(Hawaii) Hawaii’s state income tax rules for tax year 2026 stay the same as 2025, with 12 brackets and rates ranging from 1.4% to 11%. If you’re a new immigrant, student, or work-visa holder settling in Hawaii, that stability helps you plan paychecks, savings, and immigration filing costs with fewer surprises.

For most households, the practical change is not the rate but the timing and setup: withholding tables update effective January 1, 2026, and taxes on 2026 income are due April 21, 2026. The bracket structure comes from HB2404, signed by Gov. Josh Green, which widens brackets over time while keeping 2026 rates unchanged, with further changes beginning in 2027.

The 2026 Hawaii tax rules immigrants deal with first

Hawaii taxes taxable income, meaning income after deductions and exemptions. For 2026, the standard deductions and personal exemption are:

- Standard deductions

- $15,750 — Single filers

- $31,500 — Married filing jointly

- $23,625 — Head of household

- Personal exemption

- $1,144 per person

That matters for immigration households because many are building a “first year” budget that includes fees, credentialing, and travel. A predictable tax table helps, especially for families combining wages, scholarships, or side work.

VisaVerge.com reports that state tax surprises often hit newcomers hardest in the first year, when payroll settings, filing status, and residency rules don’t match real life.

Set up Hawaii withholding correctly in January 2026 with HR. If you spot any mismatch, correct it early to avoid a painful year-end adjustment and surprising take-home pay.

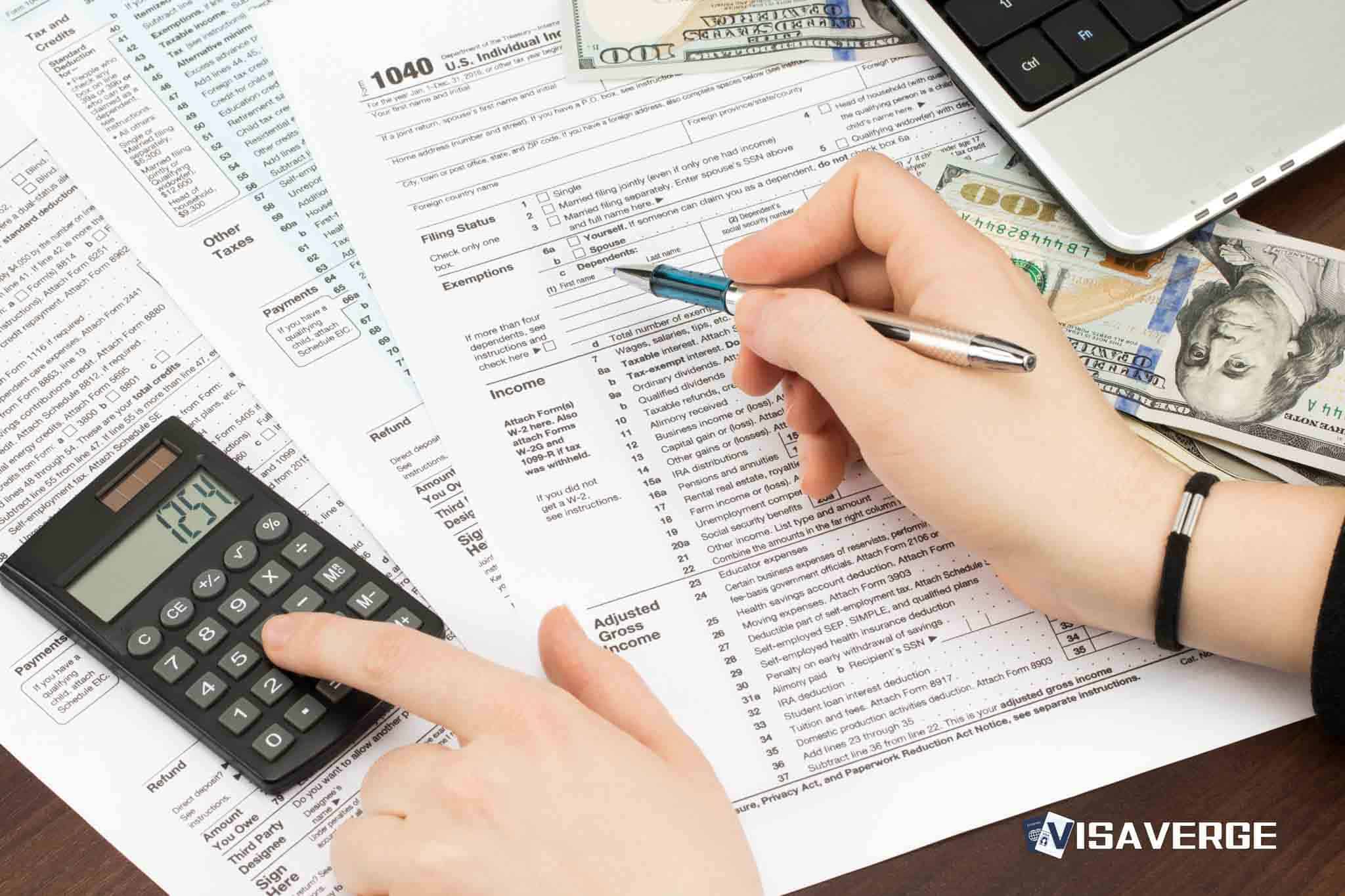

What the bracket tables mean in everyday paychecks

Hawaii’s bracket system is progressive — different slices of income are taxed at different rates. These examples illustrate how the brackets affect typical filers:

- Single (and married filing separately)

- First bracket: 1.4% on the first $2,400 of taxable income.

- Key middle range: over $48,000 – $125,000 → $2,889 + 8.25% of income over $48,000.

- Top rate: 11%

- Married filing jointly

- First bracket: $0 – $4,800 at 1.4%

- Key middle range: over $96,000 – $250,000 → $6,777 + 8.25% of income over $96,000

- Top rate: 11%

- Head of household

- First bracket: $0 – $3,600 at 1.4%

- Key middle range: over $76,800 – $200,000 → $5,917 + 8.25% of income over $76,800

- Top rate: 11%

These numbers are most useful when you compare them to your expected taxable income, not your gross salary. New arrivals often overestimate taxes because they forget deductions and exemptions.

Quick reference: deductions & exemption (2026)

| Filing Status | Standard Deduction |

|---|---|

| Single | $15,750 |

| Married filing jointly | $31,500 |

| Head of household | $23,625 |

- Personal exemption: $1,144 per person

A practical 2026 timeline for new arrivals and status changes

Immigrants often face life changes that affect taxes: marriage, a newborn, a move between islands, a first job, or a spouse arriving later. Here’s a simple process that matches how Hawaii’s 2026 system actually plays out:

- January 2026: set payroll withholding correctly (first paycheck cycle)

- Ask HR how Hawaii withholding is set up under the tables effective January 1, 2026.

- Fix mistakes early — waiting until April usually means a painful catch-up.

- First 30 days after moving: align your mailing address across agencies

- If you have a pending immigration case, file a USCIS address change using

Form AR-11at USCIS Form AR-11, Alien’s Change of Address. - Tax notices, W-2s, and agency letters get lost easily after a move.

- If you have a pending immigration case, file a USCIS address change using

- By mid-year: estimate taxable income using the 2026 deductions and exemption

- Start with expected wages, subtract the relevant standard deduction ($15,750, $31,500, or $23,625), then apply the $1,144 personal exemption per person.

- This gives a cleaner bracket estimate.

- Late January to February 2027: collect income documents and confirm filing status

- Many immigration households have mixed documents: a W-2 job, scholarship forms, or contract work.

- If a spouse arrived mid-year, double-check whether “married filing jointly” is right.

- Filing deadline / payment

- The material states: By April 21, 2027: file and pay Hawaii tax on 2026 income.

- It also states the 2026 payment deadline as April 21, 2026 for 2026 income.

- > Important: the article contains conflicting dates for the filing/payment deadline (April 21, 2026 vs. April 21, 2027). Treat April 21 as the key planning anchor and confirm the correct year with official guidance before finalizing payments.

If you don’t have an SSN yet, file Form W-7 early and plan ITIN steps alongside other documents. Also update address with USCIS within 30 days of moving to avoid missing notices.

When you don’t have an SSN yet: ITIN planning that avoids delays

Many immigrants can work only after authorization, and some spouses and dependents can’t get a Social Security number right away. For tax filing, that can create a bottleneck.

- If you need an Individual Taxpayer Identification Number, use

IRS Form W-7at IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. - Households often wait too long, then scramble near the filing deadline.

- Even if your immigration status changes during 2026, your tax filing still needs consistent identifiers for each person claimed — including children, where paperwork problems can become expensive.

Beware conflicting filing deadlines (April 21) for 2026 vs. 2027. Verify the exact year with official Hawaii guidance before submitting payments or returns.

How HB2404 shapes the near future, even when 2026 looks unchanged

HB2404 matters because it sets the path for bracket widening and later adjustments. For 2026, the point is simple: rates and bracket steps don’t shift from 2025, even though the law is phasing in changes over time and indexing brackets for inflation.

For immigrants choosing between Hawaii jobs, that “no sudden jump” year can be a budgeting advantage. You can plan for predictable take-home pay while you handle immigration costs like translation, medical exams, and travel for interviews.

Keep an eye on 2027 if you’re signing a multi-year contract. HB2404’s later changes begin then, and a raise that crosses bracket lines feels different once the tables move.

SB1649 and high earners: why top-bracket talk still matters now

- SB1649 was introduced January 23, 2025 and carried over to the 2026 session on December 8, 2025.

- It seeks to add a higher bracket for top earners and has not passed as of December 25, 2025.

For employment-based immigrants in higher-paid roles, a new bracket can change withholding, quarterly estimates, and year-end cash needs — especially for households supporting family abroad.

Still, for 2026 planning, the working rule remains the same bracket ladder with the 11% top rate under current law.

Cross-border realities immigrants in Hawaii should plan for

Immigrants often bring financial ties that long-time residents don’t think about. Hawaii taxes what counts as taxable income under its rules, so your best defense is careful recordkeeping.

Common pressure points include:

- Mid-year moves and split income between states or countries

- Family status changes that affect head of household or joint filing choices

- Cash-flow crunches when immigration fees and taxes come due close together

- Mis-set withholding that produces an unexpected bill

A steady 2026 bracket table doesn’t remove those risks, but it makes them easier to manage because your estimate is less likely to be overturned by a sudden rate change.

Key takeaway: For 2026, Hawaii’s tax rates and bracket steps are stable — focus on correct withholding, timely ITIN/SSN steps, and careful mid-year estimates to avoid surprises.

The one official Hawaii resource to rely on

For Hawaii’s official tax guidance and tools, start with the Hawaii Department of Taxation at Hawaii Department of Taxation. Use it to confirm current instructions, calculators, and updates tied to the 2026 withholding tables and filing requirements.

Hawaii’s 2026 tax landscape maintains its 12-bracket system with rates from 1.4% to 11%. Stability in these rates allows immigrants and students to better budget for relocation and visa costs. Residents should focus on the January 1 withholding update and the April 21 filing deadline. Proper planning involves utilizing standard deductions, personal exemptions, and ensuring all family members have valid tax identifiers like SSNs or ITINs.