now indexed | Roth mandate for high earners |

| Super catch-up for 60–63 in 401(k)s | No super catch-up for IRAs |

The Bottom Line: As phaseout limits solidify at $91,000 (Single) and $149,000 (Married), the era of the deductible Traditional IRA for mass affluent professionals is effectively ending. In its place emerges Roth-centric planning—where paying taxes today, rather than tomorrow, becomes the dominant strategy.

This analysis is provided for informational purposes and does not constitute tax or legal advice. Consult qualified tax professionals for guidance specific to your circumstances.