- NRI status is an Indian tax classification based on physical presence, distinct from U.S. residency rules.

- U.S. residents must report worldwide income including Indian interest, dividends, rental income, and capital gains.

- Foreign accounts exceeding $10,000 aggregate trigger mandatory FBAR reporting to the U.S. Treasury.

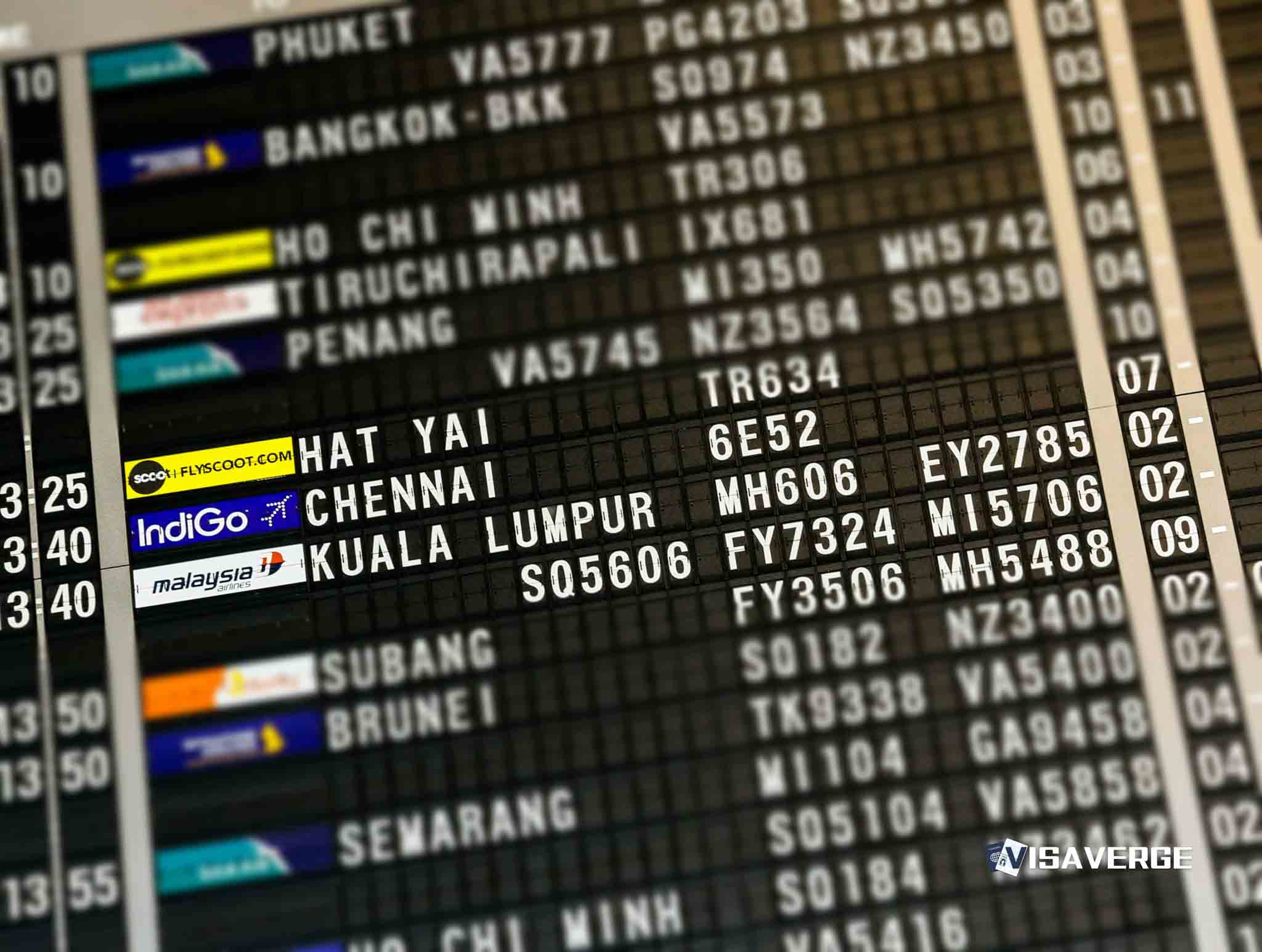

(INDIA) — The single biggest distinction for an NRI investing in India is this: “NRI” is an India tax status, but your U.S. filing duties depend on whether you are a U.S. tax resident under IRS rules.

That gap is where many cross-border surprises start. An NRI may owe tax in India on rent, capital gains, or NRO interest, while also needing to report the same income in the United States.

For tax year 2026 (returns filed in 2027), getting this right is mostly about structuring accounts correctly, tracking withholding, and meeting U.S. reporting deadlines.

This playbook compares the two systems and highlights where Compliance breaks down for NRI investors tied to India and the U.S.

1) NRI status vs. U.S. tax residency: what changes, and why it matters

India’s NRI concept is driven by day-count residency rules under India’s Income Tax Act. Once you are an NRI, India generally taxes you on Indian-sourced income (not foreign salary).

NRI status also triggers practical requirements, like converting bank accounts and following FEMA repatriation rules.

The U.S. uses different tests. Under IRS rules, you are a resident alien for tax if you meet the Green Card Test or the Substantial Presence Test.

These rules are explained in IRS Publication 519 (U.S. Tax Guide for Aliens): IRS Publication 519 (PDF)

If you are a U.S. tax resident, you generally report worldwide income, including India income, on Form 1040. If you are a nonresident alien, you usually report only U.S.-source income on Form 1040-NR.

⚠️ Warning: Many NRIs assume “NRI” means “nonresident for U.S. taxes.” That is often false for H-1B, L-1, and many F-1 students after the exempt years end.

2) Side-by-side comparison: India NRI rules vs. U.S. tax rules (what to file, what gets taxed)

Here is a quick comparison for NRIs living in the U.S. during tax year 2026.

| Category | India (as NRI) | United States (if U.S. tax resident) | United States (if nonresident alien) |

|---|---|---|---|

| Core concept | India taxes mainly India-sourced income for NRIs | U.S. taxes worldwide income | U.S. taxes mainly U.S.-source income |

| Main return | India income tax return (ITR, as applicable) | Form 1040 | Form 1040-NR |

| India income in the U.S. return | Not applicable | Report rent, gains, and interest from India | Often not reported unless U.S.-source |

| Double-tax relief | DTAA can reduce India withholding and support foreign tax credit claims | Foreign tax credit often claimed on Form 1116 | Treaty positions may apply on Form 1040-NR |

| Bank accounts | Must use NRE/NRO structure after becoming NRI | India accounts can trigger FBAR/FATCA reporting | Same reporting if thresholds apply |

| Typical pain point | High TDS withholding creates refund delays | Reporting + forms for foreign accounts and assets | Getting treaty and source rules correct |

U.S. international tax rules and reporting lists are centralized here: IRS: International Taxpayers

3) Investments in India: how the tax math compares (with numbers)

A) Listed shares, equity mutual funds, and ETFs (India-side tax)

For NRIs investing through permitted channels (like PIS for listed equities), India tax commonly follows these headline rates:

- STCG (short-term capital gains) on listed shares and equity funds: 15%

- LTCG (long-term capital gains) on listed shares/equity funds: 10% on gains over ₹1 lakh

TDS is commonly withheld at redemption/sale, which can create a cash-flow gap even if your final tax due is lower after credits and setoffs.

U.S. side (if you are a U.S. tax resident): You still report the sale on your Form 1040. The U.S. taxes capital gains under U.S. rules, and India tax paid may be creditable on Form 1116.

The character can differ between countries, so documentation matters.

Example (numbers):

You sell Indian listed equity mutual fund units in 2026 with a ₹3,00,000 long-term gain. India’s LTCG tax applies at 10% on gains over ₹1,00,000.

- Taxable LTCG amount in India: ₹2,00,000

- India tax (before any surcharge/cess): ₹20,000

If India withholds TDS at redemption, you may need an India return to reconcile or claim a refund. In the U.S., you also report the sale, then evaluate a foreign tax credit.

B) Real estate: rental income and sale withholding (India-side)

Indian real estate is popular for family support and long-term appreciation. It is also one of the most compliance-heavy assets for an NRI.

From the framework you provided, for property sales after mid-2024 changes:

- If held more than 24 months, LTCG tax is 12.5% on gains.

- TDS withholding on sale is aligned to that LTCG rate, plus surcharge and 4% health and education cess.

- If held 24 months or less, gains are STCG, taxed at ordinary slab rates. The effective burden can reach 30% plus surcharge and cess.

- The buyer must withhold and deposit tax under Section 195.

U.S. side (if resident): You report rental income and the sale. You may claim depreciation under U.S. rules, even if India tax treatment differs.

That mismatch is a common audit trigger.

Example (numbers):

You sell a Mumbai apartment in 2026. Your long-term gain is ₹40,00,000 and the buyer withholds 12.5% as baseline.

- India baseline tax: ₹5,00,000

- Plus cess and possible surcharge, depending on income level

In the U.S., you also report the gain and compute U.S. tax. Then you consider Form 1116 for India tax paid.

📅 Deadline Alert: For tax year 2026, most individuals file U.S. returns by April 15, 2027. An extension to October 15, 2027 is available via Form 4868, but it extends time to file, not time to pay.

4) NRE vs. NRO accounts: the comparison that drives tax outcomes

For NRIs, NRE and NRO accounts are not optional housekeeping. They are the backbone of correct classification and repatriation.

| Feature | NRE account | NRO account |

|---|---|---|

| Typical source | Foreign earnings | India income (rent, dividends, pension) |

| India taxation on interest | Typically tax-free in India | Taxable in India, usually with TDS |

| Repatriation | Generally fully repatriable | Repatriable, but limits and documentation apply |

| Currency | INR | INR |

| Best use | Parking foreign income in INR | Collecting India-source cash flows |

U.S. reporting impact: Whether it is NRE or NRO, if you are a U.S. person for tax, these are foreign accounts for U.S. reporting.

5) U.S. reporting: FBAR and FATCA thresholds NRIs commonly miss

If you are a U.S. citizen, green card holder, or resident alien, Indian financial accounts can trigger FBAR and FATCA reporting.

FBAR (FinCEN Form 114): File if your foreign accounts exceed $10,000 aggregate at any time during 2026. The FBAR is filed online, not with your tax return.

Form 8938 (FATCA): For U.S. residents, common thresholds include:

- Single / Married filing separately (living in U.S.): $50,000 at year-end or $75,000 at any time

- Married filing jointly (living in U.S.): $100,000 at year-end or $150,000 at any time

| Filing Status (living in U.S.) | FBAR Threshold (aggregate) | Form 8938 (End of Year) | Form 8938 (Any Time) |

|---|---|---|---|

| Single / MFS | $10,000 | $50,000 | $75,000 |

| MFJ | $10,000 | $100,000 | $150,000 |

IRS international reporting pages and forms live here: IRS: Forms & Publications

⚠️ Warning: FBAR penalties can be severe. Even non-willful violations can be penalized. Keep year-end statements and peak-balance support for each account.

6) Visa-specific U.S. angles: F-1/J-1 vs. H-1B/L-1

Visa category does not directly decide tax residency, but it changes how the IRS counts days.

- F-1 and J-1 students are often “exempt individuals” for the Substantial Presence Test for a limited period. During exempt years, many remain nonresident aliens and file Form 1040-NR. Publication 519 covers this.

- H-1B and L-1 workers often become U.S. tax residents under the Substantial Presence Test and must report worldwide income on Form 1040.

- FICA taxes: Many F-1 students working under authorized practical training can be exempt from Social Security and Medicare taxes while nonresident aliens. H-1B workers generally pay FICA.

These differences matter when you have India investment income in the same year you change status.

7) Common mistakes NRIs make—and how to avoid them

- Treating NRE interest as “tax-free everywhere.” NRE interest may be tax-free in India, but the U.S. may still tax it if you are a U.S. tax resident.

- Ignoring TDS as “final tax.” TDS is withholding. You may still need to file in India to compute actual tax or claim a refund.

- Missing FBAR because each account is under $10,000. FBAR uses an aggregate test. Five accounts at $3,000 each still triggers filing.

- Using the wrong account type after becoming NRI. Keeping resident accounts can create compliance and repatriation problems under FEMA rules.

- Not matching DTAA paperwork to the U.S. foreign tax credit file. Save India tax certificates, TDS proofs, and sale statements. These support Form 1116 positions.

“You are [X] if…” quick identifiers (2026 context)

You are an India NRI if you do not meet India’s residency day-count thresholds under India’s Income Tax Act, and your India tax is mainly on India-source income.

You are a U.S. tax resident for tax year 2026 if you meet the Green Card Test or the Substantial Presence Test, and you generally report worldwide income on Form 1040 (Publication 519).

You are a U.S. nonresident alien for tax year 2026 if you do not meet those tests, and you generally file Form 1040-NR for U.S.-source income (Publication 519).

Action items for tax year 2026 (filed in 2027)

- Confirm U.S. residency status using IRS Publication 519 rules.

- Track India TDS and retain proof for DTAA and Form 1116 foreign tax credit support.

- Check FBAR $10,000 aggregate and Form 8938 thresholds using peak balances.

- Use NRE for foreign earnings and NRO for India income, and keep FEMA documentation.

- If you are H-1B/L-1 and newly U.S. resident, budget for worldwide reporting in 2026.

⚠️ Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. Tax situations vary based on individual circumstances. Consult a qualified tax professional or CPA for guidance specific to your situation.