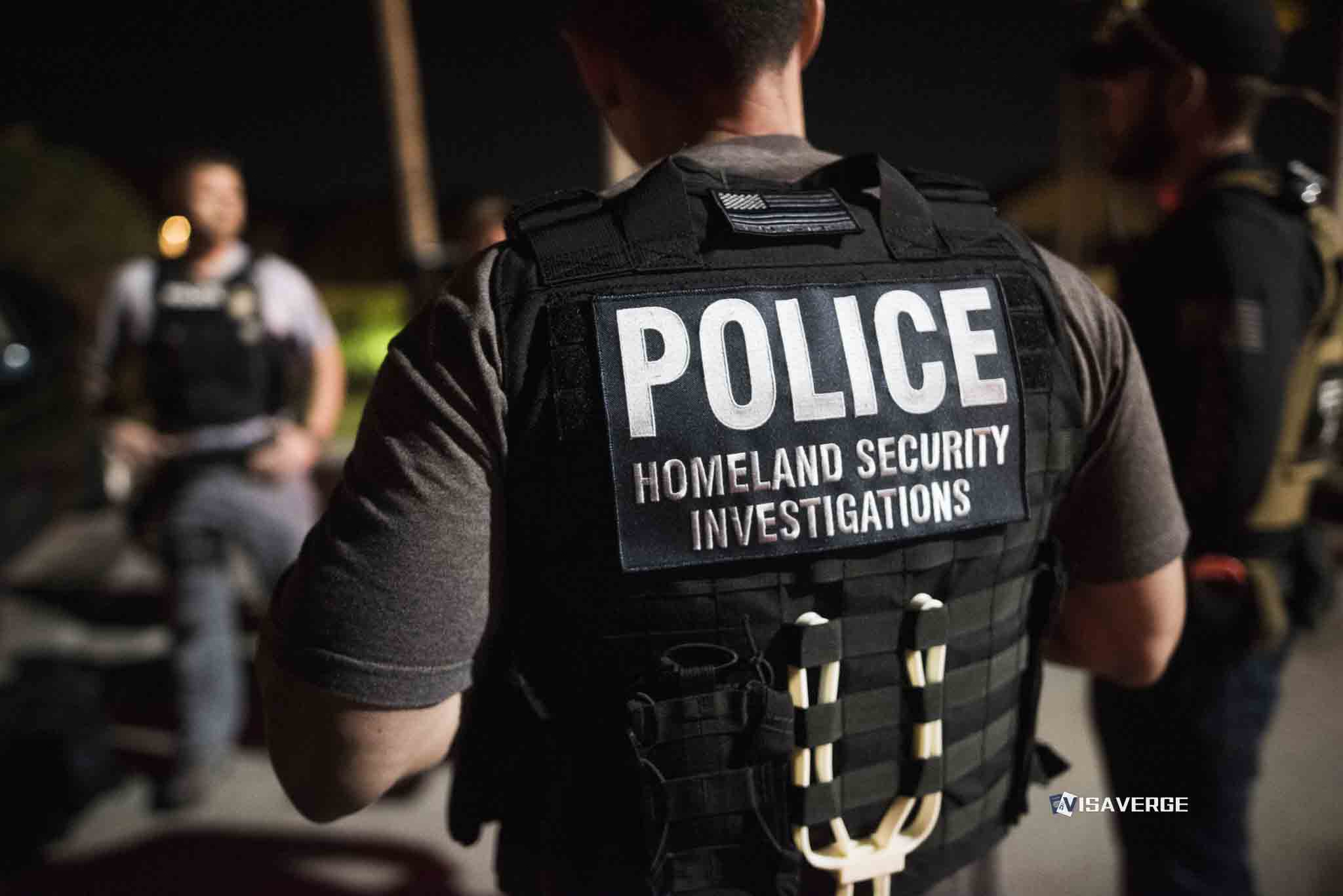

(UNITED STATES) Immigration and Customs Enforcement asked the Internal Revenue Service for taxpayer information on a sweeping scale, seeking records tied to about 1.28 million people, according to filings released this month in a lawsuit pending in federal court. The IRS said matches were found for about 47,000 people, offering the first concrete sense of how much taxpayer data may have been pulled into the dragnet.

The requests, which surfaced in materials filed in the U.S. District Court for the District of Massachusetts, have triggered new legal and political pressure over how taxpayer data can be shared with immigration authorities and whether the data could be used to support future enforcement campaigns or even mass deportations.

Who is suing and what they argue

The lawsuit was brought by:

– Community Economic Development Center of Southeastern Massachusetts

– National Korean American Service and Educational Consortium

– National Parents Union

– UndocuBlack Network

They argue that the information flow from the IRS to ICE:

– Undermines long-standing privacy norms

– Breaks public trust in the tax system

– Goes far beyond what Congress intended, targeting more than 1.28 million taxpayers (another filing referenced 1.3 million, underscoring uncertainty about the sweep’s scope)

The plaintiffs demand disclosure of:

– Who requested what

– Under which authority

– For what purpose

They seek to stop the arrangement and force clearer limits on how tax records are gathered and used by immigration officers.

Legal and privacy concerns

Advocates contend:

– The IRS has traditionally required a court order before handing over tax records to other agencies.

– That norm is critical to keep the tax system functioning because people file honestly when they believe their information will not be used against them in other contexts.

– Privacy concerns reach the core of tax collection; blurring tax administration and immigration enforcement could erode public confidence and reduce compliance.

“If large ICE records requests blur lines between tax administration and immigration enforcement, people may lose confidence and step back from the system.”

Administrative record and the litigation process

Recent developments:

– The IRS released its administrative record after a judge ordered it.

– The administrative record includes documents that lay out:

– Who was involved

– What rules were cited

– How the agency explained its approach

Why this matters:

– The record can reveal whether officials weighed privacy risks, considered less intrusive options, and followed agency policies.

– For ICE, the same documents could show that requests were targeted and lawful.

– The court will assess whether the agency acted within its authority and properly balanced privacy interests.

Stakes — compliance and revenue risks

Tax experts warn the stakes extend beyond privacy:

– If undocumented workers or mixed-status households stop filing returns, compliance could drop, reducing expected revenue.

– Analysts estimate nearly $100 billion in yearly tax collections could be threatened; undocumented immigrants paid about $97 billion in federal and state taxes in 2022.

These figures shape both the legal debate and the policy discussion:

– The lawsuit frames the issue as both a privacy matter and a test of whether taxpayer data can be repurposed for immigration enforcement without harming a system reliant on voluntary compliance.

Concerns about future enforcement

Supporters of the lawsuit fear:

– The scale of requests (roughly 1.28 million) could support broader enforcement actions in the future.

– Shared taxpayer data might be used to identify people for arrest, detention, and removal, or to build cases that could underpin mass deportations if political winds change.

Even with about 47,000 matches, the plaintiffs emphasize the chilling effect created by reporting the larger sweep:

– People hear the headline number and may avoid filing taxes for themselves or relatives.

Government response and public information

What has been publicly disclosed:

– Agencies have not fully detailed their rationale in court filings available so far.

– No official statement has outlined a specific enforcement plan tied to the records.

– The legal documents show a process: ICE submitted requests; the IRS reviewed them; records were matched for a portion of the names.

The limited public information has not eased concerns. For many immigrant families, sparse explanations plus large-scale requests increase fear about potential uses of taxpayer data.

Practical effects in communities and tax practice

On-the-ground impacts reported by tax practitioners:

– Increased questions about whether an individual taxpayer identification number (ITIN) could connect to immigration enforcement.

– Some filers asking whether to skip filing a return or forgo credits they are legally due.

– Community tax preparers note trust is fragile; headlines about large ICE requests amplify uncertainty.

Advocates reiterate:

– Tax rules have not changed — filing remains a legal obligation for those with taxable income.

– But the perception of risk drives behavior that harms families and public revenue.

Context and policy implications

Core issue:

– Where does tax administration end and policing begin?

IRS position:

– The agency says it operates under strict privacy practices.

– Official guidance on confidentiality and disclosure explains protections and when information can be shared; see the IRS privacy page: IRS Privacy and Disclosure.

For immigrants and advisers, official guidance now competes with the practical reality that records were requested on an unusually large scale.

Next steps in the case and implications

What to expect:

– More legal argumentation and additional documents detailing how the IRS processed requests and how ICE justified them.

– Plaintiffs will use the administrative record to point to internal memos and communications.

– The government will argue procedures were followed.

The decision will hinge on:

– Whether the IRS acted within its statutory authority

– Whether it properly balanced privacy and enforcement interests

Why this matters for families and the public

Immediate consequences for households:

– Parents might hesitate to file returns or claim credits that keep households afloat.

– Workers might avoid updating addresses or submitting forms that maintain accurate wage records.

– These choices directly affect families’ financial stability.

Broader consequences:

– Reduced trust in the tax system can lead to lower compliance and revenue losses.

– The ripple effects could persist long after the case concludes if broad data-sharing norms are allowed to stand.

People pay taxes when they trust the system. If that trust slips because of broad data-sharing that reaches far beyond individual cases, the damage could ripple through compliance, revenue, and community life long after this litigation ends.

This Article in a Nutshell

Court filings reveal ICE requested IRS records connected to about 1.28 million people; the IRS matched roughly 47,000 names. Four advocacy groups sued, arguing the data-sharing breaches IRS privacy norms, undermines trust in tax administration, and could depress compliance. After a judge ordered release of the administrative record, documents will be examined to see whether agencies followed legal rules and weighed privacy risks. The lawsuit could determine limits on using taxpayer data for immigration enforcement and influence future filing behavior and revenue.