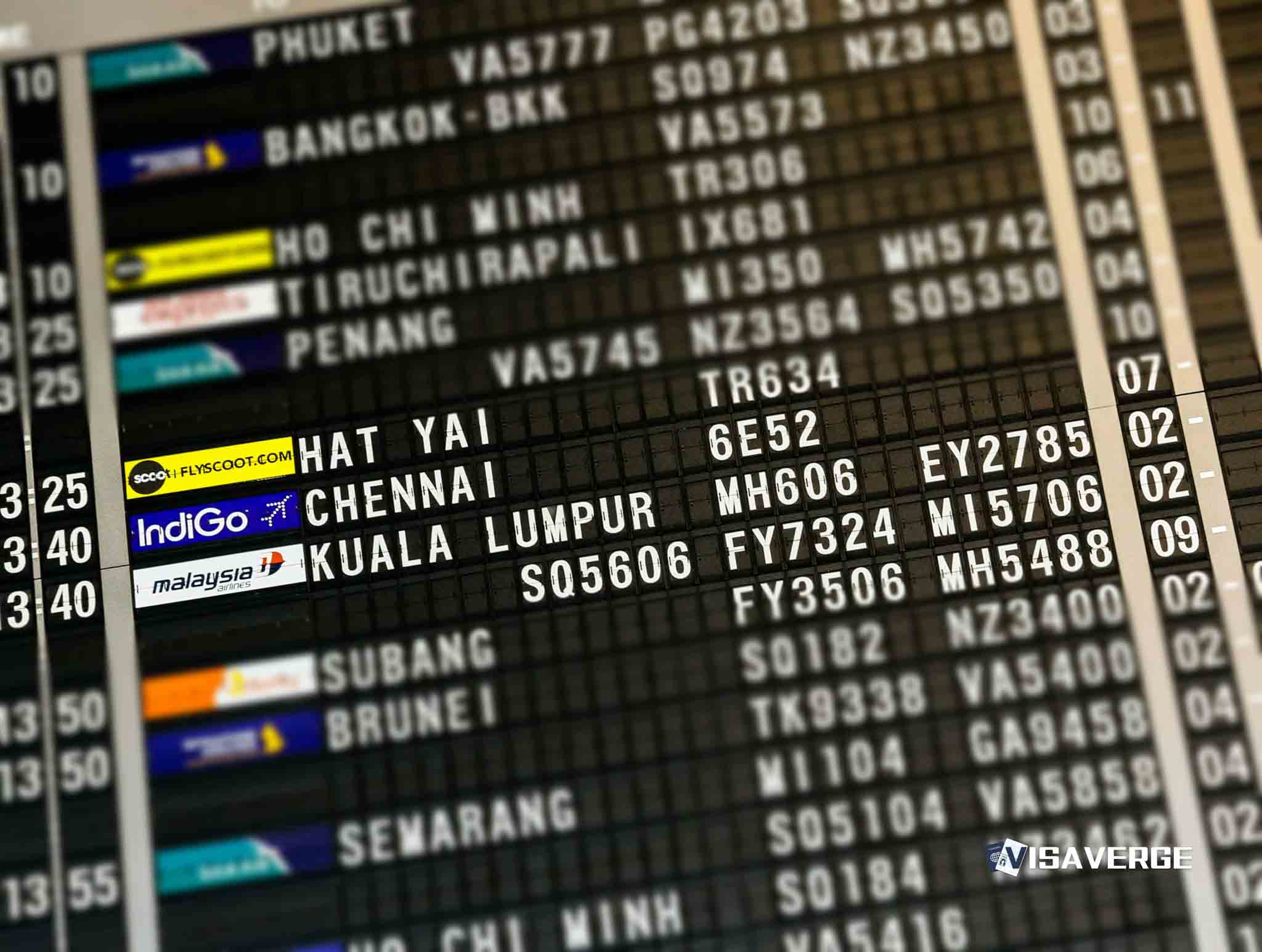

Dubai, famously dubbed as the City of Gold, beckons with its low gold prices and tax-free shopping, making it an attractive shopping destination for gold buyers across the globe, especially for those hailing from India. The allure of acquiring gold at considerably lower prices than in India drives many to ponder over the gold limit from Dubai to India, including the various rules that govern the import of gold into the country. This comprehensive guide delves into the specifics of the gold import regulations that will be in effect in 2024, helping you navigate the gold buying process with ease.

What is the Allowed Gold Limit from Dubai to India?

A point of curiosity for many is the exact amount of gold one can bring from Dubai to India without incurring customs duty. The Central Board of Indirect Taxes and Customs has set clear limits to ensure the lawful import of gold. The guidelines state:

– Male passengers can carry up to 20 grams of gold not exceeding a total value of Rs. 50,000.

– Female passengers have a slightly higher allowance, being able to carry up to 40 grams of gold, with the value not surpassing Rs. 1,00,000.

These figures represent the maximum amount of gold, in the form of jewelry, that can be brought into India without the need to pay any customs duty.

Is Gold Cheaper in Dubai Than in India?

The difference in gold prices between Dubai and India is significant, primarily due to the lack of taxes such as the 3% Goods and Services Tax (GST) on gold in Dubai. Additionally, there is no making charge on gold in Dubai, which usually is a considerable extra charge in India. Consequently, the price of 24K gold in Dubai is approximately 5% to 7% lower than in major Indian cities, making it a preferred shopping destination for gold.

Understanding the Duty-Free Import Limit on Gold from UAE to India

As of April 1, 2016, the rules state that any Indian passenger who has been away from the country for over a year can carry gold jewelry in their baggage under the specified limits without incurring a customs duty. The allowance is gender-specific, with men allowed up to 20 grams and women up to 40 grams of gold jewelry. Importantly, for duty-free import, the gold must solely be in the form of jewelry.

Bring More, Pay More: Customs Duty on Excess Gold

Should you choose to bring more gold than the allowed limit, be prepared to pay customs duty. The duty rates are:

– Rs. 300 per 10 grams plus 3% education cess for gold bars.

– Rs. 750 per 10 grams plus 3% education cess for other forms of gold, like coins or ornaments.

It’s noteworthy that if gold is brought into India without meeting the six-month overseas stay requirement, a hefty additional duty of 36.05% is levied.

Conditions for Carrying Excess Gold

Carrying gold beyond the stipulated limits and forms (bars exceeding 1 kg, for instance) is fraught with regulations:

– Payment of customs duty must be made in a convertible foreign currency.

– All purchase proofs and related documentation must be presented to customs officials.

– Detailed declaration forms need to be filled prior to arrival in India.

Failure to adhere to these rules could lead to confiscation or penalty charges.

Understanding the Custom Duty Calculation

The custom duty on gold is calculated in two forms – specific duty rate, based on the weight, and ad-valorem duty rate, based on the value of the gold plus a 3% educational cess.

Gold not only holds sentimental value but is also a significant investment, providing a hedge against inflation. For those living abroad and planning to bring gold back to India, understanding the latest rules regarding the gold limit from Dubai to India, duty charges, and import regulations is essential.

For further information and detailed guidelines on importing gold to India from Dubai, one reliable source is the official website of the Central Board of Indirect Taxes & Customs. Here, you can find the most up-to-date information on customs duties and regulations.

FAQs

How much gold is allowed from the UAE to India without duty?

– For males, 20 grams with a value cap of Rs. 50,000 and for females, 40 grams with a cap of Rs. 1,00,000.

What is the import duty on gold in India?

– The basic import duty on gold brought into India is 12.5%.

How can one import gold to India without restrictions?

– Declare your gold at customs and pay the designated import duty.

How much gold can an NRI bring from abroad to India?

– An individual of Indian origin can bring up to 1 kg of gold, subject to customs duty, provided they hold a valid Indian passport.

Gold purchasing in Dubai offers a potential cost benefit; however, it comes with its set of rules and regulations that must be understood and followed. Being well-informed about the gold import rules can make your gold shopping experience in Dubai both enjoyable and hassle-free.

This Article In A Nutshell:

Dubai tantalizes as a gold shopping hub for global buyers, notably from India, due to the lower prices and tax-free shopping. Travelers can bring up to 20-40 grams duty-free. Exceeding limits incurs duty fees. Understanding regulations and accurately declaring gold while returning to India is crucial for a seamless experience.

— By VisaVerge.com

Read More: