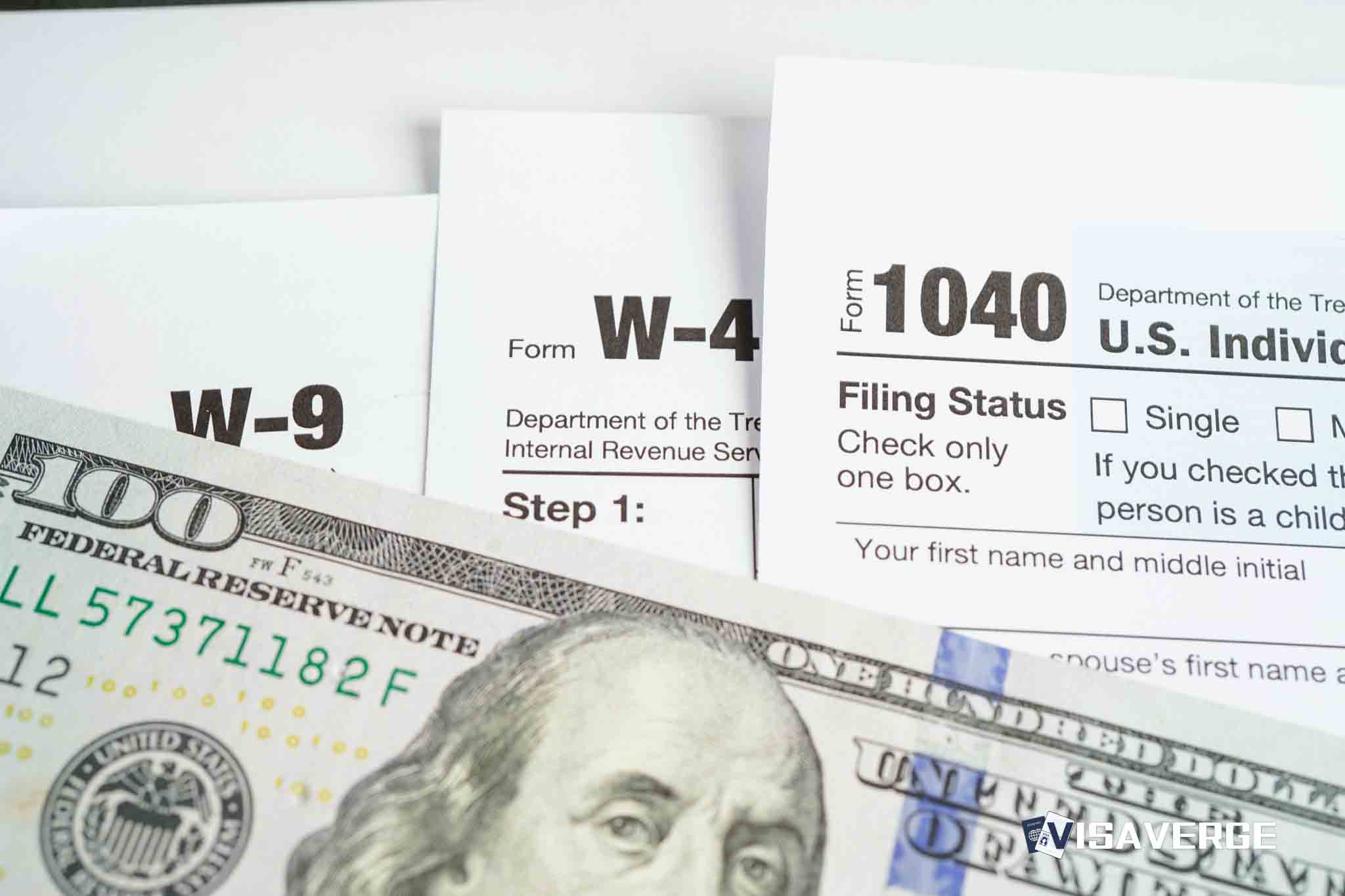

Taxpayers who end the year with an overpayment of federal income taxes can choose what happens to that money: apply it to next year’s estimated taxes, request a refund, or split it between both options. The Internal Revenue Service says filers make this choice on the tax return by indicating how much of the overpayment to carry forward and how much to send back as a refund. For those seeking speed, the IRS stresses that direct deposit is the fastest way to receive a refund, while paper checks take longer to arrive.

Ways to receive and split a refund

The IRS offers several ways to receive a refund and allows flexibility when taxpayers want to split funds or save a portion. If a taxpayer wants to deposit a refund into more than one account or purchase Series I savings bonds using part of the refund, they must include Form 8888, Allocation of Refund (Including Savings Bond Purchases) with the return.

- Form 8888 allows filers to:

- Split a refund into two or three accounts at a U.S. financial institution.

- Use up to $5,000 to buy Series I savings bonds.

- The form instructions are available at the IRS website: About Form 8888.

Policy details and processing timelines

A taxpayer who e-files a complete and accurate return should receive a refund within 21 days of IRS receipt. Paper returns usually take six to eight weeks.

If a filer wants the refund to go to only one account, they can simply enter the routing and account number on the tax return and do not need Form 8888.

Accounts eligible for direct deposit include checking, savings, and several tax-advantaged accounts, provided the account is in the taxpayer’s name:

- Traditional IRA, Roth IRA, or SEP-IRA (not SIMPLE IRA)

- Health Savings Account (HSA)

- Archer MSA

- Coverdell Education Savings Account (ESA)

- TreasuryDirect account for buying U.S. savings bonds and marketable securities

The IRS requires direct deposits to go only to accounts bearing the taxpayer’s name. Preparers may not use Form 8888 to split refunds to recover fees, nor may they open joint accounts with taxpayers to receive refunds. These actions can lead to penalties under the Internal Revenue Code and discipline under Treasury Circular 230.

If a taxpayer owes back taxes under an IRS installment agreement, the IRS will apply any refund or overpayment to those balances before sending any remaining money.

Important deadline: claiming a late refund

If a filer discovers they’re due a refund after the tax year ends, timing matters. Generally, a taxpayer must claim a refund within:

- Three years from the date they filed the original return, or

- Two years from the date they paid the tax,

whichever is later. This is commonly called the Refund Statute Expiration Date. Missing this window can mean losing the right to get the money back even if a refund is owed.

Guidance for immigrant taxpayers and mixed-status families

Immigrant taxpayers—especially those filing with an Individual Taxpayer Identification Number (ITIN)—can use direct deposit if the name on the bank account matches the name on the return. For mixed-status families, choosing who receives each portion of the refund can be important.

- Form 8888 allows directing funds to up to three accounts, which can help separate money for rent, tuition, or savings bonds.

- The ability to deposit into accounts in the filer’s name makes direct deposit accessible for many immigrant taxpayers.

Fraud safeguards and deposit limits

To protect taxpayers from identity theft and stolen refunds, the IRS limits the number of refunds that can be electronically deposited into a single financial account or prepaid debit card to three.

- When an account receives a fourth (and later) refund, the IRS will:

- Convert that refund to a paper check, and

- Mail it to the taxpayer’s address on file.

- The filer will also receive a notice explaining the limit and the expected timing for the paper check (typically about four weeks if there are no other return issues).

This rule helps block criminals from routing many refunds into one account, but it can also affect families who share an account. For example, if parents and two adult children each send refunds to the same family account, the fourth refund will be switched to a paper check.

Households expecting multiple refunds should plan ahead by either:

- Using different accounts, or

- Allowing one or more refunds to arrive by mail.

Accuracy and tracking

The IRS emphasizes that accuracy speeds up processing. Common issues that can stall a refund include:

- Mismatched names

- Incorrect routing or account numbers

- Errors in Social Security or ITIN entries

Taxpayers who need updates on the status of a refund can use the official “Where’s My Refund?” tool at IRS Refunds, which provides daily updates for most e-filed returns.

Strategic considerations and practical tips

Community tax clinics serving immigrant workers note that the overpayment choice can be strategic:

- Apply part of an overpayment to next year’s estimated taxes — helpful for self-employed filers or those with uneven income.

- Take a direct deposit refund — useful for families needing cash for urgent expenses.

- Many filers choose to split the difference: send some forward to reduce next year’s tax burden and take the rest as a direct deposit refund for immediate needs (VisaVerge.com reports this is common).

The option to purchase Series I savings bonds with a refund can serve families looking for a safe, inflation-protected savings tool. Using Form 8888, taxpayers can buy up to $5,000 in bonds each year directly from their refund. For some immigrant households building an emergency fund in the U.S., bonds provide a stable savings option without stock market volatility.

Tax professionals caution that once an overpayment is applied to next year’s estimated tax, it generally cannot be pulled back for spending later. Filers should match this choice to their cash needs and expected income:

- Gig workers and small business owners often benefit from carrying part of the overpayment forward.

- Wage earners with regular withholding might prefer a full refund.

Final recommendations

- The fastest path remains e-filing paired with direct deposit into a U.S. account in the taxpayer’s name.

- Filers who need to split a refund or buy savings bonds should attach Form 8888 to the return.

- Double-check account names and numbers before submission to avoid delays or reissued paper checks.

Key takeaway: Direct deposit + accurate e-filing = fastest and most secure refunds. Use Form 8888 when splitting refunds or purchasing up to $5,000 in Series I savings bonds.

This Article in a Nutshell

Taxpayers who end the year with federal tax overpayments can elect to apply the amount to next year’s estimated taxes, request a refund, or split the overpayment between both options on their tax return. Direct deposit is the fastest refund method; paper checks take longer. To split a refund into two or three accounts or to buy up to $5,000 in Series I savings bonds, filers must attach Form 8888. E-filed, accurate returns typically receive refunds within 21 days; paper returns usually take six to eight weeks. The IRS limits electronic deposits to three refunds per account to reduce fraud, converting a fourth deposit into a mailed paper check. Taxpayers should ensure account names and numbers match the return and be aware of refund claim deadlines (generally three years from filing or two years from payment).