(NETHERLANDS) The Dutch government will sharply raise its flight tax on private aviation from 2025, hitting short private jet flights under 2,000 kilometers with a charge of €420 per passenger as part of a wider push to cut aviation emissions and make wealthy travelers pay more.

New private jet tax rates and comparison with commercial flights

Under the new rules:

- Short private jet flights (under 2,000 km) departing from Dutch airports will face a flat rate of €420 per passenger.

- Medium-length private jet journeys (2,000–5,500 km) will be taxed at €1,015 per passenger.

- Long-distance private jet trips (over 5,500 km) will attract a charge of €2,100 per passenger.

By comparison, the general air passenger tax that applies to most commercial tickets in 2025 will be €29.40 per ticket.

Tax rates table

| Flight type | Distance | Private jet tax (per passenger) | Commercial tax (per passenger, 2025) |

|---|---|---|---|

| Short | < 2,000 km | €420 | €29.40 |

| Medium | 2,000–5,500 km | €1,015 | €29.40 (varies by distance later) |

| Long | > 5,500 km | €2,100 | €29.40 |

The scale of the increase is striking: a short private jet passenger from Amsterdam to Paris or London now typically pays the same tax as an economy traveler, €29.40 in 2025. From next year, that private jet passenger would owe €420—more than fourteen times the standard levy—with even steeper rates on longer routes.

Government rationale: environment and fairness

Officials in The Hague present the higher flight tax as:

- An environmental measure aimed at curbing emissions from some of the most polluting forms of air travel.

- A fairness measure designed to make frequent private jet users shoulder a larger share of the cost.

Key points supporting the policy:

- Private jets carry far fewer people than commercial aircraft but burn large amounts of fuel per passenger.

- Many journeys from the Netherlands are short hops that could often be done by train.

Scope increase and expected coverage

The Dutch plan increases not only headline rates but also expands which flights are captured by the private jet regime.

- By lowering the maximum takeoff weight threshold for aircraft categorized as private jets, the government expects around 82% of private jet flights from 2025 to be subject to the higher charges (analysis by VisaVerge.com).

Impact on ordinary travelers and longer-term commercial taxes

For ordinary travelers using commercial airlines, the immediate impact is smaller but still notable.

- The Netherlands already charges a general air passenger tax on each ticket.

- That levy is scheduled to rise in stages by 2027.

- Depending on distance, the charge on commercial flights could reach around €71 per passenger later this decade, according to information published by the Dutch authorities on Government.nl.

Even if commercial taxes rise, the gap between commercial aviation and private jets will remain wide.

Political pressure and the targets of criticism

The sharp rise in charges for short private jet flights reflects growing political pressure in the Netherlands to tackle what critics call luxury emissions.

- Environmental groups argue it is unfair that most households are urged to fly less while a small number of wealthy travelers continue to use private aircraft for short routes.

- Policymakers are increasingly willing to target this group through the tax system.

Industry response and potential diversion

Business aviation companies, charter brokers and some airport operators are expected to push back and raise several concerns:

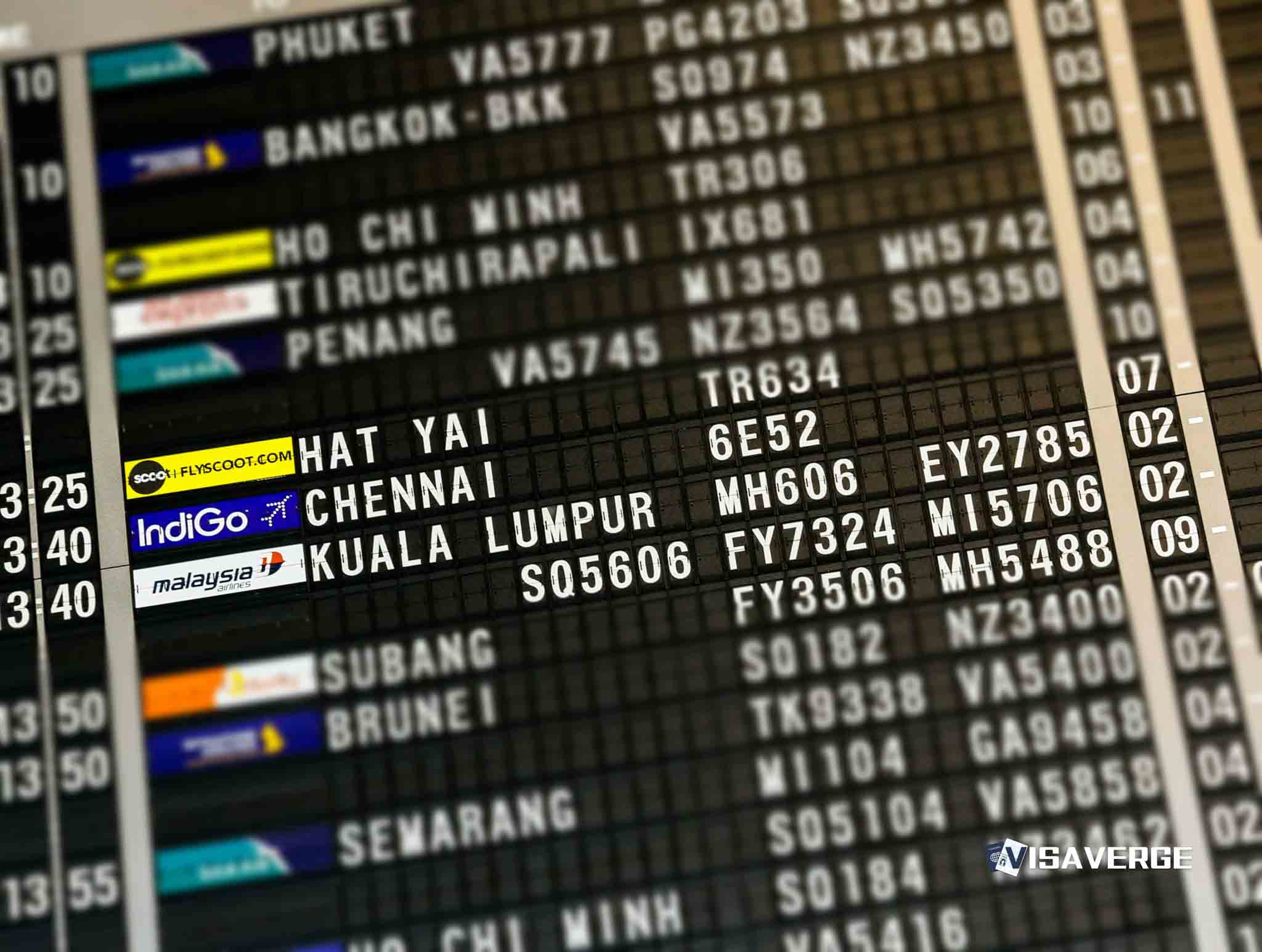

- The higher tax could drive traffic to neighboring countries with lower or less strictly applied private jet levies.

- Some private flights serve time-sensitive business deals, medical transport, or destinations with poor commercial links.

- Industry representatives question whether the Dutch change, taken alone, will reduce global emissions or simply shift departures to nearby airports.

Wider policy package and signal

The Dutch government appears prepared to accept some diversion risk to send a clear signal about climate policy and fairness. Officials emphasize the tax is part of a broader package, which includes:

- Improving rail alternatives

- Promoting cleaner fuels

- Tightening noise and emissions rules around major hubs such as Schiphol

By setting much higher rates for private jets than for commercial flights, ministers draw a deliberate line between what they consider essential travel and discretionary luxury.

Practical effects on travelers and families

For cross-border passengers who rely on private aircraft for business or family reasons, the change adds a new layer of cost.

- A group of four flying together on a short private jet route under 2,000 km would face a combined flight tax of €1,680 under the new rules, compared with €117.60 in air passenger tax if they each bought a commercial ticket in 2025.

- On a long-distance private jet trip, the tax bill alone would be €2,100 per passenger, creating a powerful price signal even for high-net-worth travelers.

Implementation starts in 2025. If you have visa or travel deadlines tied to private flights, plan early and factor in higher costs or possible detours to avoid last-minute surcharges.

Broader implications for mobility and migration

The Dutch changes come amid wider European debate on aviation in climate policy and mobility planning.

- Higher costs on short private jet flights may encourage some executives, consultants and retirees to switch to commercial airlines or high-speed trains.

- That could affect cross-border movement patterns, including for people holding residence permits who travel frequently between homes, offices and family members in different states.

Immigration lawyers note potential knock-on effects:

- Measures that reshape travel habits can affect clients even if not framed as immigration rules.

- People with tight visa timelines—attending interviews, starting jobs, or complying with registration deadlines—sometimes rely on last-minute private flights when commercial options are disrupted.

- A much higher flight tax could make that backup plan harder to afford, especially on routes under 2,000 km where the flat €420 per passenger rate applies regardless of ticket price.

Next steps and implementation

Travelers and operators are now waiting for implementation guidance from Dutch officials on how the new brackets will work in practice.

- One message is already clear: private flying from Dutch airports is about to become much more expensive for many frequent users.

Key takeaway: The Netherlands is using sharply higher private jet taxes to target luxury emissions and promote fairness—but the policy will raise costs, likely provoke industry pushback, and may shift some private aviation activity across borders.

From 2025 the Netherlands will impose steep per-passenger taxes on private jet flights: €420 for trips under 2,000 km, €1,015 for 2,000–5,500 km, and €2,100 for over 5,500 km. By lowering the maximum takeoff weight threshold, authorities expect about 82% of private flights to be taxed. The policy aims to reduce emissions and target luxury travel, though industry warns of cross-border diversion and impacts on time-sensitive flights.