- Australia applies residency-based taxation taxing residents on their total worldwide income regardless of source.

- US tax residents face worldwide taxation and FBAR reporting requirements for accounts exceeding $10,000.

- Indian NRIs must disclose all foreign assets to avoid penalties even if the income is minimal.

(AUSTRALIA) — The single most important tax difference for Indian NRIs moving to Australia is this: Australia uses Residency-Based Taxation, while the United States taxes U.S. tax residents on worldwide income and also taxes U.S. citizens wherever they live.

For tax year 2026 (returns filed in 2027), that distinction shapes what income you must report, which foreign assets trigger disclosures, and how retirement accounts like superannuation are treated when you later return to India or move again.

This is where many globally mobile Indians slip up. They assume “salary taxed at source” is the end of the story. It often is not.

Current as of Friday, January 16, 2026.

Australia vs. United States: the practical comparison NRIs need

Side-by-side comparison (high-level rules)

| Topic | Australia (for tax residents) | United States (for U.S. tax residents) |

|---|---|---|

| Core system | Residency-Based Taxation. Residents are taxed on worldwide income. | Worldwide taxation for U.S. tax residents. U.S. citizens are taxed worldwide even if nonresident. |

| How residency is determined | Multiple tests. Common triggers include “resides” factors and 183+ days (facts matter). | Green card test or Substantial Presence Test under IRS rules. See IRS Pub. 519. |

| Indian income after you become resident | Generally reportable (salary, rent, interest, gains). Double tax relief may apply via treaty/foreign tax credits. | Generally reportable (salary, rent, interest, gains). Relief may apply through credits or treaty positions. |

| Retirement system for employees | Superannuation: employer contributions are mandatory. Access is restricted until conditions are met. | 401(k)/IRA rules. Foreign pensions can create reporting and treaty questions. |

| Foreign account reporting | Australia has strict foreign income and asset reporting through tax return questions and schedules. | Separate foreign reporting regimes. FBAR and FATCA Form 8938 often apply. |

| “Leaving the country” | Losing tax residency can trigger departure tax (deemed disposal of certain assets). | No general “departure tax” for most visa holders. The U.S. has an expatriation tax for some long-term residents and citizens. |

Criteria that decide your filing position (Australia focus, with U.S. parallels)

1) When do you become a tax resident?

In Australia, residency is not about citizenship. It is about facts and intent. Common factors include where you live, family ties, and where you keep your home.

A frequent NRI pattern is a student who later moves to a work visa. Residency can start earlier than expected. Once you are an Australian tax resident, Indian income does not stay outside the Australian net.

In the U.S., residency is usually more mechanical. The IRS relies heavily on the green card test and the Substantial Presence Test. Start with Publication 519 (U.S. Tax Guide for Aliens) at irs.gov/pub/irs-pdf/p519.pdf.

2) What income becomes taxable once residency starts?

For Australian tax residents, worldwide income generally includes Indian bank interest (NRO/NRE, depending on treatment), Indian rental income, capital gains on Indian shares, mutual funds, and property, and foreign dividends and business income.

For U.S. tax residents, worldwide income generally includes the same categories. The U.S. adds heavy information reporting. That reporting is often where penalties arise.

⚠️ Warning: Many NRIs report foreign income on the U.S. return but miss FBAR and Form 8938. Those are separate filings with separate penalty structures.

Foreign reporting: what the U.S. expects (and the exact thresholds)

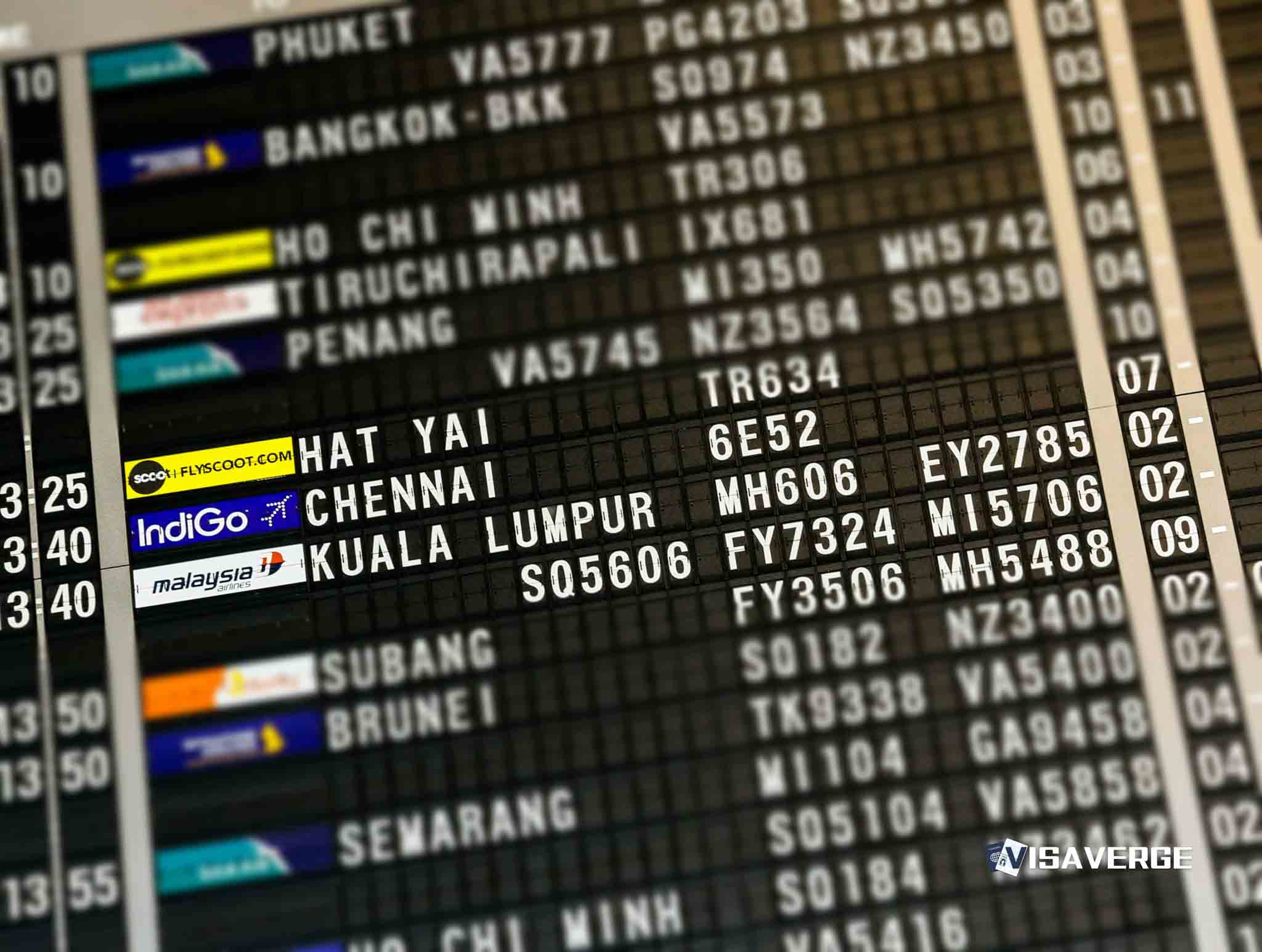

Even though this guide is Australia-led, many NRIs spend time in the U.S. on F-1, H-1B, L-1, or as green card holders. If you are a U.S. tax resident in 2026, foreign accounts and assets can trigger reporting even if the income is small.

Use the IRS international portal at irs.gov/individuals/international-taxpayers and the forms page at irs.gov/forms-pubs.

U.S. foreign reporting thresholds (common baselines)

| Filing status (living in the U.S.) | FBAR (FinCEN 114) threshold | Form 8938 (end of year) | Form 8938 (any time) |

|---|---|---|---|

| Single / Married filing separately | $10,000 aggregate | $50,000 | $75,000 |

| Married filing jointly | $10,000 aggregate | $100,000 | $150,000 |

FBAR: File if your non-U.S. accounts total over $10,000 at any point during 2026. This is an aggregate test.

Form 8938 (FATCA): File if you exceed the thresholds above. These are separate from FBAR.

📅 Deadline Alert: For tax year 2026, FBAR is due April 15, 2027, with an automatic extension to October 15, 2027. This is a separate e-filing (FinCEN Form 114).

Superannuation vs. U.S. retirement accounts: why NRIs should slow down

For many Indian professionals, superannuation becomes their biggest Australian asset without them noticing. Employers must contribute under Australia’s Super Guarantee regime. Your balance can grow quickly, especially over 5–10 years.

The tax question NRIs miss is not only Australian tax. It is what happens when you later become an Indian resident again, or if you spend a period as a U.S. tax resident.

Here is the practical planning lens:

- Liquidity: superannuation is generally locked until retirement conditions are met. Early access can be limited and taxed.

- Cross-border classification: another country may not treat superannuation like a “pension.” That can change how growth and distributions are taxed.

- Reporting overlays: if you are ever a U.S. tax resident, foreign retirement arrangements may raise reporting questions. The exact form depends on structure.

Because the U.S. treatment can hinge on treaty positions and account features, start your analysis with IRS residency rules in Pub. 519, then get advice before taking distributions.

Examples with numbers (how double tax and “top-up” tax can happen)

Example 1: Indian rental income after becoming an Australian tax resident

Assume in 2026 you are an Australian tax resident and you have net Indian rental income equivalent to A$20,000.

Indian tax paid is A$3,000 equivalent (after conversion). Australia generally taxes residents on worldwide income. You may claim a foreign income tax offset, but if your Australian tax on that income is A$7,000, you could still owe A$4,000 in Australia.

This is the “top-up” effect NRIs feel when moving from India to a higher-rate system.

Example 2: U.S. reporting trap with modest income

Assume in 2026 you are a U.S. tax resident (for example, H-1B worker meeting the Substantial Presence Test). You have Indian savings accounts with a peak balance of $11,500 and interest earned of $120.

You may owe little or no U.S. tax on $120 after credits. But you still likely must file FBAR because the aggregate balance exceeded $10,000.

The mismatch between small tax and large compliance duties is where penalties happen.

Common mistakes NRIs make (and safer alternatives)

- Accidental residency

Mistake: assuming residency starts only after permanent residency.

Better: track days and ties. Document arrival dates, leases, and family moves. - Forgetting currency conversion

Mistake: reporting Indian income using casual exchange rates.

Better: use consistent FX methodology and keep worksheets. This matters for gains and credits. - Ignoring overseas capital gains

Mistake: believing only local assets are taxed.

Better: once resident, assume worldwide gains are in scope unless clearly excluded. - Superannuation exit surprises

Mistake: planning to “cash out super” on departure without modeling tax and eligibility.

Better: ask your super fund what applies to your visa and departure facts, then model the tax cost. - U.S. information returns missed during short U.S. stints

Mistake: filing Form 1040 but skipping FBAR/Form 8938.

Better: do a foreign asset inventory every year you are a U.S. tax resident.

Deadlines that repeatedly matter (U.S. and planning checkpoints)

| Item | Deadline (tax year 2026) | Extension |

|---|---|---|

| U.S. Form 1040 / 1040-NR (most filers) | April 15, 2027 | To October 15, 2027 with extension |

| FBAR (FinCEN 114) | April 15, 2027 | Automatic to October 15, 2027 |

Australian deadlines vary by lodgment method and agent use. Confirm with the ATO or your registered tax agent.

“You are [X] if…” (use this to categorize yourself fast)

You are an Australian tax resident if you live and settle in Australia in a way that meets residency tests, often including 183+ days plus strong ties.

You are a U.S. tax resident for 2026 if you meet the green card test or the IRS Substantial Presence Test (see IRS Pub. 519).

You are in the highest-risk NRI category if you are an Australian tax resident while holding Indian property, Indian funds, and multiple Indian bank accounts.

You are in a U.S. foreign-reporting risk category if your non-U.S. accounts exceeded $10,000 in 2026, even for one day.

Action items for tax year 2026 (filed in 2027)

- Confirm your 2026 residency status before you assume “only local income” is taxable.

- Build a list of all Indian accounts, funds, property, and pensions, including peak balances.

- If you are a U.S. tax resident, calendar April 15, 2027 and October 15, 2027 for FBAR timing, and review Form 8938 thresholds.

- If superannuation is growing, plan early for departure or return-to-India scenarios before you trigger taxable events.

⚠️ Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. Tax situations vary based on individual circumstances. Consult a qualified tax professional or CPA for guidance specific to your situation.