December 18, 2025

- Added guidance for new residents and visa holders about Rhode Island tax residency tests

- Updated withholding details with publication date (February 25, 2025) and Pay Period 02 effective timing

- Clarified pension/annuity exemption eligibility rules, AGI thresholds ($107,000 single, $133,750 joint), and all-or-nothing cutoff

- Included 2025 standard deduction amounts ($10,900 single/HOH, $21,800 joint)

- Added numeric tax examples and recalculated sample liabilities for common incomes

(RHODE ISLAND) If you’ve recently moved to Rhode Island for work, a green card, or a temporary visa, your first tax season here can feel like a second paperwork test: deadlines, forms, and rules that change by year. For tax year 2025 (income earned January 1–December 31, 2025, filed in 2026), the Rhode Island Division of Taxation kept the same three income tax rates—3.75%, 4.75%, and 5.99%—while raising bracket thresholds for inflation, issuing new payroll withholding tables, and confirming a much larger pension/annuity exemption starting January 1, 2025.

Start with your residency “status” for tax purposes

Before you run the numbers, decide whether Rhode Island treats you as a resident or nonresident for 2025. This is separate from immigration status. A person on H-1B, L-1, F-1 OPT, or a green card can still be a Rhode Island resident for tax if they live in the state and meet Rhode Island’s rules (the source material notes the common “183+ days” idea used in practice).

- Residents generally report worldwide income.

- Nonresidents report Rhode Island–sourced income and prorate.

Actions to take early in the year you file:

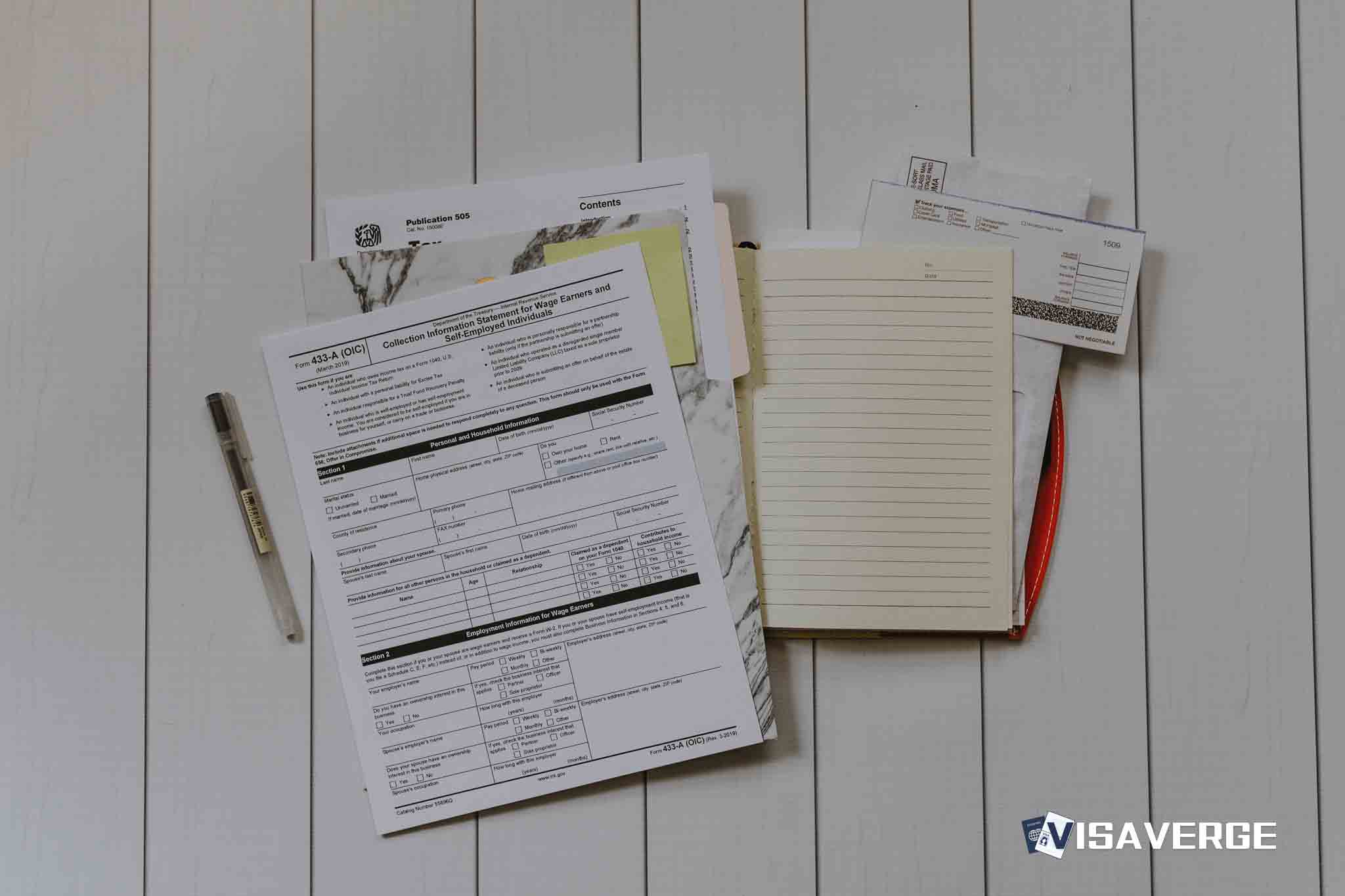

– Collect W-2s, 1099s, and any foreign income records you’ll need for federal reporting first.

– If you’re a nonresident, plan on filing RI-1040NR through the state portal at the Rhode Island Division of Taxation forms and filing page.

For federal residency tests that often matter to new arrivals, see IRS Publication 519, U.S. Tax Guide for Aliens.

Map your 2025 bracket and standard deduction early

Rhode Island uses one set of brackets for all filing statuses and adjusts the thresholds each year for inflation. For 2025, the Division of Taxation lists:

| Taxable income | Rate |

|---|---|

| $0 – $79,900 | 3.75% |

| $79,901 – $181,650 | 4.75% |

| Over $181,650 | 5.99% |

Standard deduction (2025):

– $10,900 — Single and Head of Household filers

– $21,800 — Joint filers

Doing this mapping early helps immigrants and visa holders who change jobs midyear, because a second W-2 or a late-year raise can push you into a different bracket. It also helps you spot when your withholding may fall short.

Check whether the pension/annuity exemption applies to you

The biggest 2025 change for many older newcomers is the pension/annuity exemption. Rhode Island law now lets qualifying people exclude up to $50,000 of eligible pension or annuity income (up from $20,000), and joint filers exclude up to $100,000 (up from $40,000), effective January 1, 2025.

This benefit comes with strict gates:

– You must be at full retirement age (the Social Security full retirement age range is typically 66–67).

– Your federal adjusted gross income (AGI) must be under $107,000 (single) or $133,750 (joint).

– The cutoff is “all-or-nothing”: exceed the limit by $1 and you lose the full exemption.

– Not all retirement income counts; the source flags that IRAs are not included, while many employer plans are.

Timeline tip: retirees should do a “mock return” by late October 2025, while there’s still time to adjust year-end income.

Create a 2025 Rhode Island tax map now: estimate all income (including midyear changes or bonuses) and see how it affects your bracket and withholding, so you don’t face surprise tax due at filing.

Important: The pension/annuity exemption can be entirely lost by a tiny AGI increase — plan distributions and other income carefully.

Understand the 2025 withholding reset for employees and employers

For most working families, the most visible change is payroll withholding. The Division of Taxation published new tables in the 2025 Rhode Island Withholding Tax Booklet, effective Pay Period 02, 2025 (published February 25, 2025). Employers should build this into payroll; workers should not assume their 2024 withholding is still right.

Key points from the booklet:

– Supplemental wages (bonuses and some overtime) are treated at a flat 5.99% withholding rate.

– The annual exemption amount phases out when annualized wages exceed $283,250.

– Employees must use the Rhode Island form; employers can’t rely on the federal W-4 alone.

If you’re starting a job after moving, ask HR for the state form immediately and keep a copy: RI W-4 is available from the Rhode Island Division of Taxation withholding resources.

Step-by-step: what your first Rhode Island filing year looks like

Most people complete the process in a few predictable stages:

- Stage 1 (January–February 2026): gather documents.

- Employers issue W-2s; banks and brokers issue 1099s.

- Retirees collect 1099-R forms showing pension distributions.

- Stage 2 (February–March 2026): run federal numbers first.

- Rhode Island starts from federal adjusted gross income, then applies state modifications.

- Stage 3 (March–April 2026): prepare the Rhode Island return.

- Most residents file RI-1040; quarterly payers use RI-1040ES.

- If you had Rhode Island income but lived elsewhere, prepare RI-1040NR.

- Forms are posted in the Division of Taxation site’s official forms library.

- Stage 4 (after filing): handle payment or refund.

- If you owe, pay promptly to limit penalties and interest.

- If you’re new to the state, review withholding and estimated payments before year-end to avoid surprises.

How the state computes tax: plain-language examples

Rhode Island’s rates are progressive, meaning each rate applies only to the slice of income in that bracket. The source material provides these computations:

- $50,000 of Rhode Island taxable income: 3.75% × $50,000 = $1,875.

- $120,000: $2,996.25 + 4.75% × ($120,000 – $79,900) = $4,906.

- $250,000: $7,829.38 + 5.99% × ($250,000 – $181,650) = $11,908.58.

For immigrants, these examples matter because many arrive midyear, get a signing bonus, or do contract work. Those payments can change your effective rate and create a mismatch between what you owe and what was withheld.

Common trouble spots for new arrivals

Three issues show up repeatedly for people who relocate to Rhode Island:

- Wrong state form at onboarding. If you don’t submit RI W-4, your employer may withhold incorrectly, leading to a balance due.

- Mixing resident and nonresident rules. A person who lived in Rhode Island part of the year may need careful allocation. Do not guess; keep lease dates, travel records, and pay stubs.

- Retiree income limits. The pension/annuity exemption can disappear if income creeps over the AGI line. Even a small extra distribution late in the year can erase the entire exclusion.

Don’t skip the RI W-4. If your employer doesn’t have the Rhode Island version on file, withholding may be wrong and you could owe at year end. Ensure the RI W-4 is submitted by early 2025.

According to analysis by VisaVerge.com, these state tax details often shape family choices in quiet ways—such as whether to accept a transfer, retire in-state, or keep a second home.

Planning now for 2026’s high-income surtax preview

Although the 3% surtax is not in effect for 2025, the source flags a 2026 change: a 3% surtax on income over $430,000, indexed for inflation. High earners should plan early because:

- Stock compensation, one-time payouts, and business income can spike above the threshold.

- Employers should review payroll systems for senior staff to avoid withholding errors that create a large tax bill at a sensitive time (e.g., coinciding with immigration filing fees and renewals).

A practical checklist to stay compliant and reduce surprises

- By Pay Period 02, 2025, confirm your employer applied the 2025 withholding tables and that your RI W-4 is on file.

- By October 2025, retirees should estimate AGI to protect the pension/annuity exemption and avoid a last-minute $1 mistake.

- If you pay quarterly, adjust RI-1040ES amounts after any job change, bonus, or move into or out of Rhode Island.

- Keep copies of filings and payment confirmations; they can help later when you need proof of compliance.

For the latest official updates and advisories cited in the source material, check the Rhode Island Division of Taxation official website.

Rhode Island’s 2025 tax rules keep three income tax rates but increase bracket thresholds for inflation, issue new withholding tables, and expand the pension/annuity exemption to $50,000 for singles and $100,000 for joint filers. The exemption requires full retirement age and AGI limits. Employers must adopt the updated withholding booklet (effective Pay Period 02, 2025). New residents should determine tax residency, collect federal documents first, and file the correct RI forms to avoid underwithholding.