President Trump’s mass deportation push is rippling through the U.S. economy in real time, with economists, business owners, and state officials warning of mounting job losses, rising costs, and shrinking output. Analyses released through October 2025 estimate that removing millions of workers will trigger nearly 6 million total job losses over four years—about 3.3 million immigrant positions and 2.6 million jobs held by U.S.-born workers—while slowing growth and straining public budgets.

Construction, agriculture, hospitality, and manufacturing report the sharpest strain as employers struggle to replace skilled labor that powered local economies across the country.

Projected job losses and sector impacts

- Analyses project nearly 6 million total job losses over four years:

- 3.3 million jobs held by immigrant workers

- 2.6 million jobs held by U.S.-born workers

- Hardest-hit sectors include:

- Construction

- Agriculture

- Hospitality

- Manufacturing

These industries rely heavily on experienced, on-site labor. When crews disappear, the effect cascades: suppliers sell less, professional services receive fewer contracts, and nearby businesses lose customers.

Detailed workforce and GDP forecasts

- The Economic Policy Institute and other groups estimate that deporting 4 million immigrants over four years would shrink:

- The construction workforce by 18.8%

- The child care workforce by 15.1%

- Macroeconomic models project large hits to output:

- The Penn Wharton Budget Model and others estimate up to 6.8% GDP loss in mass-removal scenarios.

- Deporting all 8.3 million undocumented workers could reduce GDP by 7.4% by 2028.

Fewer workers mean fewer paychecks, less demand in local stores, and lower tax collections—pressures that can force cuts to schools, roads, and health services in already-tight local budgets.

Local labor shortages and knock-on effects

- Industry concentrations of undocumented workers:

- About 14% of construction workers are undocumented.

- Roughly 1 in 8 farmworkers lack legal status.

- The construction industry’s staffing needs:

- Builders already needed about 439,000 additional workers in 2025 to meet demand.

- Forced removals widen that gap; firms cancel bids or extend timelines due to crew shortages or high overtime costs.

- Agriculture impacts:

- Growers—especially fruit and vegetable operations—report fewer hands for planting and harvesting, leading to smaller harvests and higher spoilage.

Price pressures on households

- Food prices:

- Industry and policy models suggest food costs could rise by up to 9% in mass-deportation scenarios, as producers pass on higher wages, training costs, and supply-chain disruptions.

- Housing and child care:

- Slower homebuilding and renovations raise prices and rents.

- With child care workforce cuts estimated at 15.1%, centers reduce hours and lengthen waitlists, forcing many parents (disproportionately mothers) to cut work hours.

- Household effects:

- Reduced household income shrinks local demand—hurting grocery stores, auto shops, clinics, and small-town main streets.

State-level consequences

- States with large immigrant communities face outsized risk:

- California: construction job losses projected at 343,000 (about 25.5% of the sector) if removals continue.

- Florida: hospitality hubs face fewer housekeepers and line cooks, reducing room availability and restaurant hours during peak season.

- Texas: delayed road and refinery upgrades tied to worker shortages.

- New York: small manufacturers and elder-care homes report rising overtime and contract costs that small operators struggle to absorb.

Fiscal impacts and public revenue

- Tax contributions:

- Undocumented immigrants contributed an estimated $96.7 billion in federal, state, and local taxes in 2022, including billions into Social Security and Medicare.

- Revenue and deficit projections:

- The American Immigration Council and others estimate mass removals would:

- Cut public revenues by $300.4 billion from 2025–2034

- Increase federal deficits by more than $861.8 billion over the same period, once lower growth and higher enforcement costs are included

For local leaders, that means fewer dollars for public safety, transit, and schools at the same time that labor shortages drive up project costs.

Business operations, closures, and community effects

- Small and midsize firms report severe operational strain:

- Employers in construction, landscaping, food processing, and hotels describe losing reliable crews in days, then spending months rebuilding teams.

- Some businesses pivot to higher-margin projects or close locations.

- Community chilling effects:

- Mixed-status families report skipping health appointments, avoiding public spaces, and pulling back from local programs.

- This reduces foot traffic, cuts participation in job training, and weakens civic life—quiet losses that accumulate.

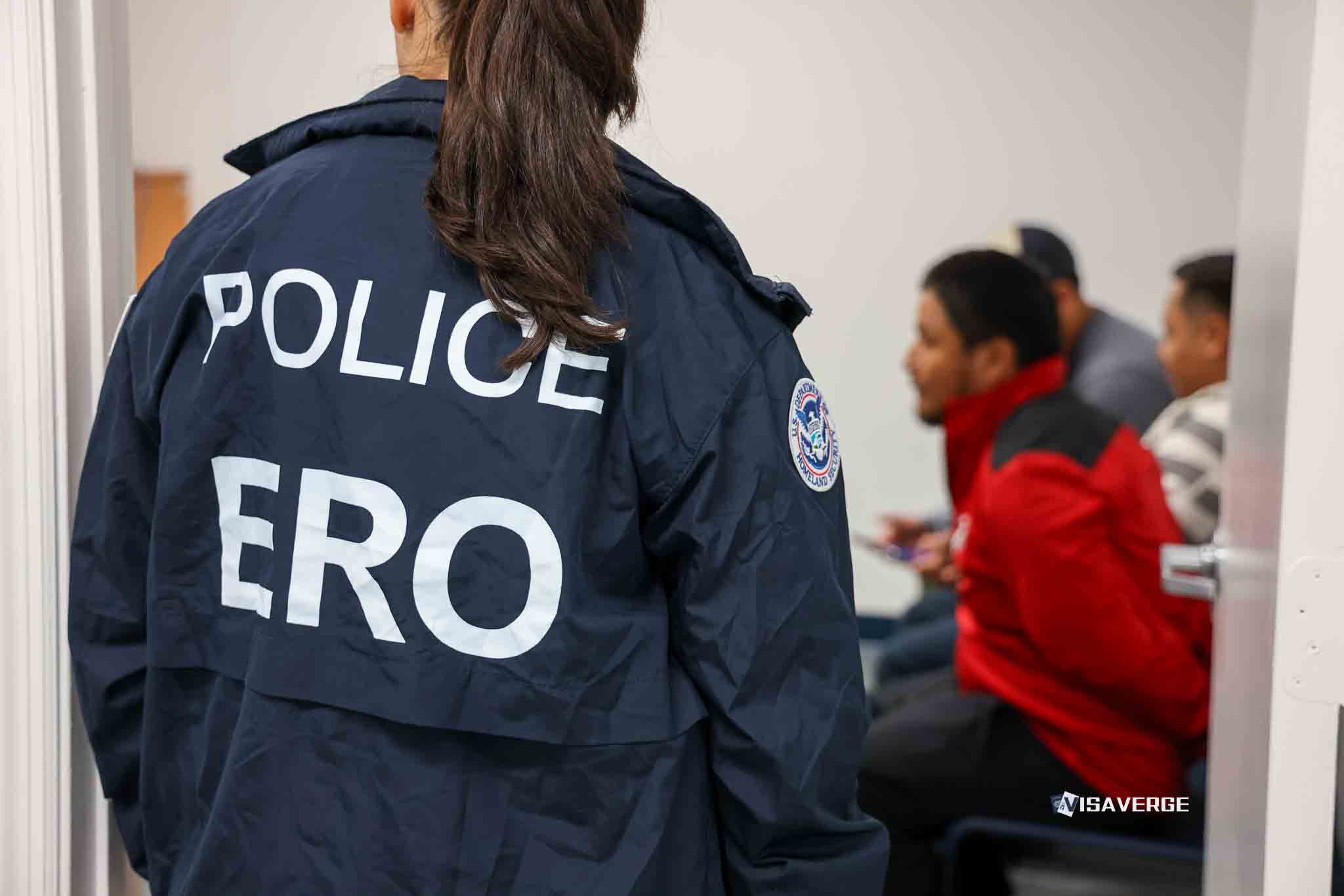

Policy context and enforcement activity

- 2025 policy moves:

- The administration doubled immigrant arrests in 2025 and proposed the “Big Beautiful Bill,” seeking $168 billion for expanded enforcement, detention, and expedited removals.

- The Department of Homeland Security’s ICE Enforcement and Removal Operations division has increased workplace and community activity, according to business groups and local officials.

- Economic outlook revisions:

- Independent researchers revised the Congressional Budget Office’s 2025 employment growth outlook downward; some now expect overall employment to decline by 2029 if current removal targets hold.

- Real project impacts:

- County road work delayed for lack of crews

- School renovations stalled

- Hospital expansions pushed to later years

Debate over intended outcomes vs. likely reality

- Supporters argue enforcement will:

- Protect wages

- Restore the rule of law

- Open jobs for U.S.-born workers

- Economists’ cautions:

- Many affected roles require experience built over years on U.S. job sites or farms.

- Vacant positions often remain unfilled because they are geographically distant from unemployed workers and require training, housing, or transit not readily available.

- The Peterson Institute and others note sudden labor shocks raise costs and lower productivity, often outweighing any short-term wage gains for some workers.

Family-level consequences

- Care sectors:

- Child care and elder care employers lose trusted staff who knew routines and client needs.

- Parents describe losing a caregiver and cutting their own hours to cover gaps.

- Even small reductions in hours can push two-earner household budgets into the red as rents and food costs rise.

- Demand ripple:

- Reduced family spending lowers sales at local businesses, reinforcing the cycle of labor loss, reduced income, and weaker demand.

Employer adaptation measures

- Strategies employers try:

- Raising pay and offering hiring bonuses

- Expanding apprenticeships (time-intensive)

- Testing mechanization in agriculture (limited for many crops)

- Cross-training hotel staff—leading to longer check-in lines and limited room availability

- Restaurants trimming menus or closing days

- Limits of adaptation:

- These steps preserve operations but do not replace lost capacity quickly, so project delays and price increases persist.

Local policy responses and recommendations

- Community and business proposals:

- Faster credential recognition for U.S.-born workers switching sectors

- More funding for vocational schools and apprenticeships

- Better transit links to spread job opportunities

- Housing support near job sites

- Chambers urging Congress to pair enforcement spending with work-visa reforms to provide legal channels for employers to fill roles

- Local evidence:

- VisaVerge.com reports small business closures cluster in counties with higher arrest activity—suggesting enforcement intensity and economic strain are linked.

What’s next: funding, legal fights, and regional divergence

- Key decision points:

- Congress will determine how much of the proposed $168 billion enforcement package advances.

- Courts will weigh challenges to detention and expedited procedures.

- Governors in construction- and agriculture-heavy states press for flexibility to avoid delayed infrastructure and reduced harvests.

- Possible future trajectory:

- If arrests continue to climb into 2026 without new legal labor channels, economists expect:

- More shortages

- Slower growth

- Wider regional gaps between places that can hire and those that cannot

For families and employers, these trends are already visible: longer waitlists for care, higher grocery bills, and “Help Wanted” signs that stay up for months.

This Article in a Nutshell

Analyses published through October 2025 warn that President Trump’s push for mass deportations would substantially weaken local economies nationwide. Forecasts estimate nearly 6 million job losses over four years—about 3.3 million immigrant-held jobs and 2.6 million held by U.S.-born workers—while construction, agriculture, hospitality, and manufacturing face the biggest shortages. Macroeconomic models project GDP declines up to 6.8% in mass-removal scenarios and significant fiscal losses, including an estimated $300.4 billion drop in public revenues from 2025–2034 and higher federal deficits. Local effects include delayed infrastructure, stalled projects, higher food and housing prices, and strained public services. Policymakers must weigh enforcement funding, legal challenges, and proposals for legal labor channels to mitigate economic damage.