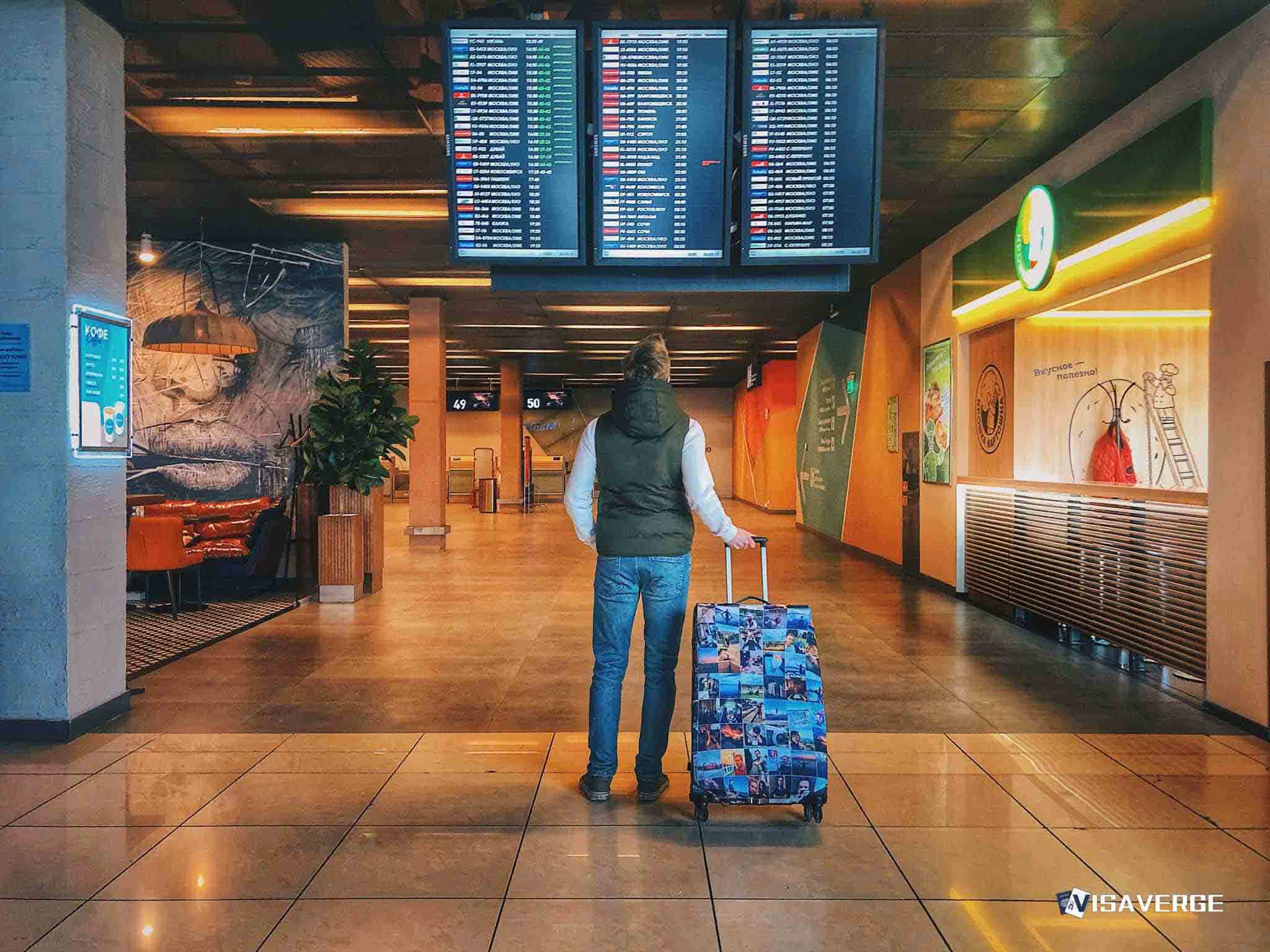

(TEXAS) Foreign workers weighing a move to the United States increasingly put tax policy and everyday costs at the center of their decision, and that’s shifting where newcomers settle. With no state income tax, Texas and Florida are drawing more foreign-born workers, while California—long a first stop for new arrivals—faces headwinds tied to high state income tax rates and steep housing costs. The financial calculus is simple for many families trying to stretch each paycheck: keep more of what you earn and spend less on housing.

Texas and Florida stand out for letting workers hold on to more take-home pay. For immigrants starting out, often sending money to relatives abroad, that difference can decide where they put down roots. California still offers strong job clusters, from tech to entertainment, and deep immigrant networks. But high costs pile up quickly, and they now outweigh the draw for many new arrivals, according to analysis by VisaVerge.com.

Tax Policy Shapes Destination Choices

The centerpiece of the contrast is income tax. Texas and Florida do not levy a state income tax at all. That means every dollar of wages is easier to keep, save, or send as remittances. In California, the state income tax can reach up to 13.3% for top earners, one of the highest rates in the country.

While not everyone pays the top rate, the overall tax structure reduces net pay and can make it harder for new families to get stable, especially during their first years in the United States 🇺🇸.

These tax differences carry real consequences for different groups:

- Skilled workers calculating post-tax income

- International students entering the labor market

- Mixed-status families balancing household budgets

Employers report the same pattern: the same salary can go further in Texas than in California because of both state income tax policy and everyday expenses.

For those seeking official information on state tax agencies and rules, the Internal Revenue Service maintains an IRS list of state tax agencies, which can help newcomers find the right state authority for questions.

Cost of Living and Jobs Weigh Heavily

Taxes are only part of the story. Housing costs in California’s coastal metros—Los Angeles, San Diego, San Jose, and the Bay Area—are a major barrier for middle- and working-class immigrants. Rents consume large shares of income, while down payments remain out of reach for many families who otherwise have stable jobs.

In contrast, while Texas and Florida have seen rising housing prices, typical rents and home costs remain more manageable compared to California’s coastal markets. That gap helps newcomers:

- Save more

- Build emergency funds

- Invest in small businesses

- Pay for training that opens better jobs

Job Growth and Industry Opportunities

Job growth also matters. Texas and Florida host fast-growing industries that rely on immigrant talent and hard work, including:

- Construction

- Hospitality and tourism

- Agriculture

- Energy and technology

These sectors provide a range of entry points, from first jobs that help build a foothold to specialized roles that reward experience and education. California’s economy remains powerful—especially in technology and entertainment—but business owners and new workers point to:

- Layers of regulation

- Higher operating costs

- A heavier overall tax burden

These factors can limit upward mobility for those just starting out. The trade-off is stark: the same worker can often find a job more quickly in Texas and keep more of their earnings once employed.

As a result, recent trends show foreign-born populations in Texas and Florida growing faster than in California. This pattern is self-reinforcing:

- Growing communities attract relatives, classmates, and former coworkers

- Immigrant-owned shops, places of worship, and cultural centers multiply

- Newcomers find familiar food, language support, and trusted advice nearby

This local support lowers the perceived risk of moving and makes Texas even more attractive for many families.

Community Growth and Human Impact

For a nurse arriving on a work visa with a spouse and two children, the decision can come down to monthly math: rent, daycare, car payments, and remittances. In Texas, the absence of a state income tax can mean several hundred dollars more per month compared to similar pay in California.

Over a year, that difference can fund:

- Credential evaluations

- Language classes

- A down payment on a reliable car

These practical steps help families stabilize faster.

Small business formation is another key piece. Many immigrants open:

- Restaurants

- Home improvement firms

- Trucking companies

- Online shops

Lower operating costs and lighter tax burdens can make the first year of business survivable. In California, higher overhead and taxes cut margins, leaving less room for error. Owners who started in California report that similar shops in Texas can break even sooner—word-of-mouth that quickly shapes where the next wave settles.

None of this means California has lost its pull. The state still offers:

- Deep community ties

- International airports

- World-class universities

- Strong industry hubs

But for new arrivals prioritizing budget security, Texas and Florida look safer. People are not just chasing a dream; they’re protecting their savings and their families’ futures.

Other Factors and the Bigger Picture

Families also weigh climate, schools, and healthcare. Safety, storm risks, and public services influence decisions alongside taxes and rent. Still, when every dollar needs to work harder, the ability to keep more pay and find affordable housing often tips the scale.

That combination—no state income tax, moderate housing costs relative to California’s coastal areas, and strong job markets—has turned Texas into a magnet for the foreign-born workforce.

Policy debates will continue. Some argue that California’s higher taxes fund strong social services and long-term investments. Others say workers should choose where dollars stretch furthest today.

For immigrants trying to build credit, support relatives abroad, and save for the future, the immediate math leads many to Texas. Employers in construction, logistics, hospitality, and energy are ready to hire, and families find growing communities that welcome them.

California officials and business leaders are aware of the challenge. But for now, the financial advantages in Texas—anchored by the absence of state income tax and supported by relatively more affordable housing—are driving the momentum.

As more families share their experiences, the map of new immigrant destinations keeps shifting toward Texas and Florida. VisaVerge.com reports that this cycle of attraction and retention feeds continued growth, as each newcomer helps expand the networks that will guide the next.

This Article in a Nutshell

Immigrant destination choices in the United States are increasingly influenced by tax policy and everyday costs. Texas and Florida, which do not impose state income taxes, are drawing more foreign-born workers who want to maximize take-home pay and stretch budgets. California remains a strong economic hub with established immigrant networks and high-paying industries, but state income taxes—up to 13.3% for top earners—and steep coastal housing costs are pushing many newcomers toward lower-cost states. The financial benefits in Texas and Florida enable faster wealth building, remittances, and small business formation, while growing communities create supportive networks that attract additional arrivals.