A new 1% remittance excise tax will apply to certain cash-based outbound transfers from the U.S. beginning January 1, 2026, while most account- and card-based transfers are exempt.

Regulators are also rolling out added reporting and withholding rules tied to cross-border payments.

At the same time, claims of a targeted “crackdown on immigrants” have been amplified online without a matching, official quote from the U.S. Treasury to back them up.

Overview and the key claim: “clarified rules,” but the verifiable changes are tax and reporting

Headlines and social posts have framed recent developments as a new “clarification” that overseas remittances will not be disrupted if funds are lawful.

That message is broadly consistent with how U.S. anti-fraud and anti-money-laundering systems usually work: legal transfers typically remain permitted, and institutions may ask for proof of where money came from.

Scott Bessent has been cited in some versions of the story as making a definitive statement about heightened scrutiny not targeting legitimate immigrant remittances.

Yet no official U.S. Treasury announcement publicly matches that quote in the way it is being circulated.

the practical effect for immigrants and NRIs comes from concrete rule changes: a new excise tax structure and additional compliance reporting.

What’s changing: tighter oversight, more reporting, and why USD 3,000 matters

Compliance around cross-border transfers has been tightening, with FinCEN and the Internal Revenue Service (IRS) playing central roles.

Banks and money transfer providers already monitor transactions for suspicious patterns. What is changing for many customers is how often a transfer may trigger questions, document requests, or structured reporting.

One commonly cited pressure point is USD 3,000. Transfers above USD 3,000 from certain U.S. regions have drawn added attention in compliance discussions.

Senders may see more frequent “know your customer” and source-of-funds checks around that level. Expect more requests for supporting records, especially when amounts or frequency look unusual for the account history.

Minnesota has also been mentioned in connection with fraud enforcement tied to alleged misuse of public funds. That enforcement is localized, but compliance playbooks tend to spread.

A rule set piloted in one place can influence how national institutions screen transfers.

Impact on immigrants, visa holders, and NRIs: remittances still allowed, but documentation expectations rise

Immigrants, international students, and NRIs in the U.S. can typically keep sending money abroad. The key is that the money should come from lawful sources and move through regulated channels.

Verification expectations may rise for transfers above USD 3,000, or for patterns that look inconsistent with a person’s profile.

A bank or remittance provider might ask for payroll records, a letter explaining purpose, or account statements. That does not automatically mean wrongdoing; it often reflects risk controls.

H-1B holders are a common group affected in day-to-day life. Many H-1B workers send regular support to family or pay expenses abroad.

The main shift is not a special immigration enforcement program. It is tax and compliance mechanics that apply broadly, regardless of immigration status.

Tax and regulatory context: the One Big Beautiful Bill Act and the 1% remittance excise tax

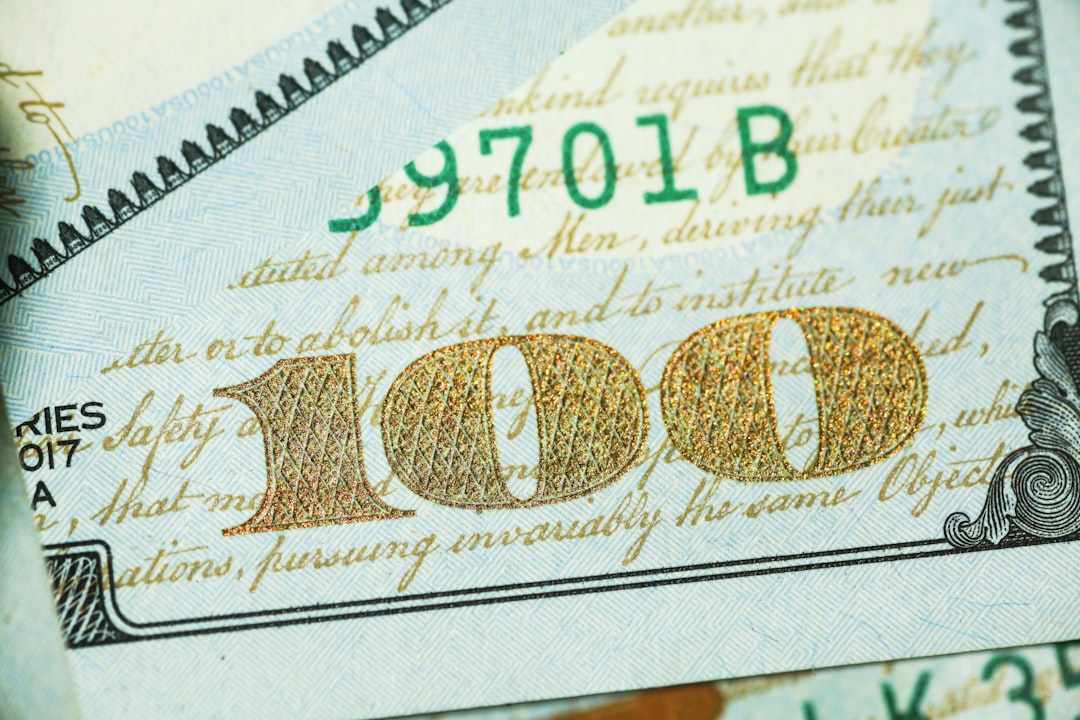

The clearest nationwide change is financial, not rhetorical. Under the One Big Beautiful Bill Act (OBBBA), a 1% remittance excise tax applies to specific outbound transfers starting January 1, 2026.

Cash is the dividing line. The tax generally applies when an outbound transfer is funded by cash or certain physical instruments, including money orders and cashier’s checks. No minimum threshold applies.

A small transfer can still be taxed.

Be aware that cash-based remittances (cash, money orders, cashier’s checks) may incur the 1% tax starting 2026.

Who pays and how it is collected. The sender pays the excise tax, and the collecting institution (bank, credit union, or money transfer business) generally collects it at the time of transfer and remits it to the IRS.

Remittance to the IRS is generally handled on a quarterly schedule.

What is generally exempt. Many account-based transfers are outside the excise tax base, including online bank transfers, ACH, and wires funded from a deposit account.

Many card-funded transfers also fall outside the taxed category. For many households, switching away from counter cash remittances can reduce exposure to the 1% charge.

Table 1: When the 1% remittance excise tax applies (and when it generally doesn’t)

| Category | Taxed Transfers | Tax Rate | Notes |

|---|---|---|---|

| Cash-based remittances | Cash-funded outbound transfers through money transfer counters | 1% | No minimum threshold; sender pays; collected by provider and remitted to IRS quarterly |

| Physical-instrument funded transfers | Money orders and cashier’s checks used to send funds abroad | 1% | Treated as cash-like for excise purposes in many cases |

| Account-based transfers (exempt in many cases) | Online banking transfers, ACH, bank-funded wires | 0% | Typically exempt from the excise tax when funded directly from a bank account |

| Card-funded transfers (often exempt) | Debit/credit card-funded remittances | 0% | Often exempt; treatment can depend on how the provider structures the transaction |

| App-based remittances (often exempt) | Many app transfers pulling from bank account or card | 0% | Many are exempt when funded from account/card rather than cash or physical instruments |

Related IRS actions: Notice 2025-55 and new withholding rules

Two additional developments matter for “Overseas Money Transfer Rules,” especially for people who rely on payment platforms.

Notice 2025-55. The IRS issued Notice 2025-55 to guide implementation and administration around the new excise tax framework, including how providers transition collection and reporting systems.

Many customers won’t read it, but institutions will build procedures around it.

Proposed regulations dated January 8, 2026. On January 8, 2026, Treasury and the IRS issued proposed regulations tied to backup withholding for third-party settlement organizations.

These proposals address when a platform may have to withhold taxes if taxpayer information is missing or incorrect, or when reporting triggers apply.

Those are system rules. They can affect immigrants and NRIs who use apps for cross-border support, but they are not written as a targeted immigrant enforcement program.

Practical guidance: how immigrants and NRIs can reduce friction and avoid unnecessary tax

Switching methods can matter as much as the amount. Cash-based transfers may face the 1% excise tax. Account-based routes often do not.

- Prefer account-based transfers such as online banking, ACH, or bank wires when possible

- Keep routine documentation: pay stubs, employment contracts, bank statements, and tax returns

- Save transfer receipts and confirmations, especially for repeat payments to family

Students and workers on visas may also want clean records for immigration-facing processes. Transfers can show up in bank histories reviewed for school compliance, visa renewals, or future permanent residence filings.

Keeping a tidy paper trail can reduce stress if questions arise.

How to minimize 1% remittance tax: Prefer account-based transfers (online banking, ACH, wires) and keep thorough source-of-funds documentation.

Implications for Indian compliance and cross-border flows

U.S. rules are only half the trip. Remittances into India can interact with India’s FEMA framework and the Liberalised Remittance Scheme (LRS) on the outbound side for India-based residents, plus Indian income-tax concepts for recipients.

Large inflows may lead Indian banks to ask for purpose and documentation, even when the money is a family transfer. Gift treatment can depend on the relationship and facts.

NRIs in the U.S. sending to India should usually coordinate with an Indian tax advisor on documentation, reporting, and how the recipient should record the funds.

Clarifying the Bessent quote: separate verifiable actions from misattributed claims

Online narratives often blend three separate ideas: fraud enforcement, remittance rules, and immigrant targeting.

The verifiable nationwide changes are the 1% remittance excise tax effective January 1, 2026, plus IRS implementation steps including Notice 2025-55 and the proposed rules dated January 8, 2026.

Scott Bessent has been linked to claims of a fresh Treasury “clarification” about heightened scrutiny and immigrants. No official U.S. Treasury statement publicly matches that exact claim as circulated.

A safer approach is to plan around what is written into law and formal IRS guidance, not viral quotes.

This article discusses tax and regulatory guidance that carries legal and financial risk; readers should consult a qualified tax advisor or attorney for personalized advice.

The U.S. is implementing a 1% remittance excise tax on cash-based outbound transfers starting January 2026 under the OBBBA. While account-based transfers remain exempt, increased scrutiny is expected for transactions over $3,000. Regulators like the IRS and FinCEN are tightening reporting rules to combat fraud. Immigrants and NRIs should switch to digital banking and maintain thorough financial records to ensure compliance and avoid unnecessary taxation.