If all H-1B visa holders were to leave the United States today, approximately 600,000 direct job positions would theoretically become available. However, this seemingly straightforward answer masks a far more complex and devastating economic reality. Research consistently demonstrates that the departure of H-1B workers would trigger cascading economic losses that would eliminate nearly 1.1 million additional American jobs, resulting in a net loss of almost 500,000 positions and wreaking havoc across multiple sectors of the U.S. economy.

This analysis examines both the immediate employment implications and the broader economic catastrophe that would unfold if all H-1B visa holders departed, drawing on extensive economic research, government data, and industry analyses to paint a complete picture of the H-1B program’s critical role in American prosperity.

Direct Employment Impact: The Job Availability Question

Current H-1B Workforce Scale

As of 2025, the United States hosts between 600,000 and 730,000 H-1B visa holders actively employed across the economy. These workers represent a critical component of the American workforce, particularly concentrated in high-skill sectors. The program issues approximately 120,000 new visas annually when accounting for both cap-subject positions (85,000) and cap-exempt positions at universities and research institutions.

The H-1B program serves as the largest temporary high-skilled work visa program in the United States, employed by approximately 50,000 employers nationwide. Computer-related occupations dominate the visa distribution, accounting for 65% of all H-1B workers, with a median salary of $123,600 in 2023. The remaining positions span architecture, engineering, healthcare, education, and research sectors.

The Multiplier Effect: Jobs Created by H-1B Workers

While 600,000 direct positions would ostensibly open if all H-1B holders departed, this calculation ignores the fundamental economic principle of job creation through skilled labor. Multiple peer-reviewed studies establish that H-1B workers create substantially more jobs than they fill.

Research from the American Enterprise Institute and Partnership for a New American Economy demonstrates that every 100 H-1B visa holders create an additional 183 jobs for native-born Americans over a decade. This 1.83 job creation multiplier operates through several mechanisms: H-1B workers and native workers possess complementary skills that enhance overall productivity; immigrant workers spend their wages in local economies, stimulating demand; businesses expand U.S. operations rather than offshoring when they can access talent; and H-1B workers frequently launch new businesses that generate employment.

The National Foundation for American Policy found an even more dramatic effect: for every H-1B position requested by an employer, an average of 7.5 additional jobs are created in the United States. This multiplier proves particularly pronounced in the technology sector, where companies like Google, Microsoft, and Amazon rely on H-1B talent to sustain growth that creates demand for marketing, sales, customer service, and other complementary roles.

Net Job Impact Calculation

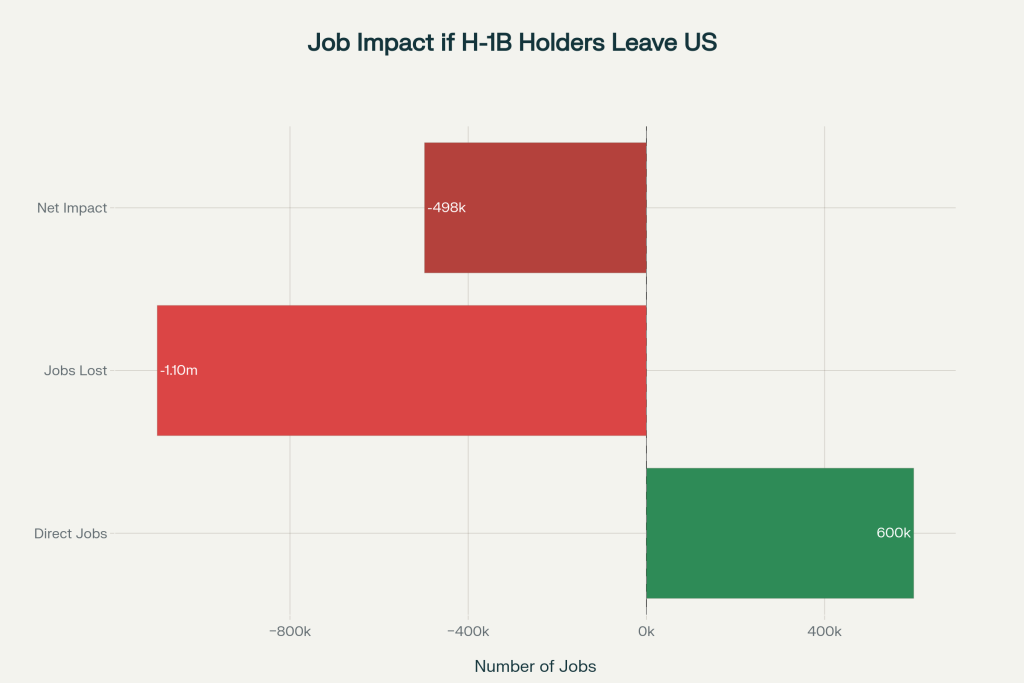

Applying the conservative 1.83 multiplier to the current H-1B population yields a stark conclusion:

- Direct jobs that would open: 600,000

- Additional jobs that would disappear: 1,098,000

- Net job impact: -498,000 jobs lost

This negative net impact occurs because H-1B workers serve as economic catalysts. Their presence in skilled positions enables companies to expand, innovate, and create additional positions that would not exist without their contributions. Recent research from Columbia University published in the Proceedings of the National Academy of Sciences confirms this pattern at the regional level: when the number of skilled immigrants in a metropolitan area doubles, entrepreneurship in that region increases by 6% within three years.

Economic Devastation: Beyond Direct Employment

The departure of all H-1B visa holders would trigger economic damage extending far beyond employment figures, with consequences measured in hundreds of billions of dollars annually and trillions over the long term.

Annual Economic Contributions

H-1B visa holders inject over $131 billion annually into the U.S. economy through multiple channels. This massive economic footprint breaks down into several critical components that would evaporate if these workers departed.

Tax Contributions: H-1B workers contribute more than $27.1 billion per year to Social Security and Medicare—programs from which many will never benefit since they may not remain in the United States long enough to collect these benefits. With a median annual salary of $108,000 and a base income tax rate of 24%, H-1B holders pay approximately $28,344 per year in federal income taxes, totaling roughly $15.6 billion annually across the entire H-1B population. These tax payments support federal programs, infrastructure, and services that benefit all Americans.

Consumer Spending: H-1B visa holders spend approximately $76.7 billion at U.S. businesses annually, with 74% of this spending (approximately $57.1 billion) flowing directly to local businesses within their communities. This spending supports retail establishments, restaurants, service providers, and countless other businesses that depend on consumer demand. In concentrated H-1B markets like the San Francisco Bay Area, Seattle, Austin, and Boston, this spending constitutes a significant driver of local economic activity.

Business Investment: Beyond consumption, H-1B workers invest more than $12 billion into U.S. businesses annually, supporting American entrepreneurship and economic expansion. This investment capital flows into startups, small businesses, and growth companies, providing the funding necessary for innovation and job creation.

Housing Market Impact: H-1B visa holders represent significant participants in American real estate markets, particularly in technology hubs. Indian nationals alone, many on H-1B visas, purchased approximately 4,700 homes in 2024-25, spending roughly $2.2 billion. This housing demand supports construction jobs, real estate services, mortgage lending, and property tax revenues that fund local schools and services. The departure of H-1B workers would devastate housing markets in cities like San Francisco, Seattle, Austin, Dallas, Phoenix, and Raleigh-Durham, where H-1B concentration is highest.

Following the Trump administration’s March 2025 decision to exclude non-permanent residents from FHA loan eligibility, the share of FHA loans to non-permanent residents plummeted from over 6% in April to virtually zero by August. This policy change alone demonstrates the immediate market impact of restricting H-1B workers’ economic participation.

Long-Term Fiscal Impact

The long-term economic consequences of H-1B departure extend far beyond annual contributions, with effects measured in trillions of dollars over multiple decades. Recent research from the Manhattan Institute provides sobering projections of these long-term impacts.

Individual Fiscal Contribution: Each H-1B visa issued today will likely increase GDP by $500,000 after 30 years and reduce the national debt by $2.3 million. Indian immigrants, who comprise the largest share of H-1B holders, save the federal government an average of $1.7 million over 30 years while contributing significantly to GDP growth. Chinese immigrants reduce the national debt by approximately $800,000 per person, followed by Filipinos at $600,000.

These contributions dramatically exceed those of other immigrant groups and far surpass the fiscal impact of native-born Americans in comparable income brackets. The fiscal surplus arises from H-1B workers’ high earnings (and correspondingly high tax payments), low utilization of government services, and economic productivity that generates benefits throughout the economy.

Aggregate Economic Loss: With approximately 600,000 H-1B workers currently in the United States, their collective departure would result in:

- Total GDP loss over 30 years: $300 billion

- Total increase in national debt: $1.38 trillion

- Annual GDP reduction: Approximately $10 billion per year

These figures represent only the direct fiscal impact and do not account for the cascading effects on innovation, entrepreneurship, and economic dynamism discussed in subsequent sections.

Program Elimination Scenario: The Manhattan Institute study also modeled the specific impact of eliminating the H-1B program entirely, finding that such a policy would be the single most negative immigration policy change for the U.S. budget. Over 10 years, ending the program would add $185 billion to the national debt and reduce economic output by $26 billion. Over 30 years, the debt would rise by $4 trillion and the economy would shrink by $55 billion, with the debt-to-GDP ratio increasing by 4.8 percentage points.

Innovation and Entrepreneurship Collapse

Beyond direct employment and fiscal contributions, H-1B workers serve as critical engines of American innovation and entrepreneurship. Their departure would devastate the U.S. technology sector, university research programs, and startup ecosystem.

Patent Innovation and Research Output

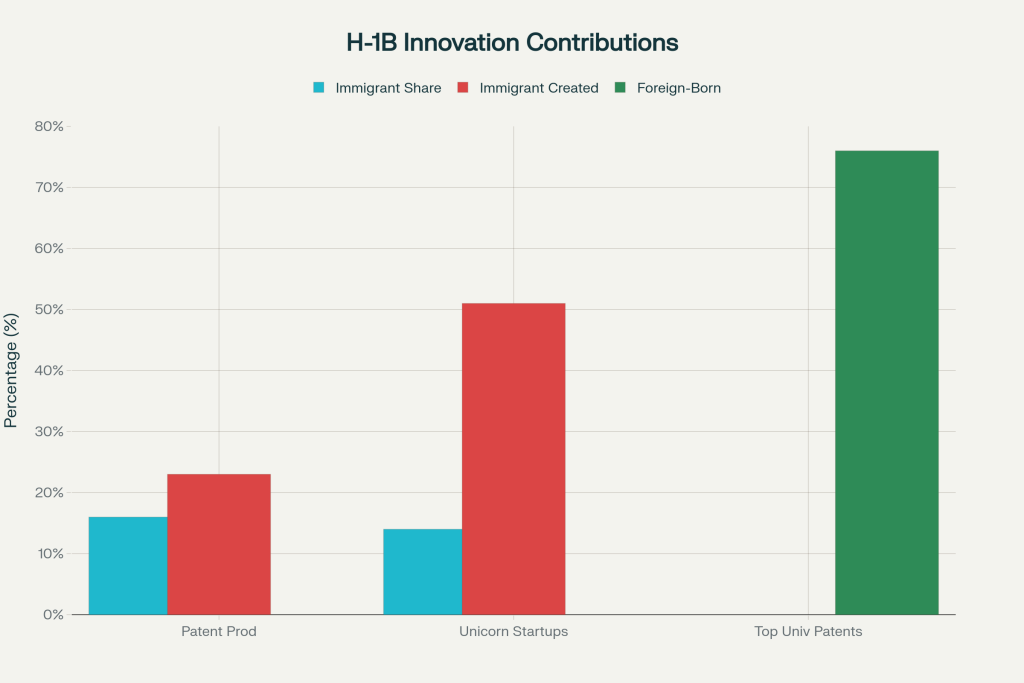

H-1B visa holders demonstrate extraordinary productivity in generating patents and driving technological innovation. Multiple studies document that immigrants produce 23% of all U.S. patents despite representing only 16% of the inventor population—a 40% overperformance relative to their share of researchers. Indian and Chinese inventors, who comprise the majority of H-1B workers, contribute disproportionately: Indians account for 7.6% of all patents and Chinese for 11.8%, despite each group representing less than 1% of the U.S. population.

Research by economists William Kerr and William Lincoln establishes a strong causal relationship between H-1B visa availability and patent production. Their analysis found that a 10% increase in H-1B admissions is associated with 3% higher growth in patenting rates for H-1B dependent firms. The correlation between H-1B visa holder numbers and issued patents in a state registers at 0.89, indicating an exceptionally strong statistical relationship.

The quality of immigrant-generated patents also exceeds that of native-born inventors. Research by economists Shair Bernstein, Rebecca Diamond, Timothy McQuade, and Beatriz Pousada, which linked actual patents to inventors, demonstrates that immigrants file more patents over their careers, receive more patent citations, and their patents have higher economic value than those filed by native-born Americans. Immigrant inventors generated 25% of the aggregate economic value created by patents produced by publicly traded companies, substantially exceeding their population share.

University research would face particularly severe disruption. At the top ten patent-producing universities, 76% of patents include at least one foreign-born inventor. Universities rely heavily on H-1B visas to employ postdoctoral researchers, staff scientists, and visiting scholars who drive cutting-edge research. The loss of this talent would cripple American universities’ research capacity and threaten U.S. leadership in scientific discovery.

Startup Formation and Entrepreneurship

H-1B workers and immigrants generally demonstrate remarkable entrepreneurial success, founding companies that become cornerstones of the American economy. Research from the National Foundation for American Policy reveals that 51% of U.S. startups valued at $1 billion or more (so-called “unicorns”) were founded by immigrants. These 44 immigrant-founded companies collectively employ over 33,000 workers with an average of 760 jobs per company.

The three highest-valued U.S. companies with immigrant founders include Uber Technologies, Palantir Technologies, and SpaceX—companies that have revolutionized their respective industries and created tens of thousands of American jobs. Over the past decade, more than half of Silicon Valley startups were founded by immigrants, employing 450,000 workers and generating $52 billion in sales by 2005.

The Kauffman Foundation estimated that if H-1B holders could freely start companies rather than remain in salaried positions, they would create at least three times more jobs than they currently generate through employment. This calculation suggests that current H-1B restrictions actually suppress American job creation by limiting immigrant entrepreneurship.

Recent research published in the Proceedings of the National Academy of Sciences provides causal evidence of the relationship between H-1B immigration and regional entrepreneurship. The study found that a doubling of immigrants to a metropolitan area is followed by a 6% increase in entrepreneurship within three years. Importantly, this effect emerges even though H-1B workers primarily hold conventional salaried jobs rather than starting businesses themselves. The mechanism appears to involve knowledge transfer: highly skilled immigrants share ideas and expertise with others in their community, facilitating new business formation.

Tech Sector and Industry-Specific Innovation

The technology sector’s dependence on H-1B talent is absolute. Computer-related occupations account for 65% of all H-1B workers, with major technology companies serving as the program’s largest users. Amazon secured over 10,000 H-1B approvals in the first half of 2025 alone, with Microsoft, Meta, Google, and Apple each obtaining more than 4,000 visas.

Research from the National Bureau of Economic Research establishes that H-1B immigration increased U.S. native welfare, lowered computer scientist wages by 2.6-5.1%, but increased IT output by 1.9-2.5%, generating substantial benefits for consumers and firms while creating net positive welfare effects. The study found that firms in the IT sector earned substantially higher profits due to H-1B immigration, enabling them to expand operations and hire more workers overall.

Companies that win H-1B lottery positions demonstrate superior performance across multiple metrics. Research shows that firms winning the H-1B lottery expand employment and revenues and are more likely to survive in subsequent years. Crucially, these studies find no evidence that hiring H-1B workers displaces native college-educated workers. Instead, the biggest beneficiaries are small, high-productivity firms that grow faster and hire more native graduates once they bring in immigrant talent.

Sector-Specific Devastation

The departure of all H-1B workers would inflict catastrophic damage across multiple economic sectors, each dependent on this talent pool in distinct ways.

Healthcare Crisis

While comprising only 4.2% of H-1B petitions (16,937 approvals in fiscal year 2024), H-1B workers in healthcare fill critical gaps in underserved communities. Over 64% of international medical graduates practice in medically underserved areas, with more than 45% in rural settings. These physicians provide essential care in communities that struggle to attract American-born doctors.

The Health Resources and Services Administration projects that the U.S. requires an additional 13,075 physicians immediately to address existing shortages, with a projected deficit of 87,150 full-time equivalent primary care physicians by 2037. Rural and safety-net hospitals would face immediate closure or severe service reductions if they lost access to H-1B physicians.

Healthcare organizations have vocally opposed the Trump administration’s $100,000 H-1B fee, with over 50 organizations including the American Medical Association calling for exemptions for international medical graduates. As Carol Lundry, residency coordinator at SSM Health St. Luke’s Hospital in Missouri, stated: “There’s no way we’re going to pay $100,000. If you’re going to take away the H-1B visas from that pool, it’s going to shrink our pool of choices”.

Technology and Innovation Ecosystem

The technology sector would face existential threats from H-1B departure. As noted earlier, over 65% of IT workers hold H-1B visas, making the sector uniquely dependent on this program. The share of IT workers with H-1B status has risen from 32% in 2003 to over 65% in recent years, reflecting the sector’s dramatic growth and the domestic workforce’s inability to fill these positions.

The United States faces a projected shortage of 1.2 million engineers by 2026, with demand for tech talent growing at twice the rate of the overall U.S. workforce. Only 50% of American high schools offer foundational computer science courses, and less than 5% of students in 37 states actually enroll in them. This education gap ensures that the domestic talent pipeline cannot meet industry needs without substantial immigration.

Startups would suffer disproportionately from H-1B restrictions. The $100,000 H-1B fee announced in September 2025 has already caused startups and small businesses to halt hiring, cancel job offers, and reconsider expansion plans. As Eva Yao, founder of Flari Tech in Boulder, observed: “Highly skilled immigrants are increasingly shifting their job search towards larger companies” that can afford the fee, leaving startups unable to compete for talent.

University Research and Education

Universities and research institutions, while exempt from H-1B caps, would face severe disruption if H-1B workers departed. International students and researchers comprise a substantial portion of graduate programs in STEM fields, with many transitioning to H-1B status after completing degrees. The loss of this talent would undermine research productivity, reduce patent generation, and weaken American universities’ global competitiveness.

The Association of American Universities has expressed concern that new H-1B policies “risk fracturing the critical pipeline between U.S. universities and the companies and small businesses that drive our economy”. Approximately 120,000 new H-1B visas are issued annually, with universities accounting for a significant share of the cap-exempt positions.

Regional Economic Concentration Effects

H-1B workers concentrate in specific metropolitan areas, creating regional economies highly dependent on their presence. The San Francisco Bay Area, Seattle, Austin, Dallas, Phoenix, Raleigh-Durham, Boston, and New York metro areas host the largest H-1B populations. These regions would experience:

- Plummeting housing demand and prices, devastating real estate markets, construction employment, and property tax revenues

- Reduced consumer spending at local businesses, forcing closures and layoffs

- Startup formation collapse, as regional entrepreneurship depends on skilled immigrant talent

- Corporate exodus, as companies relocate operations to countries with more accessible talent pools

Competitive Losses to Other Nations

The departure of H-1B workers would not occur in isolation; these highly skilled professionals would migrate to competitor nations that welcome their talent, strengthening America’s economic rivals.

Offshoring and International Competition

When U.S. firms face difficulties hiring H-1B workers, they increasingly shift operations offshore, particularly to India and Canada. A 2024 working paper demonstrates that many skilled workers who fail to secure H-1B status relocate to Canada, where they bolster the Canadian IT sector. China has introduced a new visa aimed at facilitating the entry of top STEM talent, timing the announcement just days after Trump’s H-1B fee increase.

Major technology companies with international offices increasingly hire employees abroad rather than bringing foreign workers to the U.S.. This trend accelerates with each new H-1B restriction, as companies seek stable access to talent without immigration uncertainty. As Sarah Glennon, a tech policy expert, noted: “This creates an impression of an unwelcoming environment, making top talent less inclined to come to the U.S.”.

Long-Term Competitiveness Erosion

The long-term consequences of H-1B restrictions extend beyond immediate economic losses to threaten America’s position as the global innovation leader. The U.S. currently dominates the technology sector, accounting for over 10% of GDP, but this lead requires continuous access to global talent. By 2030, tech labor shortage in America could lead to losses of up to $163 billion in revenue.

Economists warn that restricting H-1B visas could reduce high-skilled immigration, slow innovation, decrease productivity growth, and reduce U.S. GDP. Michael Clemens and Giovanni Peri, prominent immigration economists, argue that high-skill immigration is directly tied to U.S. startup formation and that firms winning the H-1B lottery produce 27% more output than those that lose.

A permanent 10% reduction in college-educated immigrants—most of whom arrive through the H-1B program—would lower annual welfare for U.S. natives by approximately $2.9 billion, according to research by economists studying multinational company behavior. These losses operate through two channels: H-1B workers perform tasks that complement native workers, raising demand for natives overall; and by lowering production costs, immigrant labor reduces prices, boosting purchasing power for U.S. consumers.

Policy Implications and Current Challenges

The Trump administration’s September 2025 implementation of a $100,000 fee for new H-1B applications has already begun demonstrating the economic damage that H-1B restrictions inflict. Previously, H-1B application fees ranged from $2,000 to $5,000 depending on company size; the 20-fold to 50-fold increase has sparked widespread opposition from businesses, universities, healthcare organizations, and economic researchers.

The U.S. Chamber of Commerce, America’s largest business lobbying organization, filed one of several lawsuits challenging the fee, arguing it is “cost-prohibitive for U.S. employers, particularly start-ups and small to mid-sized businesses”. Healthcare organizations including the American Medical Association have called for exemptions for international medical graduates. The Association of American Universities has urged reconsideration of the weighted lottery system proposed by the Department of Homeland Security.

Early evidence suggests the fee is already reshaping hiring patterns. Multiple companies have announced they will no longer sponsor H-1B visas for certain positions. Workers on H-1B visas report companies advising them to avoid international travel and some firms recalling employees from overseas visits due to uncertainty about re-entry. The policy has created a “chilling effect” on both employers and applicants, discouraging pursuit of H-1B employment even for positions exempt from the fee.

Conclusion: The Economic Necessity of H-1B Workers

The question of how many jobs Americans could find if all H-1B holders left reveals a profound economic paradox. While 600,000 direct positions would theoretically open, the reality is that Americans would lose nearly 500,000 net jobs due to the cascading economic effects of H-1B departure. Far from benefiting American workers, the loss of H-1B talent would trigger economic devastation measured in:

- Net job losses: -498,000 positions

- Annual economic losses: $131 billion

- Long-term GDP reduction: $300 billion over 30 years

- National debt increase: $1.38 trillion over 30 years

- Innovation collapse: 23% of U.S. patents at risk

- Entrepreneurship destruction: 51% of unicorn startups founded by immigrants

- Healthcare crisis: Critical physician shortages in underserved areas

- Technology sector exodus: Companies offshoring operations to access talent

H-1B workers do not take American jobs; they create them. The economic research is unambiguous: each H-1B worker generates 1.83 to 7.5 additional American jobs through complementary skills, consumer spending, business formation, and innovation. These workers contribute over $131 billion annually to the economy while paying into Social Security and Medicare programs they may never access.

The departure of all H-1B holders would devastate American communities, particularly in technology hubs, rural healthcare settings, and university research centers. Housing markets would collapse, small businesses would close, startups would fail, and America’s innovation leadership would erode. Competitor nations like Canada, China, and European countries would welcome this talent, strengthening their economies at America’s expense.

The data clearly demonstrates that H-1B workers are economic assets, not liabilities. Their contributions to job creation, innovation, tax revenue, and economic growth far exceed the direct employment they occupy. Rather than viewing H-1B workers as competition for American jobs, evidence-based policy would recognize them as catalysts for American prosperity and job creation for native-born workers.