- International students should prioritize capital protection and liquidity over chasing high market returns.

- Maintain a 60–90 day cash buffer to manage potential policy shifts or visa delays.

- Avoid long-term illiquid assets like real estate that could trap funds during status changes.

As immigration policy evolves—from fixed admission periods to heightened vetting and revised processing fees—international students must reframe investment choices to preserve option value and minimize irreversible commitments.

The point is simple: your best financial move in school often looks like capital protection and maximum flexibility, not chasing the highest return.

1) Overview: what this guide is for, and why it matters

international students face constraints that many U.S. citizens never deal with. visa timelines can change, travel can be disrupted, tax residency can flip, and one paperwork mistake can cost months.

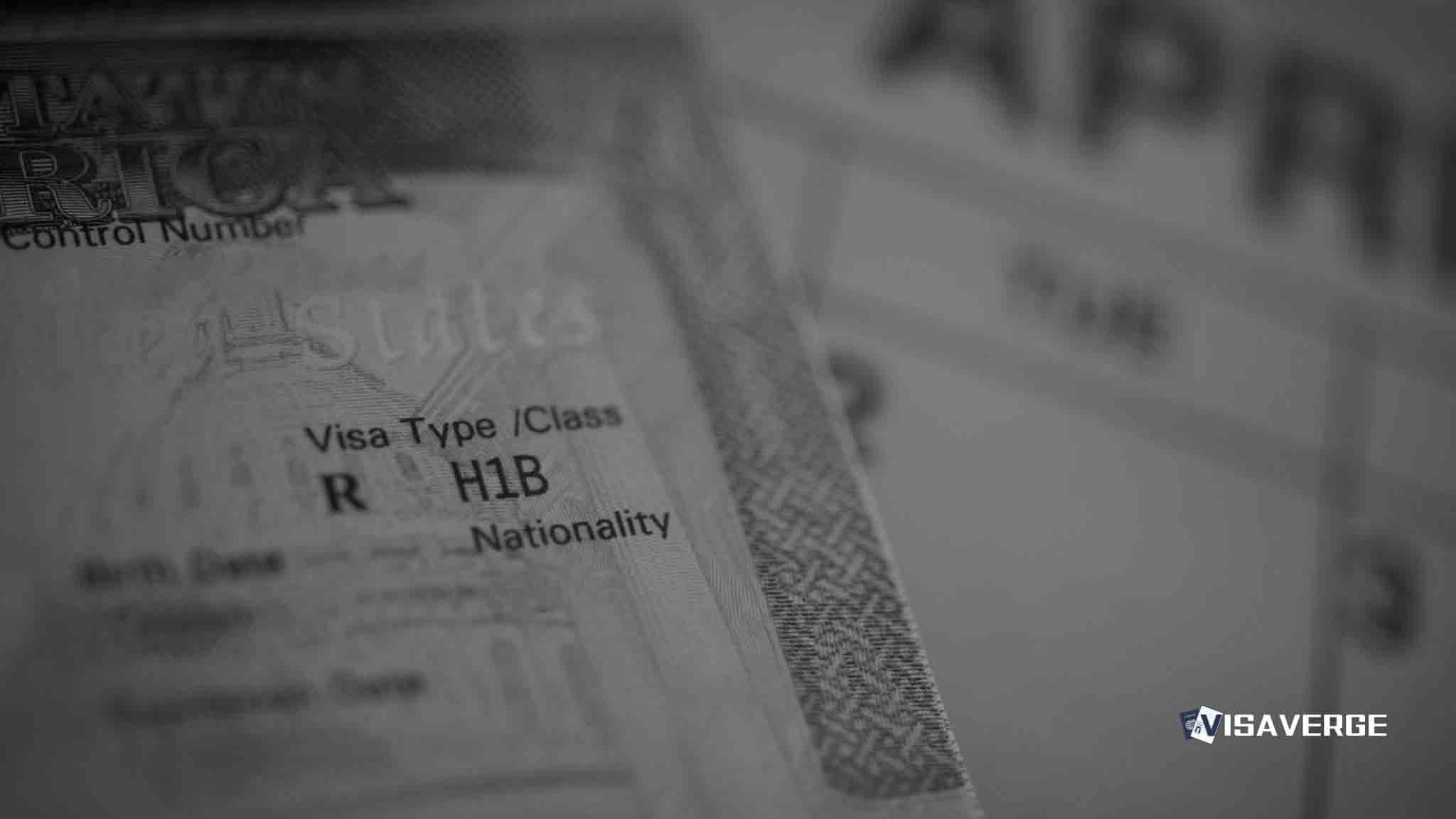

Money decisions made during F-1/J-1 years can also follow you into OPT to H-1B transitions. A “smart” investment that is hard to unwind may become a problem if your immigration outcomes shift fast.

Use this guide to keep choices reversible. Expect practical steps, not personalized advice. For decisions with legal or tax impact, you’ll typically want a qualified professional.

What you’ll need before you start

- A realistic 60–90 day budget (rent, food, insurance, tuition, flights)

- Your work authorization timeline (CPT/OPT dates, STEM OPT plans, or J-1 rules)

- A clean record system (statements, cost basis, transfer logs, immigration dates)

- A plan for two paths: stay in the United States or leave quickly

2) Core investment principle for students

Your largest asset is not your current savings. It is your future earnings, plus the ability to work in the United States after graduation.

That “immigration optionality” has real dollar value. So does time for interviews, networking, and skill-building. An investment plan that creates stress, lockups, or compliance risk can reduce your future choices.

Treat early investing like risk control. Prefer moves you can reverse without penalties, long delays, or complicated reporting. Short and boring often wins here.

3) Recommended investment approach (step-by-step)

Follow a sequence. It reduces regret.

- Build an emergency fund first. Aim for cash that covers essentials and travel if plans change.

- Pay down high-interest debt. A guaranteed high interest cost usually beats uncertain market gains.

- Choose simple, diversified holdings. Complexity raises the chance of reporting errors later.

- Automate only after stability. Automatic contributions help after your budget and status feel steady.

Liquidity comes first for a reason. If you need to relocate for a job, respond to a visa issue, or cover a gap between graduation and employment, you want funds you can access quickly.

Practical selection criteria help keep you safe: low fees and simple statements, easy tax reporting in the United States, portability if you return to India or move elsewhere, and minimal administrative burden when you get busy.

Employer benefits can matter too. If you later work during OPT and have access to a plan with matching, read the plan rules carefully and ask how vesting works. Avoid assumptions—match rules can differ by employer.

This approach tends to fit students on F-1 or J-1 status in the United States, plus those in other study-permit systems who expect post-study work permits. It also fits students who may return to India and those who are unsure where they will settle long term.

4) What to avoid (because it reduces flexibility)

Avoid long lock-in products. Real estate, private funds, and illiquid business stakes can trap cash for years. A forced sale during a visa change is usually a bad sale.

Skip complex cross-border structures unless you have strong professional support. Multi-country layers, trusts, and hard-to-explain arrangements can explode your paperwork load when your tax residency changes.

Be cautious with “investing” that looks like work. In many cases, passive investing is fine. Activity that resembles providing services, running a business, or active trading at scale can raise immigration risk.

Policy volatility may alter time horizons and filing costs; avoid irreversible, long-term commitments until residency/career clarity solidifies.

5) The most common student investment mistake

The recurring mistake is committing too much of a small savings base into illiquid or volatile bets. Students often do this to feel “ahead,” or because friends make it look easy.

Second-order costs hit fast. You might sell at the wrong time to cover rent, miss tuition deadlines, or lose interview time due to stress.

Prevent it with two rules:

- Define a minimum cash runway you will not touch.

- Treat everything above that as optional, not required.

6) Practical guidance you can act on now

Build a “policy shock plan.” Write down what you would do if you had to leave the United States in 60–90 days. Include flights, lease break costs, storage, and account access from abroad.

Next, set a re-check schedule. Reassess your holdings during OPT filing windows, before travel, after job changes, and before any H-1B filing season. Timing matters. So does cash on hand.

Document hygiene reduces future pain. Keep brokerage statements, cost basis records, and clear dates for buys, sells, and transfers. Store copies in two places and make sure you can explain every large movement of funds.

What to do this week: build a 60–90 day liquidity buffer, review work authorization timelines, and document tax-residency-relevant records (brokerage statements, cost basis, dates).

7) Final takeaway for student investing

Option value beats return-chasing in your student years. Liquidity buys time. Simplicity reduces mistakes.

Your real “portfolio” is career growth plus compliant immigration status. Money choices should support that.

8) Official DHS/USCIS updates (as of January 14, 2026) that affect planning

August 27, 2025 marked a clear shift toward fixed-term thinking for student status. DHS moved away from flexible “Duration of Status” and toward fixed admission periods, with a maximum of 4 years for most F-1 and J-1 students.

Extensions now require a formal USCIS process, so long lock-ins carry more risk. Plan for a higher chance you must extend, transfer, or depart sooner than previously expected.

December 15, 2025 expanded mandatory social media vetting for F, J, and M visa holders, and for H-1B applicants. Expect more scrutiny of consistency and credibility, which can cause delays and disrupt work start dates and travel.

USCIS Director Joseph Edlow spoke on January 9, 2026 about increased vetting. That stance increases the risk of timing surprises during OPT/H-1B processing and reinforces the need for cash and schedule buffers.

On January 11, 2026 USCIS confirmed premium processing fee hikes (effective March 1, 2026). Budget for higher filing costs if premium processing becomes necessary for timing.

These policy changes have direct financial implications: higher chance of needing extensions, delays that affect employment start dates, and increased filing costs. The practical response is to keep funds liquid, increase cash runways, and avoid multi-year lockups until your residency and career direction are clearer.

Verify updates directly with U.S. Citizenship and Immigration Services (USCIS) and the U.S. Department of Homeland Security (DHS) at uscis.gov and dhs.gov. Use official pages before changing plans.

Policy change summaries and what they mean for your finances

Fixed admission periods (DHS, August 27, 2025): expect limited stays and more formal extension processes, so keep funds liquid and budget for extensions.

Expanded social media vetting (December 15, 2025): plan for delays and keep documentation consistent; increase cash runway.

Heightened vetting emphasis (USCIS Director comments, January 9, 2026): build time buffers and avoid financial commitments tied to a single start date.

Premium processing fee hikes (confirmed January 11, 2026; effective March 1, 2026): reserve funds for filings and avoid spending cash needed for processing options.

Context on selection rules and employment (2026): evolving lottery/selection mechanics may favor higher wages and affect employability; prioritize career roles that support sponsorship.

The interactive policy tool (where available) will display detailed policy dates, financial implications, and recommended actions in an easy-to-scan format. Use that tool to explore scenarios; meanwhile, use the summaries above to guide immediate cash and timing decisions.

9) Financial compliance: passive vs. active income

Under 8 CFR 214.2(f), passive investing is generally allowed for F-1 students. Buying and holding stocks or funds is typically treated differently than providing services for pay.

Risk rises when “investing” starts to look like employment. Examples include running an active business, material participation in a trade, or activities that resemble ongoing services. If you cannot explain what you do in plain language, pause and get advice.

Tax rules add another layer. Many students start as nonresident aliens for IRS purposes, then later become resident aliens under IRS rules after status and time in the United States change. A move to H-1B status often makes the Substantial Presence Test relevant.

Reporting and withholding may shift in that transition. Cross-border reporting can also change—depending on facts and thresholds, FBAR and FATCA rules may apply to foreign accounts and assets.

Use IRS resources at irs.gov and keep clean records so you can answer questions later.

10) The “Trump Gold Card” and investment paths (January 2026)

Headlines can push students toward big, irreversible moves. The “Trump Gold Card,” sometimes described with I-140G Trump Gold Card wording, has been discussed as a high-level idea tied to a very large, non-refundable contribution model.

Treat that kind of proposal as background noise for planning. Policies can change quickly, and no concept replaces the standard reality for most students: graduate, use OPT, seek sponsorship, and manage status deadlines carefully.

Your safest stance is conservative. Keep liquid reserves. Avoid locking funds based on political promises. Focus on the paths you can control now, including skills, job targeting, and clean compliance records.

This article provides information intended to educate international students on financial planning in light of immigration and tax considerations. It is not legal or tax advice. Readers should verify policy details with USCIS, DHS, and IRS, and consult qualified professionals for individual circumstances.

Build your 60–90 day buffer before March 1, 2026, and keep it intact until your work authorization and tax residency direction are clear.

This guide advises international students to favor liquidity and simplicity in their financial planning. Given the shift toward fixed-term admission and increased vetting, students should avoid illiquid investments. By maintaining a 60–90 day cash runway and focusing on career-building over high-risk market bets, students preserve the flexibility needed to navigate complex immigration transitions and potential policy shocks through 2026.