Knowledge

Boost your visa and immigration Knowledge with our comprehensive guides, FAQs, and expert insights to navigate complex legal landscapes with ease.

12 Visa-Free Destinations for Americans in 2025 with Updates

U.S. passport holders enjoy broad visa-free access in 2025: Mexico allows up to 180 days, Canada up to six months (air travelers need an eTA), and the Schengen Area permits…

Project Firewall: What Indian H-1B Holders Must Know Now

Project Firewall, announced September 19, 2025, empowers the DOL to aggressively investigate H-1B abuse. A presidential proclamation adds…

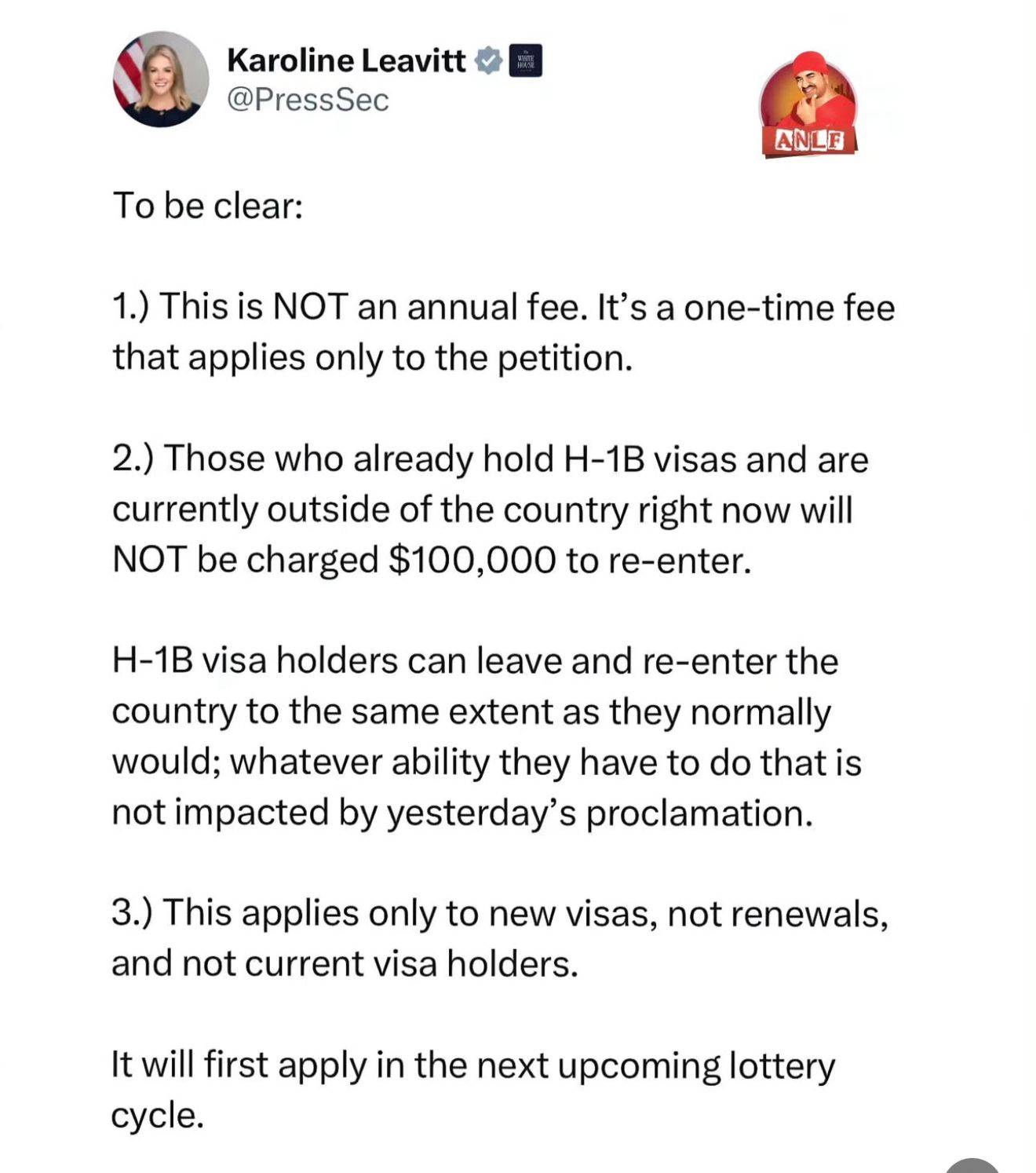

Trump’s $100,000 H-1B Fee: What Employees Must Do Next

A $100,000 annual H-1B fee takes effect September 21, 2025, covering new petitions, renewals, and transfers. Employers advise…

Trump’s $100,000 H-1B Fee: What Employers and Workers Should Know

A $100,000 annual fee per H-1B worker takes effect September 21, 2025, applying to new abroad-filed petitions, certain…

Saudi Arabia Visa for Indians: Types, Eligibility, Fees, and Process

From mid-September 2025, Indians can apply online for Tourist, Business, Umrah, and Family Visit visas with faster processing,…

UAE 13 Official Work Permits: Eligibility, Process & Renewal (2025)

The UAE’s MoHRE enforces 13 official work permits covering hires, transfers, part‑time, students, juveniles, freelancers and Golden Visa…

OPT Under Fire: Lawmakers Move to Eliminate Post-Study Work

OPT and the STEM OPT extension remain active but face possible termination through legislation and tighter oversight. In…

India’s Passport: Blue Ordinary, White Official, Maroon Diplomatic

As of September 2025, India issues dark blue, white, and maroon passports; orange covers are discontinued. ePassports rolled…

USCIS Announces 2025 Civics Test: 128 Questions, 12/20 Pass

Starting October 20, 2025, USCIS will require naturalization applicants filing Form N-400 to study a 128-question civics pool…

What Indian H-1B Holders Must Know About the 2025 Civics Test Changes

On October 20, 2025, USCIS will require the 2025 Civics test for N-400 filings, using a 128-question pool…