(DUBAI, UNITED ARAB EMIRATES) Ethiopian Airlines has deepened its long partnership with Boeing by confirming an order for 11 additional Boeing 737 MAX 8 aircraft at the Dubai Airshow on November 17, 2025, a move that will shape flight links, jobs, and future travel patterns across Africa, the Gulf, and beyond. The expansion comes as governments in the region push for closer economic ties, and as immigration and visa systems strain to keep pace with growing passenger numbers driven by trade, tourism, and labor mobility.

Order details and strategic intent

The new order builds on what is already the largest Boeing fleet on the African continent. Ethiopian Airlines currently flies 22 Boeing 737 MAX 8 jets and has long used the type on high-frequency routes across Africa, the Middle East, India, and Southern Europe.

The airline had already locked in firm orders for 30 more 737 MAX 8s from earlier deals signed in 2014, 2016, and 2023, plus an additional 28 aircraft scheduled for delivery by 2030. Exercising 11 more options at the Dubai Airshow confirms that the Addis Ababa-based carrier intends to keep the Boeing 737 MAX 8 at the center of its regional network for the next decade.

Quick summary (fleet & orders)

| Item | Number |

|---|---|

| Currently operated 737 MAX 8 | 22 |

| Firm orders from earlier deals | 30 |

| Additional aircraft scheduled by 2030 | 28 |

| Options exercised at Dubai Airshow (Nov 17, 2025) | 11 |

How the order links to migration and travel flows

Airline managers say the decision is not only about aircraft performance but about keeping up with shifting travel flows in and out of Africa, where millions move every year for work, study, and family reasons.

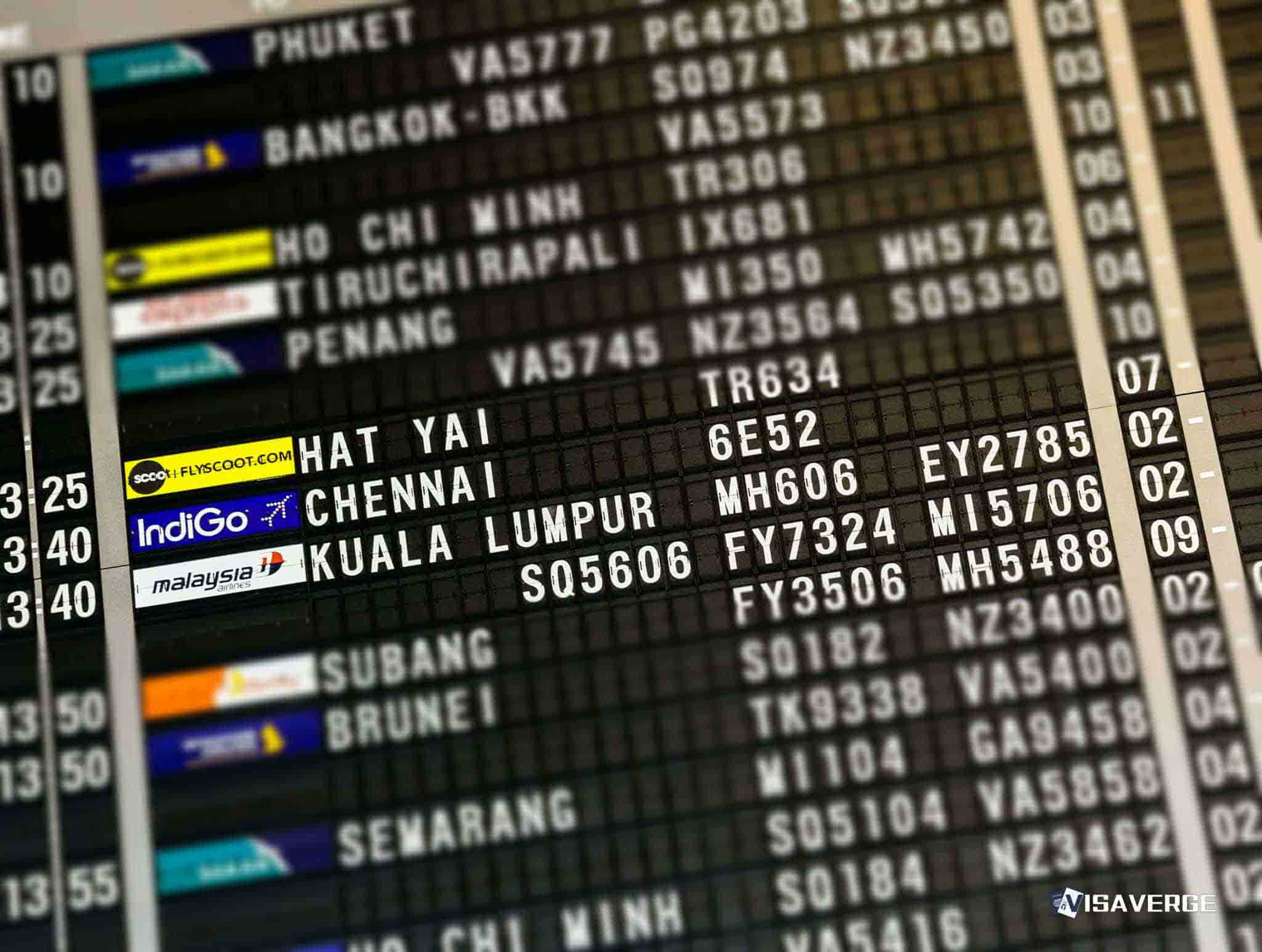

Ethiopian’s hub in Addis Ababa has become a transit point for workers heading from East and West Africa to Gulf states, Europe, and North America. More seats on routes to the Middle East and to visa hubs such as Dubai and Doha can influence:

- where migrants apply for residence permits

- where students lodge study visa applications

- which airports families choose for reunion trips

These choices depend on complex entry rules and processing times, and increased capacity can shift migration patterns accordingly.

Impact on immigration and consular services

The expansion has direct consequences for immigration systems in destination countries served by Ethiopian Airlines.

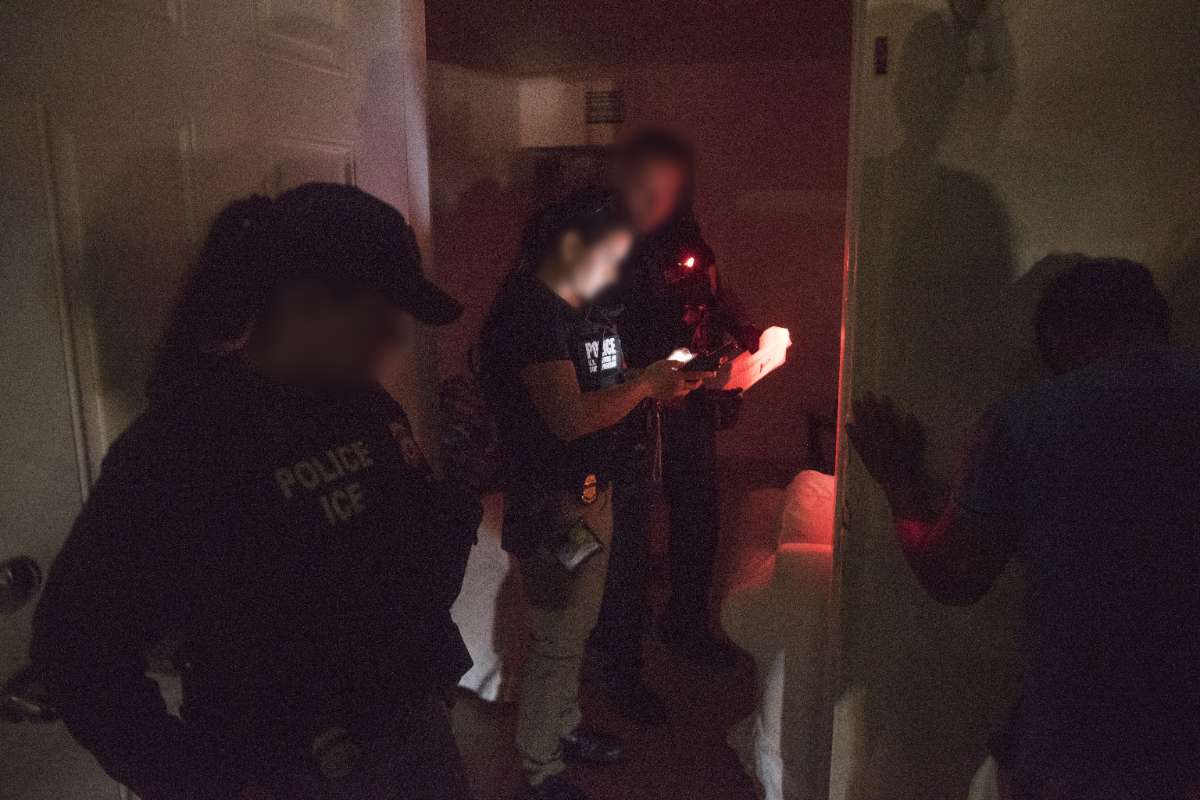

- More capacity on routes to Europe and North America means more travelers going through background checks, visa interviews, and security screenings.

- Consulates on busier routes often face higher demand for appointments, prompting longer wait times or changes in local staffing.

- For example, travelers heading to the 🇺🇸 often must complete the

Form DS-160online nonimmigrant visa application, available through the U.S. Department of State’s official portal, which explains required documents and interview steps for most temporary visas (travel.state.gov).

When airlines like Ethiopian increase frequencies and open new destinations, consular posts frequently need to adapt rapidly to surges in demand.

Important: Official guidance, such as that published by the U.S. Department of State, often cautions applicants not to finalize travel plans before a visa is issued (travel.state.gov). Still, flight availability strongly affects when people attempt to book appointments and make travel arrangements.

Ethiopian’s role as a regional connector

Ethiopian Airlines operates as a key connector between countries with limited direct links and major migration destinations.

- Its Boeing 737 MAX 8 fleet is used on many short and medium routes where quick turnarounds and high-frequency schedules matter.

- Typical passenger groups include:

- seasonal workers bound for Gulf states

- religious travelers to Saudi Arabia via regional hubs

- families visiting relatives across Africa and Europe

According to analysis by VisaVerge.com, strong airline networks can indirectly shape immigration trends by making some routes cheaper and easier than others, which in turn affects where people choose to apply for work visas, asylum, or long-term residence.

Safety history and confidence rebuilding

The airline’s latest move comes after a painful chapter in its history, when an earlier 737 MAX crash involving Ethiopian Airlines led to a worldwide grounding of the model.

- That tragedy remains in public memory, but the carrier has since returned the aircraft to service after extensive changes to training, software, and regulatory oversight.

- Industry analysts interpret the decision to order more 737 MAX 8 jets as a sign of renewed confidence in Boeing and in the aircraft’s safety record since recertification.

For governments that rely on Ethiopian’s network to move their citizens, this restored confidence is important because many embassies and consular posts use the airline for official travel and staff rotations linked to visa and immigration services.

Dubai Airshow context and regional trends

The order was signed at the Dubai Airshow, which has become a major stage for African and Middle Eastern carriers to announce fleet plans tied to long-term economic and migration goals.

- The same event saw Air Senegal confirm a separate order for nine 737 MAX jets, underlining a wider African trend toward fuel-efficient narrowbody aircraft.

- These jets allow carriers to open thinner routes that may not support larger planes but still connect secondary cities with major migration and visa-processing centers.

As a result, migrants who once had to travel overland or through multiple stops to reach an embassy or consulate may soon have more direct flight options.

Boeing’s pitch: efficiency and operational flexibility

Boeing promotes the 737 MAX family’s fuel efficiency and range as tools for airlines trying to control costs while adding new destinations.

- For travelers leaving Africa for study, work, or family reunion, these fleet choices can mean lower fares or more flexible schedules.

- Cheaper and more frequent flights can influence:

- when people book consular appointments

- how they gather paperwork

- whether they risk losing nonrefundable tickets if visas are delayed

Operational flexibility, policy response, and migration consequences

Ethiopian’s position as Africa’s largest Boeing operator affects how quickly the continent can respond to sudden policy changes, such as new entry rules, health checks, or work visa schemes.

- When a government opens a new seasonal worker program or relaxes visa rules, airlines with flexible, efficient fleets are often the first to add flights.

- The Boeing 737 MAX 8 gives Ethiopian the ability to adjust capacity on short notice, adding frequencies to Gulf states or European hubs that host large African communities.

This flexibility can help reduce pressure on irregular migration channels by offering more legal, documented travel options—provided travelers can secure the right visas.

Border control, screening, and passenger protections

At the same time, the rapid growth of air links raises questions for immigration and border control systems about screening, data sharing, and passenger protection.

- Airports acting as transfer points for Ethiopian Airlines—especially Addis Ababa, Dubai, and other Gulf hubs—must coordinate with destination countries on:

- advance passenger information

- watchlists

- return procedures for people refused entry

- As more Boeing 737 MAX 8 aircraft join the fleet and schedules grow denser, both airlines and governments will have to balance commercial goals with the legal shields and due process rights travelers should enjoy when crossing borders under national and international law.

Key takeaway: Expanded air connectivity offers clear benefits—cheaper travel, greater flexibility, and improved access to consular services—but also places renewed demands on immigration systems to scale, coordinate, and protect passenger rights.

This Article in a Nutshell

Ethiopian Airlines confirmed 11 additional Boeing 737 MAX 8s at the Dubai Airshow on November 17, 2025, adding to an existing 22-aircraft MAX 8 fleet and prior commitments for 30 firm orders and 28 deliveries by 2030. The expansion aims to strengthen connectivity from Addis Ababa to the Gulf, Europe, India and beyond. Increased seat capacity may shift migration and visa application patterns, pressuring consulates and immigration systems to scale services and manage higher appointment volumes.