(INDIA) — April 15, 2027 is the main U.S. federal filing deadline for many India-to-U.S. movers reporting both indian and U.S. income for tax year 2026 (returns filed in 2027).

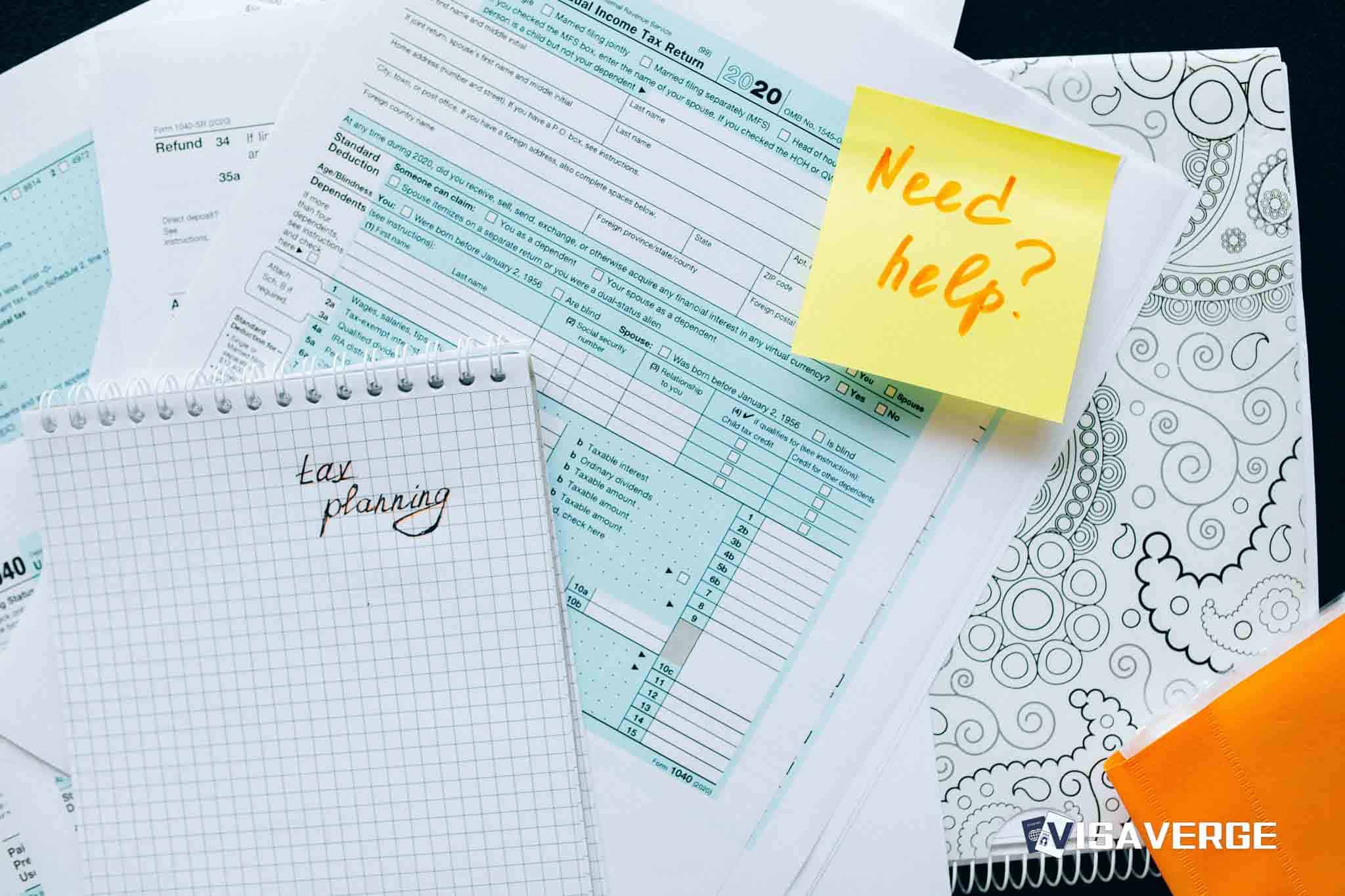

This deadline hits hardest in “migration years,” when you earn salary in India for part of the year and later earn U.S. wages. Many taxpayers assume the India–U.S. DTAA prevents any double reporting. In reality, the DTAA mainly prevents Double Taxation through foreign tax credits, not by hiding income.

The U.S. filing posture depends on your U.S. tax residency. your indian filing posture depends on RNOR vs ROR status. Confusing those two can lead to incorrect reporting, missed credits, and avoidable notices.

📅 Deadline Alert: For tax year 2026, most individuals must file Form 1040 by April 15, 2027. Missing it can trigger late-filing penalties and interest.

The 2027 deadline calendar (for 2026 income)

| Tax event (tax year 2026) | Who it affects | Deadline | Extension available |

|---|---|---|---|

| U.S. individual return (Form 1040 / 1040-NR) | Most filers | April 15, 2027 | Yes, to October 15, 2027 (Form 4868) |

| Automatic extra time to file (if living outside U.S. on 4/15) | U.S. citizens/residents abroad | June 15, 2027 (filing) | Yes, to October 15, 2027 (Form 4868) |

| Pay U.S. tax due | Anyone who owes | April 15, 2027 | No automatic extension to pay |

| FBAR (FinCEN Form 114) for foreign accounts | If threshold met | April 15, 2027 | Automatic to October 15, 2027 |

| Form 8938 (FATCA), if required | If thresholds met | With your tax return | With return extension |

IRS references: Publication 519 (U.S. Tax Guide for Aliens) covers residency rules and dual-status topics. See IRS international portal at irs.gov/individuals/international-taxpayers and Publication 519 at irs.gov/pub/irs-pdf/p519.pdf.

What happens if you miss the U.S. deadline

Missing the filing deadline can be costly, especially if you owe tax.

- Failure-to-file penalty: generally 5% of unpaid tax per month, up to 25%.

- Failure-to-pay penalty: generally 0.5% per month, up to 25%.

- Interest: accrues on unpaid tax and penalties.

These rules are explained in IRS guidance for individual taxpayers. Your exact penalty can vary by facts.

Deadline for most 2026 income is April 15, 2027; extension to October 15 is available; also monitor FBAR and FATCA thresholds to determine if separate filings apply.

⚠️ Warning: Form 4868 extends time to file, not time to pay. Pay by April 15, 2027 to reduce penalties and interest.

Where migrants get tripped up: RNOR vs ROR and U.S. worldwide income

In India, your residential classification can change what India taxes. Confusing Indian residential status (RNOR vs ROR) with U.S. residency leads to reporting mistakes.

Practical comparison many migrants face:

| Item | RNOR (India) | ROR (India) |

|---|---|---|

| Indian-source salary | Taxable in India | Taxable in India |

| Foreign salary after leaving India | Often not taxable in India | Taxable in India |

| U.S. salary shown in India return | Often no | Often yes |

| DTAA credit claimed in India | Often not needed | Often needed |

| Form 67 (India) | Usually not required | Often required if claiming FTC |

In the U.S., once you are a U.S. tax resident, the U.S. generally taxes worldwide income. Publication 519 explains residency rules, including the Substantial Presence Test and dual-status concepts.

How the DTAA typically prevents Double Taxation in migration years

The India–U.S. DTAA often prevents Double Taxation through a credit system. Key points:

- Income can be reported in both countries.

- Relief is often claimed via a Foreign Tax Credit in the country taxing the income again.

For U.S. filers, the most common mechanism is Form 1116 (Foreign Tax Credit). If Indian salary was taxed in India, and the same salary is also included on a U.S. return, Form 1116 can reduce U.S. tax, subject to limitations.

For treaty background, IRS treaty material is summarized in Publication 901 (U.S. Tax Treaties).

Common India-to-U.S. mid-year pattern (how reporting usually works)

In a mid-year move:

- India generally taxes salary for services performed in India.

- The U.S. may tax both the U.S. salary and the earlier Indian salary, if you are a U.S. resident for 2026.

Typical sequence many follow:

- Pay Indian tax on Indian salary.

- Report Indian salary on the U.S. return if U.S. residency requires worldwide income reporting.

- Claim a credit in the U.S. for eligible Indian tax using Form 1116.

This process often prevents net double taxation but requires accurate reporting and documentation.

Foreign account reporting: FBAR and FATCA (often missed by new arrivals)

Many Indian families keep accounts in India after moving. Two U.S. reporting regimes matter:

| Filing status (living in U.S.) | FBAR threshold | Form 8938 (end of year) | Form 8938 (any time) |

|---|---|---|---|

| Single | $10,000 aggregate | $50,000 | $75,000 |

| Married filing jointly | $10,000 aggregate | $100,000 | $150,000 |

- FBAR is filed electronically as FinCEN Form 114.

- Form 8938 (FATCA) is filed with your tax return.

If your foreign account balances exceed these thresholds, calendar FBAR deadlines and include Form 8938 when required.

Form 4868 only extends filing, not payment; if you owe, pay by April 15 to reduce penalties and interest, and consider partial payments if you’re unsure of the final amount.

Special circumstances: disaster relief and extensions

- The IRS sometimes grants postponed deadlines for federally declared disasters. Affected zip codes and dates vary.

- Check irs.gov/newsroom for disaster tax relief announcements for your location.

If you need more time, file Form 4868 by April 15, 2027 to extend filing to October 15, 2027. Remember: payment is still due April 15.

Action steps to prepare now (January 2026)

Take the following steps to reduce surprises:

- Track U.S. and India workdays and your move date; keep visa and entry records.

- Collect Indian tax proof: Form 16, tax challans, and payslips.

- Keep U.S. paystubs and Form W-2 for 2026 wages.

- Confirm U.S. residency for 2026 using Publication 519 rules.

- If Indian tax applies to income also taxed in the U.S., plan for Form 1116.

- If India accounts exceed $10,000 total at any point, calendar FBAR.

If you’ll report both Indian and U.S. income, prepare Form 1116 early and document foreign tax credits; keep Indian tax receipts and W-2s together; verify RNOR vs ROR to avoid double reporting.

Important: maintain clear documentation of where services were performed, dates, and taxes paid — these facts determine eligibility for credits and treaty relief.

⚠️ Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. Tax situations vary based on individual circumstances. Consult a qualified tax professional or CPA for guidance specific to your situation.

This guide outlines critical 2027 tax deadlines for individuals migrating from India to the U.S. It emphasizes that U.S. residents must report worldwide income, including earnings from India. While the DTAA provides relief via tax credits, failure to file Form 1040, FBAR, or Form 8938 by April 15 can result in heavy penalties. Proper documentation of workdays and Indian tax payments is essential for compliance.