(INDIA) JPMorgan’s top Asia Pacific banking executive says India’s growth path remains strong despite new U.S. trade and visa measures that have unsettled companies and workers across both countries. In a recent interview, Sjoerd Leenart, CEO and Head of Banking for Asia Pacific at JPMorgan, called the latest steps from Washington “speed bumps,” not roadblocks, and argued that India’s young workforce, strong consumer demand, and steadier policy setting give the country room to keep growing. “These are the India decades,” he said, putting a clear marker on the bank’s long view.

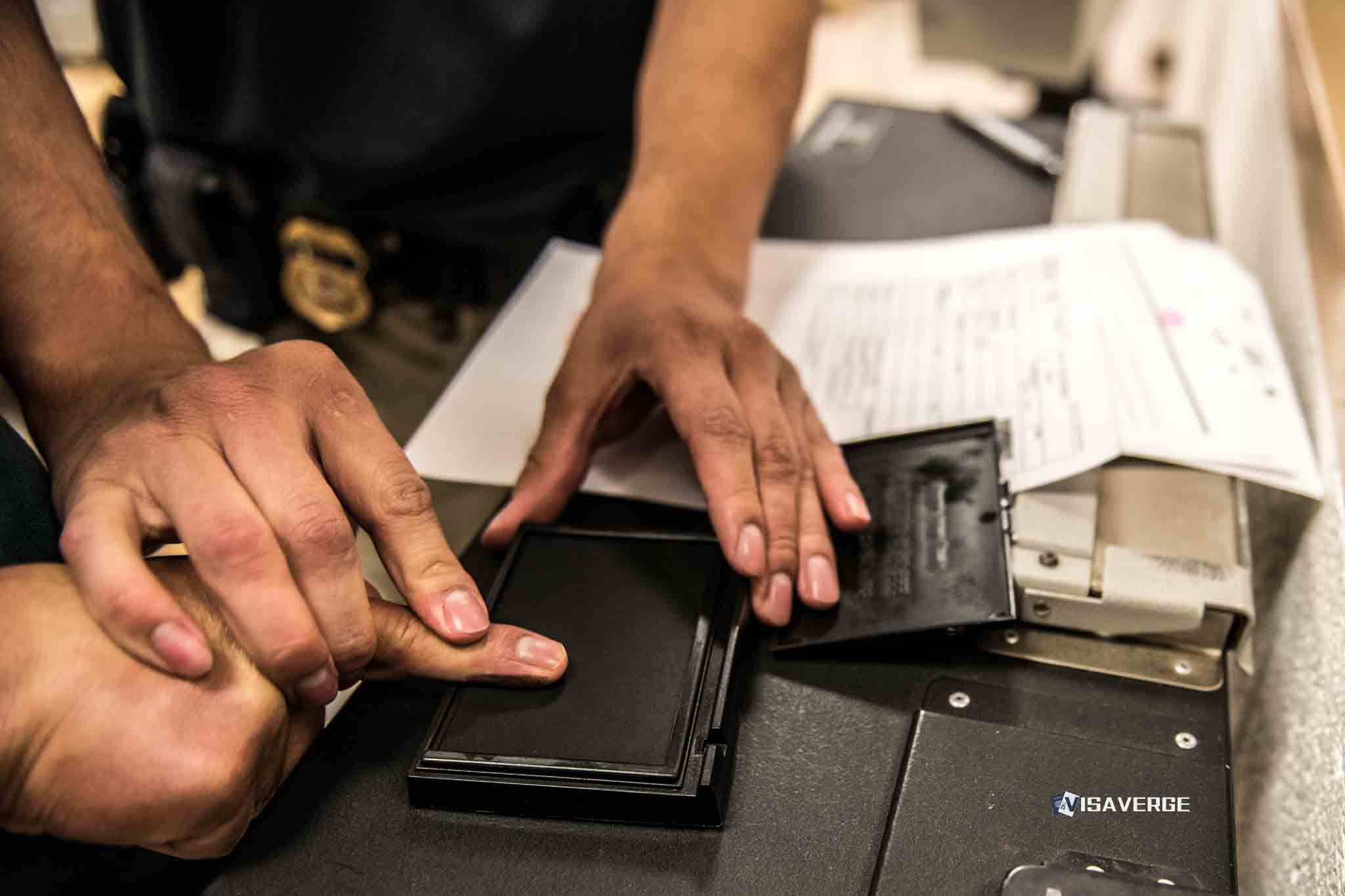

The comments come after two moves from the United States that hit India directly. The U.S. government imposed an additional 25% tariff on certain Indian goods linked to purchases of Russian oil, pushing the total surcharge on those items to 50%. It also introduced a controversial $100,000 fee on fresh work visas, a sharp cost that industry groups say falls hardest on Indian professionals. While both steps create near-term pressure, Leenart said the overall story is intact because India’s domestic drivers are powerful enough to absorb shocks.

JPMorgan’s view rests on the belief that policy consistency—once seen mainly in mature economies—is now showing up more often in India’s governance. That steadier hand, together with a big internal market, allows businesses to plan and invest even as global rules shift. According to analysis by VisaVerge.com, employers and skilled workers in India are paying close attention to how higher visa costs and longer screening can affect job offers and start dates, but most large firms still see India as a key base for talent and operations.

Policy Moves From Washington and Why They Matter

The two U.S. measures change incentives for businesses and workers in distinct ways:

- Tariffs

- The additional 25% tariff (bringing certain items to a 50% total surcharge) raises costs for importers and can make some Indian exports less competitive.

- Businesses face three choices: absorb the hit, pass it to consumers, or shift sourcing.

- Visa fees

- The $100,000 fee on fresh work visas changes the economics of sending employees to the U.S.

- Smaller firms may be deterred from filing, project timelines can be delayed, and companies might build roles outside the U.S. instead.

For readers tracking official rules, the U.S. Department of State – U.S. Visas page provides current policy and fee details for nonimmigrant and immigrant categories, consular processing, and travel updates. You can find it here: U.S. Department of State – U.S. Visas. While this page doesn’t address every employer strategy point, it remains the main government source for visa information used by applicants, families, and HR teams.

JPMorgan argues that the pain from these measures is real but manageable because India’s economy leans more on domestic consumption than on exports to a single market. Leenart also pointed to tax and regulatory changes that can help offset outside pressure by boosting demand at home.

Domestic Cushion: Tax Reform, Consumption, and Market Depth

Ahead of the festive season, the government reworked Goods & Services Tax (GST) slabs. Key product groups moved to lower bands of 5%, 18%, and 40%, a design meant to support household spending and keep business activity steady during a choppy global period. Leenart called the timing smart, describing it as a way to spur demand while the world economy remains uncertain.

JPMorgan’s broader thesis highlights several domestic strengths:

- Infrastructure build-out

- Simpler taxes and GST adjustments

- Improved ease of doing business

- Deepening capital markets

- Strong education pipeline and liquid equity markets

These elements give companies confidence to commit capital and create a buffer against sudden shifts in trade or visas. The bank’s market team also favors sectors aligned to a domestic-led model:

- Real estate

- Power

- Financials

These sectors benefit from strong local demand and large public and private investment plans. Even with occasional equity volatility, JPMorgan remains positive on India’s long-run returns, arguing steady reforms and consumer growth will carry portfolios through rough patches.

Corporate Strategy: JPMorgan’s Bet on India

JPMorgan is not only advising clients to stay the course — it’s expanding its own India footprint.

- The firm employs about 55,000 people across the country, with a large share working inside four Global Capability Centres (GCCs).

- These centers handle advanced functions—well beyond basic back-office tasks—and anchor technology, operations, and analytics.

This approach reflects a broader corporate trend:

- India hosts more than 1,800 GCCs, employing roughly 1.9 million professionals (industry figures from Nasscom).

- GCC sector output was about $64.6 billion in 2024 and is projected to reach $110 billion by 2030.

Companies are placing higher-value roles in India to build resilience amid geopolitics and changing rules. When cross-border work becomes harder or more costly, a strong in-country base helps maintain service quality, speed, and cost control.

From a worker’s perspective, the GCC boom creates more leadership tracks inside India and reduces the reliance on U.S. onshore assignments. That eases the blow from tighter U.S. work visas, though professionals still planning to move to the U.S. may face longer timelines and larger budgets. Large employers are likely to reserve onshore visas for roles where face-to-face work is essential and shift other projects to India.

Leenart’s “speed bumps” comment reflects how firms are adapting:

- Rebalancing staffing between onshore and India-based teams.

- Launching hybrid delivery models.

- Leveraging India’s deep talent pool to maintain service levels if onshore moves slow.

Scaling in India is often faster than creating new sites elsewhere, given the country’s hiring scale, language skills, and established vendor networks.

Risks, Signals to Watch, and Household Impacts

There are still risks that could undermine the positive case:

- Policy instability at home could unsettle markets and slow investment.

- Currency swings can raise import costs or squeeze dollar-borrowing companies.

- Global slowdowns and supply chain shocks can hit export sectors and reduce company-sponsored travel and visa filings.

The GCC ecosystem’s health will depend on:

- Continuous upskilling

- Better transport and power networks

- Strong digital links and secure cloud access

- Faster site approvals

Workers want clear skill development paths and fair pay for high-demand roles. If wages rise faster than productivity, India’s cost advantage may shrink. The next phase of GCC growth will likely focus on:

- Advanced engineering

- Data platforms

- Cybersecurity

- AI-related roles

These areas require steady training and improved infrastructure.

Still, JPMorgan sees more upside than downside. The bank believes policy reforms and domestic demand can offset external hits, and corporate investment in skills and tech lifts long-term competitiveness. Investor interest should stay firm as long as reforms continue and rulemaking remains predictable.

Practical Implications by Group

- For Indian families:

- Higher U.S. visa costs and tighter budgets may delay some overseas plans.

- Strong hiring by multinationals in India can create higher-paying jobs at home.

- GST slab changes may help keep household spending power steady during holidays.

- For small and mid-size companies:

- Map visa budgets early and prioritize critical onshore roles.

- Build backup teams in India.

- Review export contracts for tariff pass-through clauses and consider alternate routes if costs rise.

- For employers and investors:

- Expect tighter cost checks and longer lead times on U.S. visas.

- The growth of GCCs and domestic-facing sectors offers more paths to senior roles and long-term investments inside India.

Key Trends to Watch

Three trends JPMorgan highlights as important to monitor:

- Any further U.S. moves on trade or visas and India’s diplomatic or domestic policy responses.

- The speed and quality of India’s GCC expansion, especially growth in higher-value roles that build global products from India.

- The government’s fiscal discipline as it funds roads, power, and digital systems that underpin private investment.

Leenart’s core message: India’s fundamentals can carry the load. A young population, steady consumer demand, and a more predictable policy setting help companies commit capital. Reforms like the GST changes are timed to support spending when the global mood is weak, and corporate behavior — including JPMorgan’s expansion — shows firms are building in India now rather than waiting for perfect clarity from abroad.

The bottom line for workers and employers is practical: tighter cost checks and longer lead times for U.S. roles, but more senior and global opportunities inside India. For investors, a mix of reforms, demand, and corporate build-out supports a patient stance even as headlines swing.

In short, U.S. tariffs and visa costs have made the road bumpier. But JPMorgan believes India has the tools — and the momentum — to keep moving forward, turning pressure from abroad into fresh investment at home.

This Article in a Nutshell

JPMorgan’s Asia Pacific chief Sjoerd Leenart describes recent U.S. measures—a new 25% tariff raising some surcharges to 50% and a $100,000 fee on fresh U.S. work visas—as manageable disruptions to India’s broader growth trajectory. The bank cites India’s domestic consumption, GST reforms, infrastructure investments, deeper capital markets, and a steady policy environment as buffers that allow companies to continue investing. JPMorgan itself employs roughly 55,000 people in India and leans on four Global Capability Centres, reflecting a corporate shift to higher-value local roles. While risks such as currency volatility, policy instability, and global slowdowns could pose challenges, JPMorgan remains optimistic that reforms, skills investment, and market depth will sustain long-term returns and create senior opportunities inside India despite tighter U.S. visa dynamics.