December 18, 2025

- Updated title to include immigration guidance alongside rates and thresholds

- Clarified filing thresholds remain $10,000 (single) and $20,000 (joint) for 2025

- Added step-by-step filing guide with estimated times for each task

- Included practical checklist for immigrants (records, ITIN note, residency tests)

- Added program updates: expanded EITC eligibility and ANCHOR benefit amounts

(NEW JERSEY) New Jersey’s state income tax rules for the 2025 tax year are steady in the places that matter most for day-to-day filers, including many immigrants, new arrivals, and cross-border workers who live in one state and earn money in another. The state keeps its progressive tax structure, with rates that run from 1.4% to 10.75%, and it keeps the same filing thresholds that trigger a required return: $10,000 for single (and several related filing statuses) and $20,000 for married filing jointly (and similar joint statuses). These 2025 returns are generally filed in 2026, so people who moved during 2025—or who changed jobs, visa type, or household setup—still have time to get organized.

For immigrants, the bigger stress point often isn’t the tax rate itself. It’s the paperwork trail: how to track residency dates, how to report income that might come from more than one place, and how to avoid surprises like a bill when you expected a refund. According to analysis by VisaVerge.com, tax compliance is also one of the most common “silent stressors” for new residents because it sits at the crossroads of work authorization, household finances, and long-term planning.

The basic shape of New Jersey’s 2025 state income tax: what stays the same

New Jersey’s personal income tax stays progressive for 2025. That means higher rates apply as income rises, but only to the slice of income inside each bracket, not to every dollar you earn. The range stays 1.4% to 10.75%, and the 10.75% top rate applies to income over $1,000,000.

The core filing triggers also stay in place for 2025:

- $10,000: single, head of household, or married filing separately

- $20,000: married filing jointly, civil union partners filing jointly, or qualifying surviving spouses

Even if you earn under these amounts, you may still decide you should file—especially if New Jersey tax was withheld from your paycheck, you made estimated payments, or you may qualify for a refund or a state credit.

Step 1 — Decide residency status (right after you start work or move)

This step drives everything else: which return you file, what income you report, and what documents you need to keep.

New Jersey tax residency is mainly about where you live and keep your home, not your immigration label alone. That matters for immigrants because you can be a tax resident while on a temporary visa, and you can be a nonresident even if you regularly work in the state.

Ask yourself:

- Did you live in New Jersey as your main home during 2025?

- Did you keep a home there while working elsewhere?

- Did you live outside New Jersey but earn New Jersey–source income (wages from a New Jersey employer, rent from NJ property, etc.)?

If you are a nonresident who earned New Jersey–source income, you may need the nonresident return, Form NJ-1040NR. If you are a resident, you generally file the resident form and may report a wider set of income.

Estimated time:

– 30–60 minutes to decide once you list addresses, move dates, and work locations

– 2–3 hours if your year included moves, travel, or multiple jobs

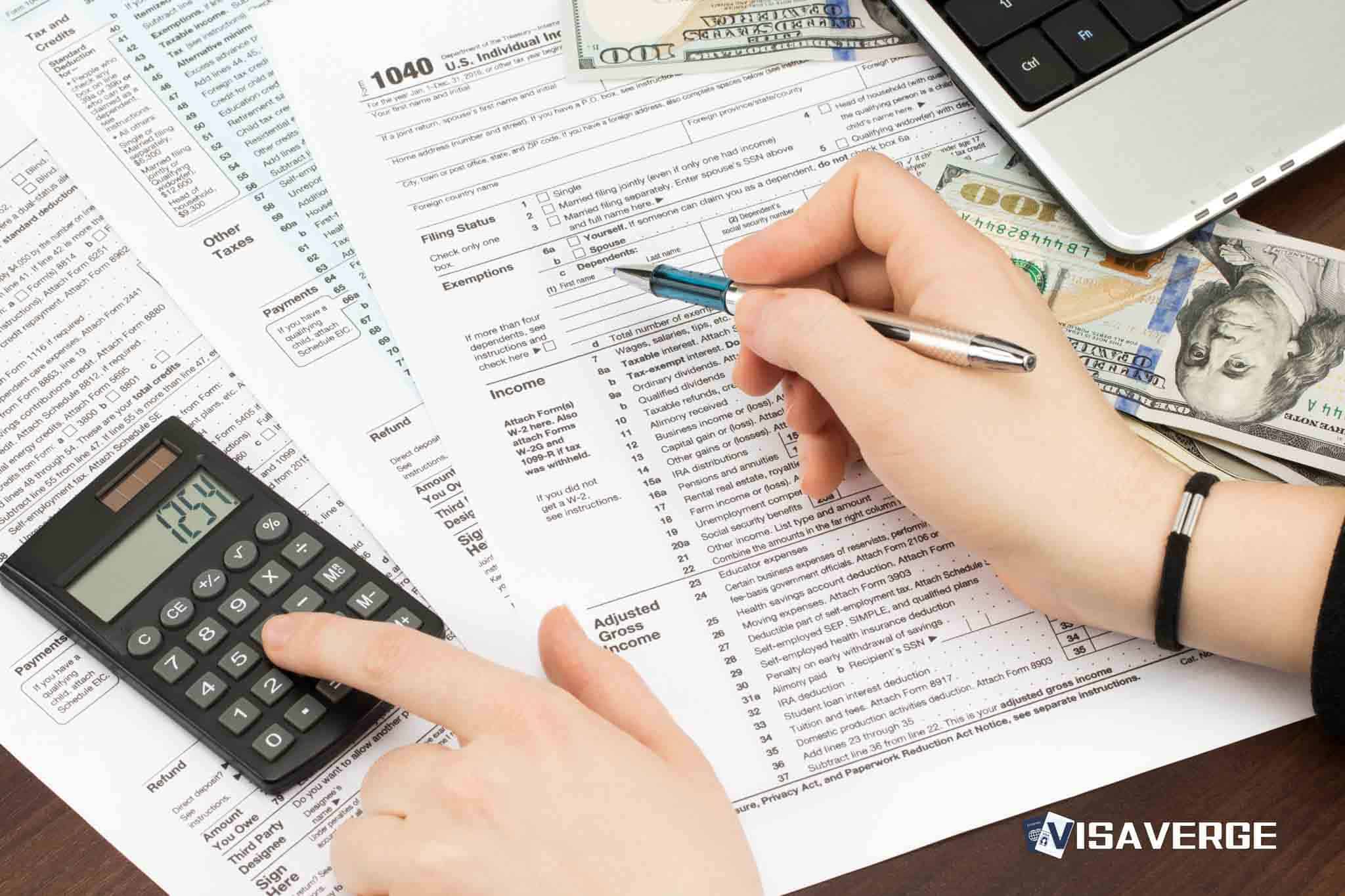

Step 2 — Gather records immigrants often miss (early in the year)

Taxes go off track when records are scattered across employers, banks, and family members. Immigrants may face extra complexity when documents come from multiple countries or names are spelled differently.

Collect the following for your 2025 New Jersey filing:

- W‑2s, 1099s, K‑1s, and similar income statements

- Records of any foreign income, if applicable

- Proof of New Jersey tax withheld by employers

- Records of estimated payments you made

- Property tax bills or rent records if claiming property-tax-related benefits

- Household details for filing status and dependents (names, ID numbers, relationships)

Note on ITIN filers:

– Some filers use an ITIN instead of a Social Security number. ITIN filers can still have New Jersey tax withheld and may sometimes qualify for certain state-level credits. Eligibility varies by program; check rules carefully.

Estimated time:

– One weekend if income is only from wages

– 2–4 weekends for multiple jobs, self-employment, or foreign income

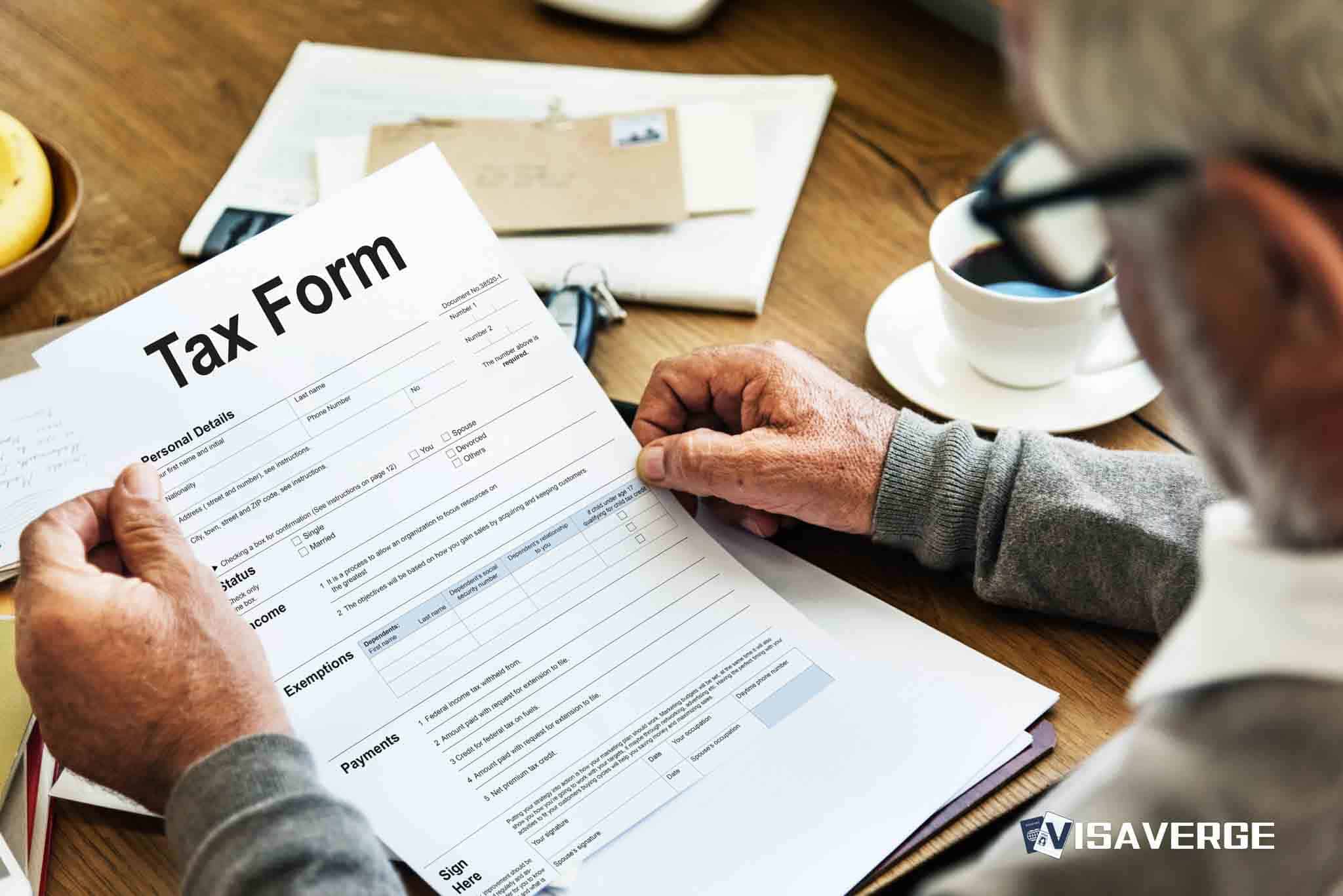

Step 3 — Confirm whether you must file (before doing math)

Do you cross New Jersey’s 2025 filing thresholds?

Filing thresholds for 2025:

– $10,000 if you are single, head of household, or married filing separately

– $20,000 if you are married filing jointly, in a civil union filing jointly, or a qualifying surviving spouse

You generally must file if your income is above your status threshold. You may also need to file if you are a nonresident with New Jersey–source income. Even below the threshold, filing can make sense to claim a refund or credit.

Estimated time: 10 minutes once you have income totals and filing status

Step 4 — Understand the brackets (the part many newcomers fear)

The key is marginal taxation: each rate applies only to the income inside that bracket.

2025 brackets for single filers and married filing separately:

- 1.4% on $0 to $20,000

- 1.75% on $20,001 to $35,000

- 3.5% on $35,001 to $40,000

- 5.525% on $40,001 to $75,000

- 6.37% on $75,001 to $500,000

- 8.97% on $500,001 to $1,000,000

- 10.75% on income over $1,000,000

2025 brackets for married filing jointly, head of household, or qualifying surviving spouse:

- 1.4% on $0 to $20,000

- 1.75% on $20,001 to $50,000

- 2.45% on $50,001 to $70,000

- 3.5% on $70,001 to $80,000

- 5.525% on $80,001 to $150,000

- 6.37% on $150,001 to $500,000

- 8.97% on $500,001 to $1,000,000

- 10.75% on income over $1,000,000

Important detail:

– Joint/head-of-household filers have an extra 2.45% bracket for $50,001–$70,000, which smooths the rate increase for many households.

Estimated time: 20–40 minutes to read and apply to your income

Step 5 — Bracket example (quick reality check)

If you are single with $45,000 taxable income in 2025:

- First $20,000 taxed at 1.4%

- Next $15,000 ($20,001–$35,000) taxed at 1.75%

- Next $5,000 ($35,001–$40,000) taxed at 3.5%

- Final $5,000 ($40,001–$45,000) taxed at 5.525%

Takeaway: people often overestimate tax liabilities by assuming one high rate applies to all income. New Jersey applies rates only to the income within each bracket.

Estimated time: 15 minutes with a calculator; longer if adding deductions and credits

Step 6 — Check exemptions, credits, and property-tax relief programs

Credits and exemptions can materially change a tax bill—especially for immigrant families.

Personal exemptions:

– New Jersey allows personal exemptions for yourself, your spouse or civil union partner, and dependents. These reduce taxable income and often tie to household changes (marriage, a child, dependents moving in).

New Jersey Earned Income Tax Credit (EITC) update:

– Expanded eligibility includes taxpayers 65 and older even if they do not have a dependent, which can help older immigrants with low or moderate earnings.

Property-tax relief programs:

– ANCHOR (Affordable New Jersey Communities for Homeowners and Renters)

– Homeowners with income up to $250,000 may receive up to $1,750.

– Renters with income up to $150,000 may receive up to $700.

– Senior Freeze (Property Tax Reimbursement) Program

– Higher income limits and no longer requires 10 consecutive years of New Jersey residency. Recent cycles have had income limits increased to over $160,000, with adjustments over time.

Estimated time: 1–3 hours to check eligibility and gather proof; longer if applying for the first time

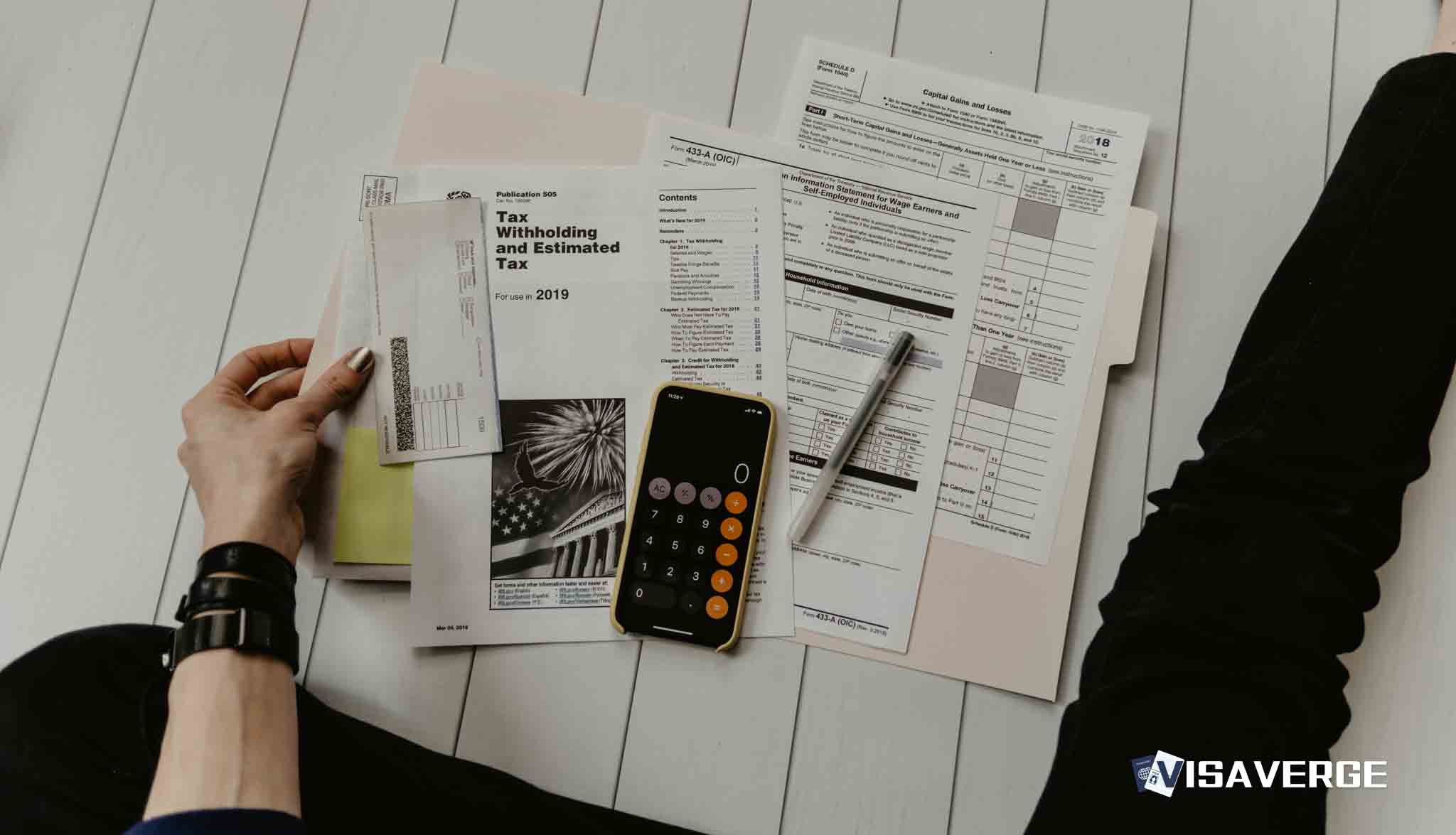

Step 7 — File the right return and avoid withholding surprises (filing season)

When filing your 2025 return in 2026, you can file online, by mail, or through a tax professional experienced with immigrant and cross-border cases. Your choice depends on complexity.

Common pressure points for immigrants:

1. Withholding mismatches: If your withholding settings changed (marriage, dependents, second job), your paycheck withholding may not reflect your final liability. New Jersey’s payroll withholding formulas are approximations—not replacements for statutory brackets.

2. Multi-state issues: Living outside New Jersey but working inside it, or moving mid-year, can create filing duties in more than one state.

For forms, instructions, residency rules, and program details, use the New Jersey Division of Taxation’s official portal: https://www.nj.gov/treasury/taxation/

Estimated time:

– 1–2 hours for wage-only filers once documents are ready

– More time if dealing with nonresident allocations, credits, or property-tax programs

Step 8 — After you file: track refunds, notices, and follow-up requests

Tax agencies sometimes ask for clarification—especially when a return includes credits, refunds, or residency questions. This can feel intimidating, particularly for immigrants unfamiliar with official letters or concerned about cross-connections to other records.

Practical follow-up steps:

- Keep a full copy of the filed return

- Save supporting records for large items (withholding, rent/property tax claims, income statements)

- Respond promptly and on time if the state requests information

Estimated time:

– 15 minutes to set up a folder system

– 1–2 hours to answer a state letter if one arrives

Key takeaway: Keep organized records and respond promptly—these steps reduce stress and the chance of penalties or delays.

Step 9 — Policy watch for households: stability for 2025, but debates continue

For 2025, the core structure remains: 1.4%–10.75% bracket range and $10,000 / $20,000 filing thresholds.

There is an active policy conversation:

– S840, introduced in the 2024–2025 legislative session, would aim to reduce the “marriage penalty” by adjusting brackets for joint filers so more income at lower levels is taxed at 1.4% and 1.75%. It has been introduced but not enacted, so it does not apply to 2025 returns.

Why this matters for immigrants:

– Household structures often change quickly after arrival—marriage, family reunification, or both spouses working. A change in joint filing brackets would affect what you owe, though it wouldn’t change whether you cross filing thresholds.

Estimated time to stay informed:

– 30 minutes a year to check for updates; more if planning household changes that affect filing status

If you need a quick checklist or a customizable timeline for your own 2025-to-2026 filing (residency timeline, documents to gather, and which forms to expect), tell me your filing status and whether you had moves, foreign income, or multiple employers in 2025—and I’ll format a tailored checklist.

New Jersey’s 2025 state income tax maintains its progressive rates from 1.4% to 10.75%. Key filing thresholds remain $10,000 for individuals and $20,000 for joint filers. The guide emphasizes residency determination and proactive record-keeping for immigrants. Programs like ANCHOR and Senior Freeze provide relief, while the EITC now includes older adults without dependents. Compliance ensures long-term financial stability and avoids common filing stressors.