(UNITED STATES) The White House’s 2025 trade-and-immigration package—anchored by a 10% baseline tariff on most imports and a $100,000 surcharge on new H-1B visa petitions—is reshaping debates over jobs, prices, and the meaning of “U.S. prosperity.” While America remains a global leader by GDP, innovation, and military power, the push to “Make America Great Again” reflects a domestic argument: who feels the benefits of that strength, and at what cost to families, patients, students, and employers at home.

The tariff plan goes further than a universal rate. India, a fast-growing trade partner, faces 50% duties on selected goods and a 100% tariff on pharmaceutical imports. Supporters say the policy increases leverage in negotiations and encourages more critical manufacturing onshore. Critics warn it acts like a tax on consumers and risks retaliation that could hit U.S. farm exports, energy, and services.

In healthcare, hospitals and pharmacies depend on low-cost Indian generics. A 100% duty could raise drug prices for patients and insurers, with spillover costs for public programs and private employers.

On immigration, the new $100,000 fee on initial H-1B filings has already forced hiring pivots in tech and healthcare. Existing H-1B workers and renewals are exempt, but the entry price for new talent is steep. Some firms are pausing sponsorships; others are turning to remote-first contracts abroad. Economist Peter Schiff warned in The Times of India:

“One of the unintended consequences of Trump’s $100K fee on H-1B visas is that companies will outsource the work outside of the U.S. Remote workers won’t pay U.S. income taxes or spend their earnings in ways that benefit local landlords or other U.S. businesses.”

This policy mix lands at a moment when employers already learned to run distributed teams. After the pandemic, many companies normalized remote work. For them, the new surcharge becomes one more reason to keep roles offshore. That means fewer local dollars spent on rent, groceries, transit, and childcare—everyday spending that usually follows when high-skilled immigrants live and work in the community.

Analysts say the gap between America’s global dominance and worker frustration explains why “Make America Great Again” still draws support. The country leads in finance, tech, culture, and defense, yet people in many towns see little payoff. Wages lag, life expectancy varies, and aging roads and hospitals add daily strain. The question for policymakers is whether tariffs and visa fees bring those families relief—or shift costs onto them through higher prices and slower growth.

Policy moves: tariffs and visa fees

Policymakers backing the tariff strategy argue it is a broader and tougher playbook that can reshape supply chains. By putting a price on imports, they hope to pull production of crucial goods—especially medicines—back to the United States 🇺🇸. The 10% baseline is meant to be simple and universal; the targeted 50% and 100% rates are designed to send a stronger signal to specific sectors.

Economists counter that tariffs work like a sales tax on consumers. A 10% add-on can show up in the checkout line; a 50–100% duty is much harder to absorb. In pharmaceuticals, where margins are tight and demand is steady, big tariffs tend to pass through to patients. That undercuts household budgets and can pressure insurers, employers, and public health programs.

The immigration fee is equally consequential. The H-1B program supports “specialty occupation” roles that need at least a bachelor’s degree in areas like software, engineering, and healthcare. The new $100,000 surcharge applies to new petitions only, which employers file using Form I-129. USCIS still runs the H-1B lottery and adjudication under existing rules, but the price shock is changing behavior today.

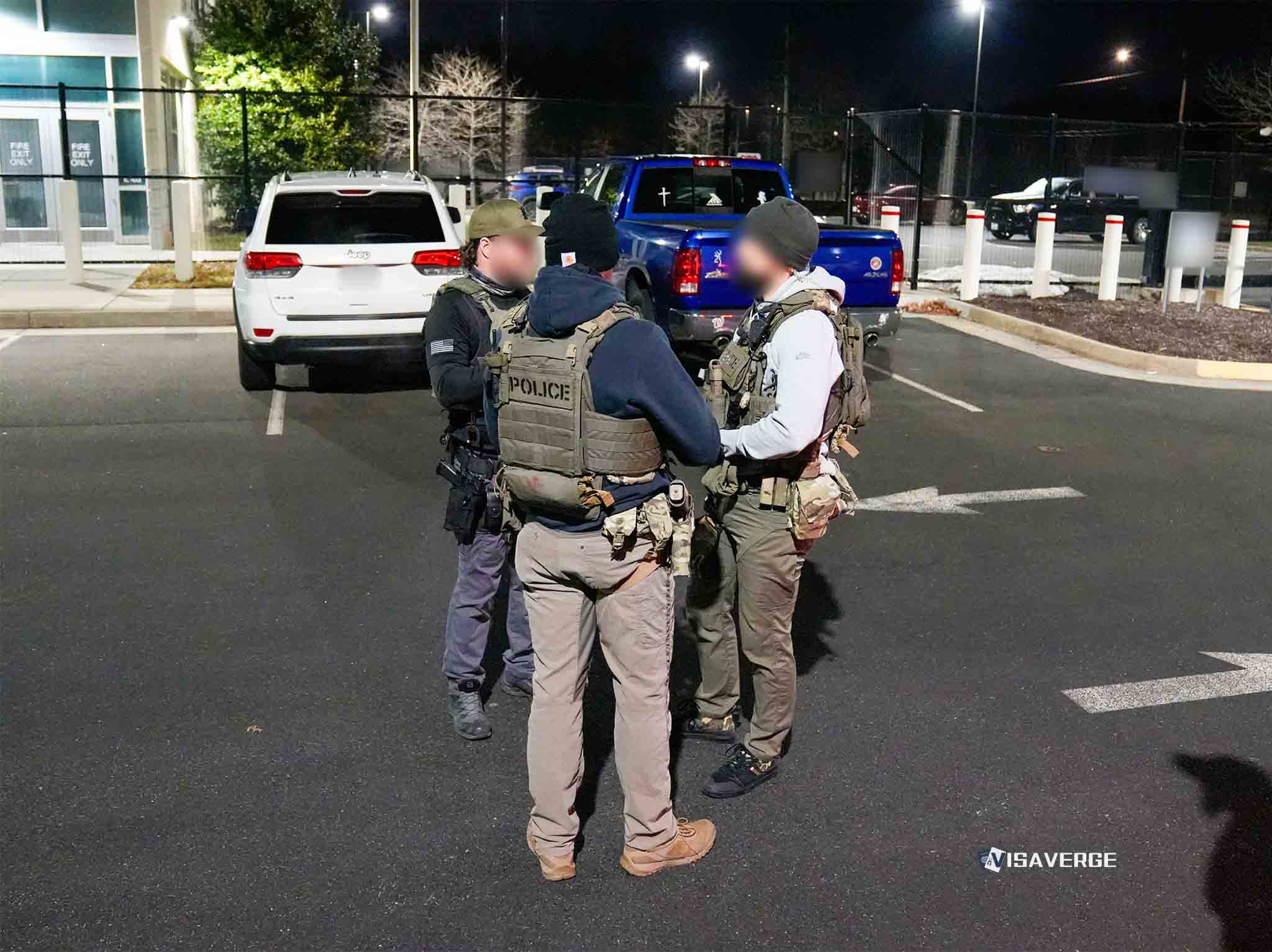

As VisaVerge.com reports, employers now weigh the surcharge against options such as:

- nearshoring,

- remote contracting, or

- opening satellite teams abroad.

Those choices can reduce U.S. payrolls, tax receipts, and local spending.

Supporters, including advisers aligned with President Trump, say the fee protects American workers and forces companies to invest in U.S.-based training. Critics note that when the price of hiring onshore rises quickly, firms accelerate offshoring instead of expanding local training pipelines. Startups and small clinics say they feel the pinch most: they rely on hard-to-find specialists and lack the cash buffers of large corporations.

Impact on workers, students, and employers

The policy package carries trade-offs that will show up unevenly across the country.

- Prices and patients

- A 100% tariff on Indian pharmaceuticals could push up costs for generic drugs used in hospitals, cancer centers, and pharmacies.

- Budget-strapped providers may reduce services or delay upgrades.

- Families could see higher out-of-pocket bills and insurance premiums.

- Jobs and pay

- Tariffs can give breathing room to some factories and labs, supporting wages in communities tied to onshore production.

- But higher input costs can also slow hiring in downstream industries where parts and materials become more expensive.

- Innovation

- The $100,000 H-1B fee raises the hurdle for startups that often depend on a few highly skilled engineers or clinicians.

- Some early-stage companies may choose to base research in countries with easier work-visa paths.

- Over time, that can weaken the ecosystem that feeds U.S. patents, spinoffs, and high-wage clusters.

- Higher education

- International students often choose U.S. universities because of strong job pathways after graduation.

- If employers retreat from sponsorships, fewer students may enroll—affecting tuition revenue and local economies in college towns.

- That also erodes soft power as alumni networks build careers elsewhere.

- Talent shortages

- Hospitals in rural regions and fast-growing tech hubs already report shortfalls in specialized roles.

- If sponsorship becomes rarer or slower, vacancies may last longer, affecting patient care and project timelines.

These outcomes cut across party lines. Patients who depend on stable drug supplies, factory workers who want steady pay, founders who need a niche hire, and students who plan a long-term career in the United States all have something at stake. The question is not whether America is great—it is how policy choices spread that greatness more widely.

Practical steps for employers and affected groups

For employers still planning to sponsor, the basic H-1B steps remain:

- File

Form I-129to petition for a worker (see Form I-129). - Note that the new surcharge applies to initial filings only.

- USCIS continues to run the cap selection process and adjudicate cases.

- Build budgets that account for the $100,000 surcharge, standard filing fees, and legal costs.

- Plan earlier for start dates given likely changes in hiring behavior.

Practical choices now revolve around three paths:

- Sponsor and absorb the cost for top roles where local supply is tight.

- Shift the role offshore or hire a contractor abroad, keeping the work but losing local spending.

- Delay the project, accept slower growth, or automate tasks to reduce headcount needs.

Each path affects communities differently. When a sponsored worker moves to a city, they pay rent, buy a car, use public transit, and dine out. That spending supports local jobs beyond the original role. When the role shifts overseas, the product may still ship, but the regional economy loses the multiplier effect that immigrants often bring.

On trade, the same “seen and unseen” tension applies. A reopened factory may grab headlines. Less visible are higher prices for everyday goods, or lost export sales if a partner country retaliates. India is a key market for U.S. farm products, energy, and digital services. If it responds with 50–100% duties, American exporters could feel the hit.

Alternatives, mitigation, and policy design

Officials close to President Biden have emphasized supply chain resilience with allies and targeted incentives at home. Advisers aligned with President Trump argue for stronger border and trade tools. Both camps claim their approach protects workers and strengthens the middle class. The evidence will show up in data most households understand: prices at the pharmacy, job postings in local markets, and whether young people see a future that feels within reach.

According to analysis by VisaVerge.com, the current mix of tariffs and the H-1B surcharge could slow inward mobility in high-skill sectors while raising near-term prices—unless paired with clear timelines and domestic build-out plans.

Several economists suggest alternatives or mitigations, including:

- Narrower, time-limited measures tied to specific capacity goals (for example, rebates for U.S.-made sterile injectables).

- Fee waivers for small firms or critical shortage roles to protect hospitals and startups while preserving the policy’s stated goals.

- Clear timelines and capacity milestones to smooth transitions and limit price shocks.

Key takeaway: Broad tariffs and blanket visa surcharges can bring quick headlines yet also dampen hiring, raise costs, and push work offshore. Targeted tools, clear timelines, and narrow carve-outs may better align with the goal of wider, lasting U.S. prosperity.

Advice for families, students, and patient advocates

- Employers considering H-1B:

- Review petition rules and required evidence using

Form I-129(Form I-129). - Factor the $100,000 surcharge into offers and timelines.

- Review petition rules and required evidence using

- Students:

- Weigh Optional Practical Training plans against the current sponsorship climate.

- Talk to career offices and potential employers early about alternatives, including roles with cap-exempt institutions like universities and some nonprofits.

- Patient advocates and providers:

- Track drug purchasing contracts over the next two quarters.

- A 100% tariff on Indian pharma could change availability and pricing, especially for hospital-administered generics.

America’s baseline is strong: the dollar anchors world finance, U.S. labs and startups drive breakthroughs, and culture exports shape global tastes. The MAGA message resonates because many neighbors do not feel that strength in their daily lives. Policy can help spread it—but design matters. Broad measures and blanket surcharges may have unintended consequences; more targeted approaches may better deliver the goal of shared, lasting U.S. prosperity.

This Article in a Nutshell

The 2025 policy package combines a 10% baseline tariff with targeted 50–100% duties on specific imports—most notably a 100% tariff on certain Indian pharmaceuticals—and a $100,000 surcharge on initial H-1B visa petitions. Supporters argue the measures strengthen U.S. bargaining power, incentivize onshoring, and protect domestic workers. Critics contend tariffs and the H-1B fee will act like taxes, raising drug and consumer prices, prompting retaliation from trade partners, and encouraging firms to hire remotely or offshore rather than sponsor new hires. Hospitals, startups, and college towns face potential price shocks, talent shortages, and reduced local spending. Economists advise more targeted, time-limited actions, fee waivers for critical roles, and clear capacity milestones to mitigate harms while pursuing domestic build-out goals.