(OHIO) — ohio construction employers face a new state hiring-compliance requirement when House Bill 246, the E-Verify Workforce Integrity Act, takes effect on March 19, 2026, mandating use of the federal E-Verify system for defined categories of construction work.

Governor Mike DeWine signed House Bill 246 on December 19, 2025. The law ties Ohio contracting and construction activity to work-authorization verification through E-Verify, which is administered federally by the U.S. Department of Homeland Security (DHS) in partnership with USCIS.

while federal law already requires employers nationwide to complete Form I-9 for new hires, see INA § 274A and 8 C.F.R. § 274a.2, Ohio’s new statute adds a state-layer mandate for certain construction employers to run E-Verify cases for new employees in covered work.

Deadline Watch (State Law)

March 19, 2026 is the operational date for Ohio’s E-Verify mandate under House Bill 246. Employers typically need lead time to enroll, train users, and update onboarding workflows.

Overview: what HB 246 changes and why it matters

At a high level, HB 246 requires covered construction employers to use E-Verify for new hires connected to certain construction activity. In practice, this means an employer must complete the Form I-9 process and then “create a case” in E-Verify within the program’s rules for each covered new employee.

This is separate from, and in addition to, ordinary HR onboarding steps. The policy is designed as a state-level enforcement mechanism that can affect eligibility to work on projects, bid on public work, and maintain good standing in regulated construction markets.

The exact signing and effective-date milestones are best read together, because they shape planning time for compliance.

Who is covered—and what is exempt

HB 246 is written to reach the multi-tier reality of construction staffing. Coverage is role-based and can include contractors, subcontractors, and labor brokers.

That matters because an employer may not be the prime contractor but still supplies labor on a covered site. A staffing company placing tradespeople on a commercial build may be treated differently than a residential remodeler.

The law applies to two major project categories:

- Public works performed for state agencies or political subdivisions, such as local governments.

- Nonresidential private-sector construction, which can include commercial buildings and major infrastructure-type work.

The statute also includes meaningful carve-outs. Residential construction is excluded, including single-, double-, or triple-family homes. Agricultural structures are also excluded.

These exclusions create common “mixed portfolio” issues. A business that does both residential and nonresidential work may need a workflow that identifies which hires are tied to covered work, and then applies E-Verify consistently for those hires.

Because the timeline and key events can affect how quickly employers should act, readers should review the full sequence of dates in the supporting materials and then map them to internal implementation deadlines.

Employer requirements under HB 246

For covered employers, the operational duties generally fall into four buckets.

First, run E-Verify for covered new hires. E-Verify does not replace Form I-9. It is a second step that relies on I-9 information. Federal I-9 rules still apply under INA § 274A and 8 C.F.R. § 274a.2.

Second, follow E-Verify’s case-creation and processing rules. “Creating a case” is not a mere internal note. It is the formal E-Verify transaction. Employers should assign trained users and maintain secure credentials.

Third, maintain records. HB 246 includes a state retention rule tied to the hire or termination date. Recordkeeping is often the difference between a manageable audit and an expensive dispute.

Fourth, define internal ownership. HR usually handles I-9 and E-Verify, but construction adds complexity. Project management and procurement may control subcontractors. Compliance can fail when contract award teams and onboarding teams do not share data.

Compliance Warning (Operational)

Treat E-Verify as a controlled process. Untrained users, shared passwords, and inconsistent case timing can create avoidable exposure.

Penalties and enforcement risk

HB 246 grants enforcement authority to the Ohio Attorney General, including investigative power. Employers should assume that complaints, bidding disputes, or project compliance reviews may trigger scrutiny.

Consequences can include monetary penalties and operational restrictions. Exposure escalates with repeat violations. The business stakes are often larger than the fine amount.

Debarment from public contracts, licensing consequences, bonding questions, and loss of subcontractor eligibility can all follow from compliance findings.

This changes pre–March 19, 2026 risk posture. Before the effective date, employers can still reduce future exposure by documenting training, enrollment, and written procedures. After the effective date, failures may be framed as noncompliance rather than startup friction.

Risk Alert (Bidding and Project Eligibility)

For public work, prime contractors may require proof of compliance from subs and labor brokers. Missing documentation can become a performance and payment issue.

Official statements: context, not a substitute for the statute

Supporters of HB 246 framed it as a worker-protection measure and as a response to unauthorized employment concerns. Those themes can signal political interest in visible enforcement, especially in public contracting.

Still, employers should separate commentary from legal obligation. The enforceable rules are in the bill text and any implementing contract clauses. Public statements may help predict enforcement posture, but they do not change statutory requirements.

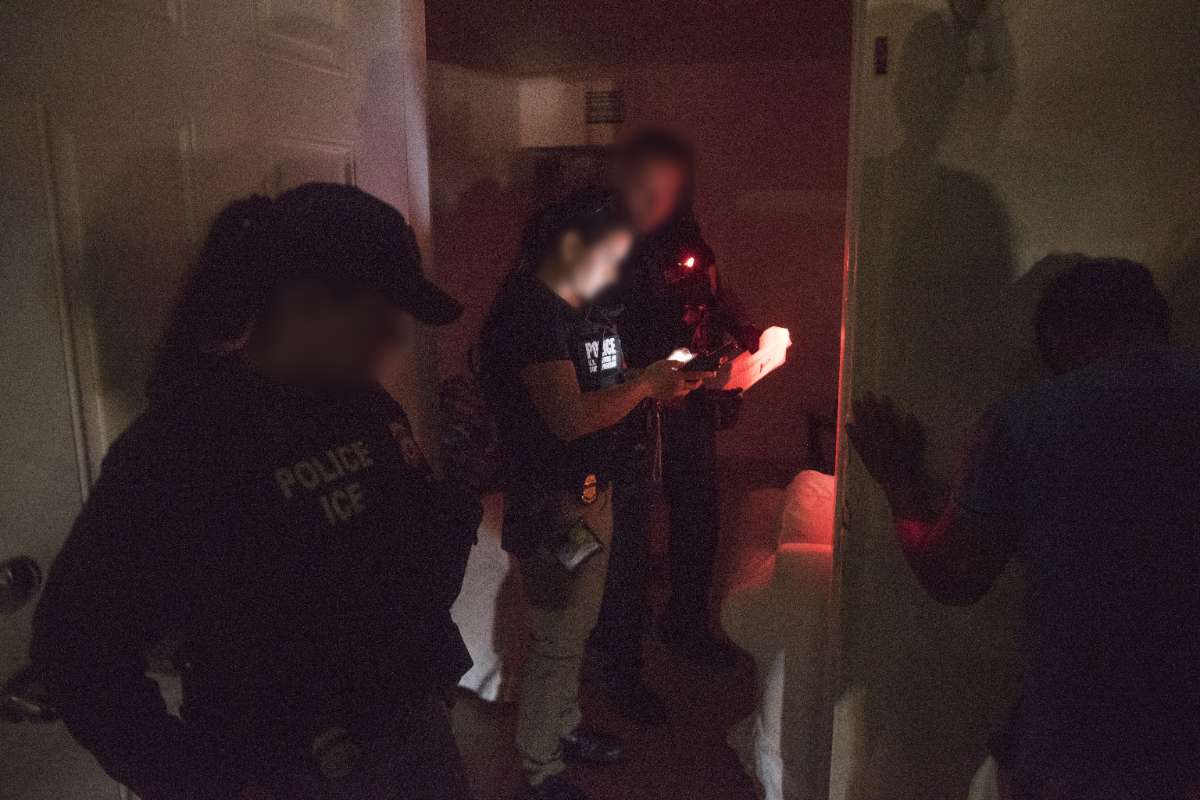

Federal context in January 2026

The Ohio mandate arrives during active federal messaging about immigration enforcement and fraud investigations. Federal activity can affect employer decision-making because it may increase audits, reputational concerns, and workforce volatility.

But the legal rule here remains state-based. HB 246 is an Ohio requirement that uses a federal tool. Federal initiatives do not change the statute’s coverage terms.

Employers should treat federal developments as a reason to tighten documentation discipline, not as a source of Ohio-specific rules.

Practical impact: what construction employers should do now

Implementation is mostly project-management discipline applied to hiring.

Enroll in E-Verify if you are not already enrolled. Limit account access to trained users. Use role-based permissions. Keep a clear chain of responsibility.

Update onboarding workflows. For covered work, build a checklist that links: offer letter timing, Form I-9 completion, E-Verify case creation, and file retention. For mixed portfolios, add a “project type” flag so HR knows when the Ohio mandate applies.

Plan for nonconfirmations. A Tentative Nonconfirmation (TNC) typically requires timely employee notice and a chance to take action within E-Verify rules. A Final Nonconfirmation is more serious and can force rapid operational decisions.

Employers should have a written escalation path involving HR and counsel.

Flow compliance through contracts. Prime contractors should review subcontract language for E-Verify obligations, proof requirements, and audit rights. Subcontractors and labor brokers should be ready to provide documentation that cases were created properly.

Conduct an internal readiness review before March 19, 2026. Many employers can reduce risk by checking that I-9 storage is consistent, E-Verify users are trained, and project files contain the compliance artifacts owners and agencies may request.

Action Window (Recommended)

Aim to complete enrollment, user training, and workflow updates well before March 19, 2026, so early projects are not used as test cases.

Official government resources

For enrollment and program rules, start with E-Verify (link removed). For federal verification and compliance updates, employers can monitor USCIS announcements at USCIS Newsroom and DHS releases (link removed).

For the primary text of House Bill 246, see the Ohio Legislature page (link removed).

As a practical matter, employers should save copies of the guidance and program instructions they relied on when setting procedures. That can help later if practices are questioned.

Recommended next steps and timeline: identify covered work, assign an internal owner, enroll and train users, update onboarding, revise subcontract clauses, and perform a dry run before the March 19, 2026 effective date.

Given the penalties and project impacts, many employers will want an Ohio employment attorney and an immigration compliance attorney to review their plan.

⚖️ Legal Disclaimer: This article provides general information about immigration law and is not legal advice. Immigration cases are highly fact-specific, and laws vary by jurisdiction. Consult a qualified immigration attorney for advice about your specific situation.

Resources

Ohio’s House Bill 246 mandates that construction employers use the federal E-Verify system for new hires on public and nonresidential private projects starting March 19, 2026. The law introduces state-level enforcement through the Attorney General, carrying risks of fines and contract debarment. Employers must update onboarding processes, train staff, and manage subcontractor compliance to navigate these new requirements and ensure continued eligibility for major construction contracts.