Frontier’s Booking Calendar Shows Gap After April 2026 Amid Schedule Review

Frontier Airlines is currently only selling tickets through April 13, 2026, during a network-wide schedule review. While new…

Jim Grey serves as the Senior Editor at VisaVerge.com, where his expertise in editorial strategy and content management shines. With a keen eye for detail and a profound understanding of the immigration and travel sectors, Jim plays a pivotal role in refining and enhancing the website's content. His guidance ensures that each piece is informative, engaging, and aligns with the highest journalistic standards.

www.visaverge.com

Frontier Airlines is currently only selling tickets through April 13, 2026, during a network-wide schedule review. While new…

The report highlights the critical role of a federal court stay in preserving Syrian TPS status amidst shifting…

Missouri’s 2026 tax rules feature progressive rates up to 4.70%. For immigrants, filing correctly with an SSN or…

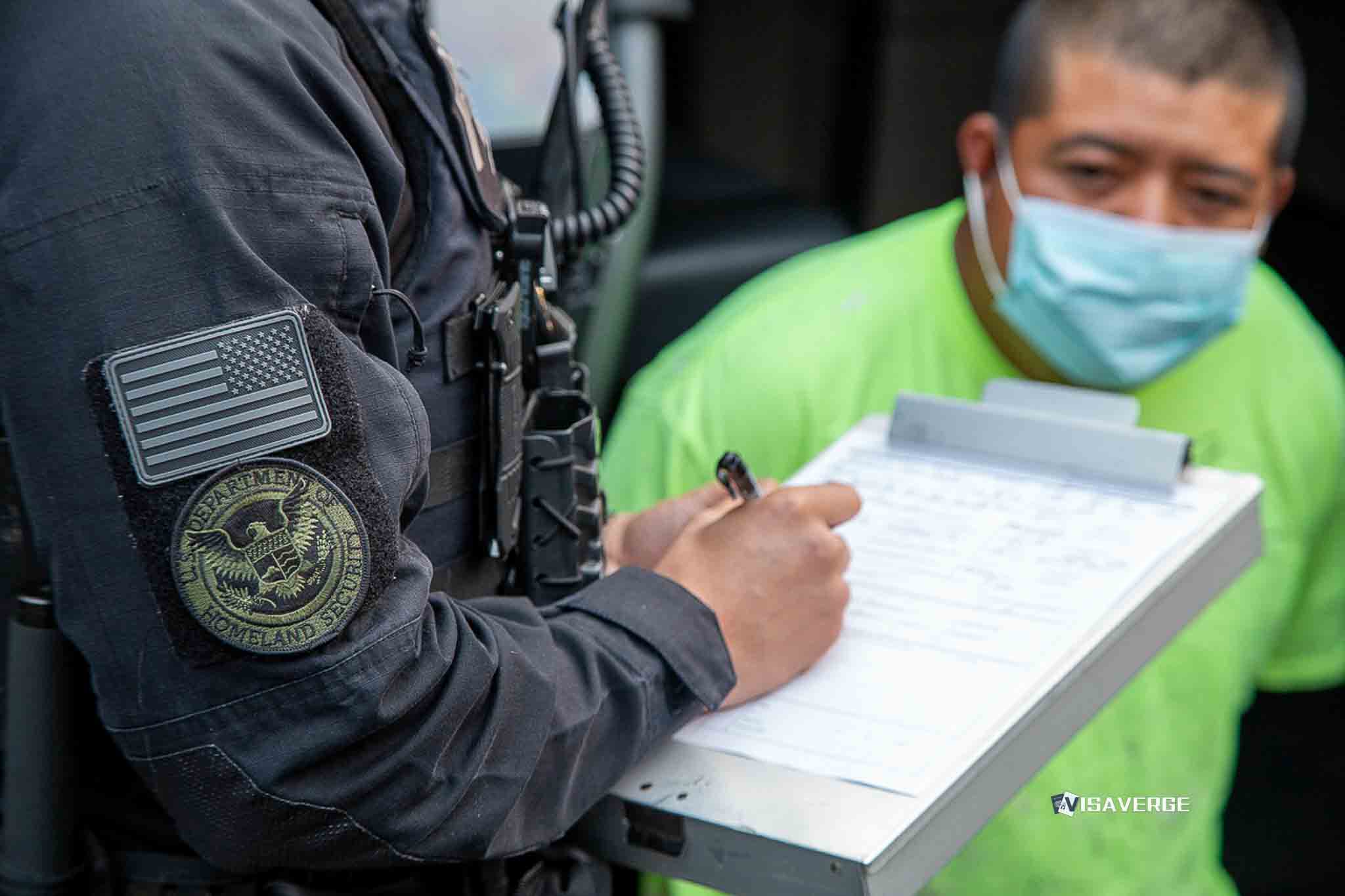

Charles Wall is the new ICE Deputy Director, replacing Madison Sheahan. His appointment coincides with intensified 'surge' operations…

Switzerland faces a 2026 vote on a proposed 10-million-person population cap. The initiative, opposed by the government, seeks…

The U.S. is experiencing a decline in international student enrollment as federal agencies implement tougher screening and 'integrity-based'…

The Philippines has ordered the deportation of YouTuber Vitaly Zdorovetskiy following his arrest for disruptive 'prank' livestreams. After…

Three workers at El Tapatio in Willmar were detained by ICE agents on January 14, 2026. The arrests…

The shooting of Renee Nicole Good during a Minneapolis ICE operation highlights the need for immediate legal documentation.…

Get weekly visa policy updates, processing time alerts, and expert analysis delivered to your inbox.