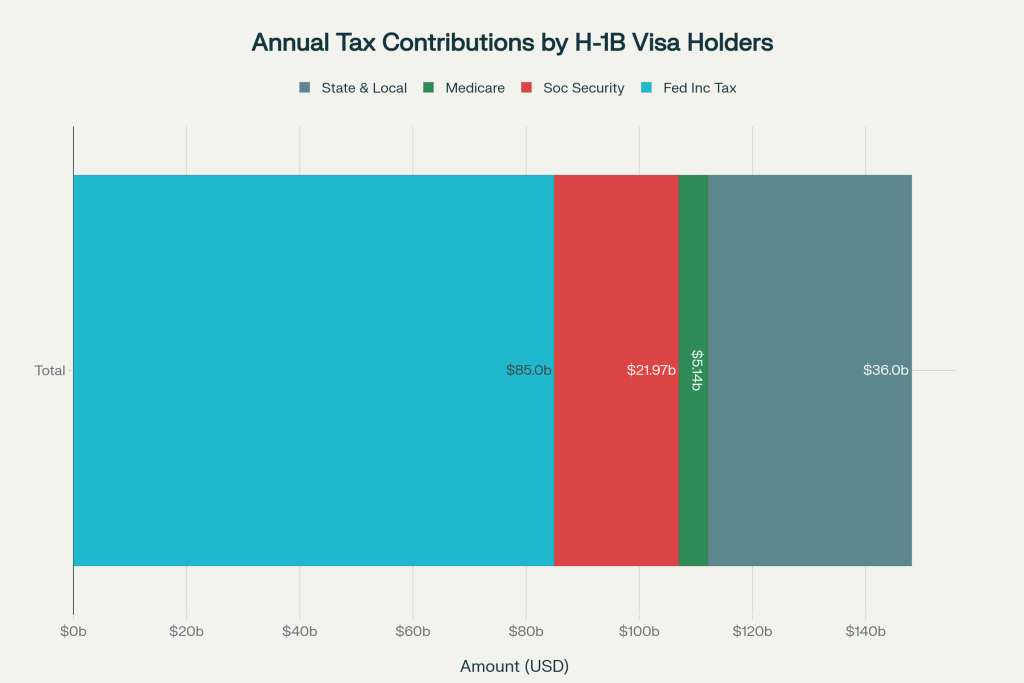

H-1B visa holders represent a significant source of tax revenue for the United States, contributing an estimated $147.57 billion annually across federal, state, and local taxes. This comprehensive analysis examines the detailed tax contributions of approximately 3 million H-1B visa holders currently working in the U.S., drawing from data published by Stilt, the U.S. Citizenship and Immigration Services (USCIS), Pew Research Center, and other authoritative sources. The findings reveal that these temporary workers pay substantial taxes while contributing billions to programs like Social Security and Medicare—benefits they cannot access unless they eventually obtain permanent residency or citizenship.

Federal Tax Contributions

Income Tax Payments

H-1B visa holders contribute massively to federal income tax revenues. Based on an average annual salary of $118,100, each H-1B worker pays approximately $28,344 in federal income tax, calculated at a base rate of 24%. When aggregated across all H-1B visa holders in the United States, this amounts to $85.03 billion in annual federal income tax revenue. This figure represents a substantial portion of overall federal tax collections and underscores the fiscal importance of skilled immigrant workers to the U.S. Treasury.

The federal income tax rate for H-1B holders varies based on income level and filing status, following the same progressive tax brackets as U.S. citizens. Most H-1B visa holders fall into the 22% to 24% marginal tax brackets due to their above-average salaries in specialized occupations. For the 2024 tax year, H-1B workers earning between $47,151 and $100,525 (single filers) pay a 22% marginal rate, while those earning between $100,526 and $191,950 pay 24%. Higher earners, particularly in technology and finance sectors, can face marginal rates of 32% to 37%.

Social Security and Medicare Contributions

Beyond federal income taxes, H-1B visa holders make substantial contributions to Social Security and Medicare through the Federal Insurance Contributions Act (FICA) taxes. Each H-1B worker pays 6.2% of their gross salary toward Social Security, amounting to approximately $7,322.20 annually per person. Additionally, they contribute 1.45% toward Medicare, totaling approximately $1,712.45 per person annually. Combined, these FICA tax contributions amount to $9,034.65 per H-1B holder each year.

When calculated across all H-1B visa holders, the aggregate contributions are staggering: $21.97 billion annually to Social Security and $5.14 billion to Medicare, for a combined total of $27.10 billion in FICA taxes. These contributions are particularly noteworthy because H-1B visa holders generally cannot benefit from these programs unless they eventually adjust their status to permanent residency. Unlike F-1 student visa holders who are exempt from FICA taxes for their first five years, H-1B workers pay these taxes from their first day of employment, regardless of their residency status.

Employers also match these FICA contributions, effectively doubling the total amount flowing into Social Security and Medicare trust funds from H-1B employment. This employer-employee combined contribution represents a significant subsidy to programs that primarily benefit U.S. citizens and permanent residents.

State and Local Tax Contributions

State Income Taxes

State income tax obligations for H-1B visa holders vary considerably depending on their state of residence, ranging from zero in states without income taxes to over 10% in high-tax states. California, which hosts the largest H-1B population, imposes state income tax rates ranging from 6.5% to 10% of gross income. New York levies rates between 4% and 10.9%, while New Jersey’s rates span 1.4% to 10.75%.

Several states with significant H-1B populations impose no state income tax, including Texas, Florida, Washington, Nevada, Wyoming, Alaska, and South Dakota. Tennessee and New Hampshire only tax interest and dividend income at the state level, not wage income. For H-1B workers in these states, the absence of state income tax can result in substantially higher take-home pay compared to their counterparts in high-tax states.

Based on weighted averages across all states, H-1B visa holders pay an estimated $35.43 billion in combined state and local income taxes annually. This represents approximately 10% of their aggregate gross income and varies significantly by location. In California alone, H-1B workers contribute an estimated $4.68 billion in state income taxes, while New York contributes approximately $1.81 billion.

Local and Municipal Taxes

In addition to state taxes, many H-1B visa holders face local income taxes imposed by cities and municipalities. These local taxes typically amount to approximately 4% of gross income but vary by jurisdiction. Major cities with significant H-1B populations, such as New York City, impose additional local income taxes on top of state taxes, further increasing the overall tax burden.

Local taxes are generally withheld by employers along with federal and state taxes, provided the employee has correctly updated their address on Form W-4. However, workers who live in one jurisdiction and work in another may need to file returns in multiple localities, sometimes paying the higher of the two tax rates.

State-by-State Tax Contribution Analysis

Top Contributing States

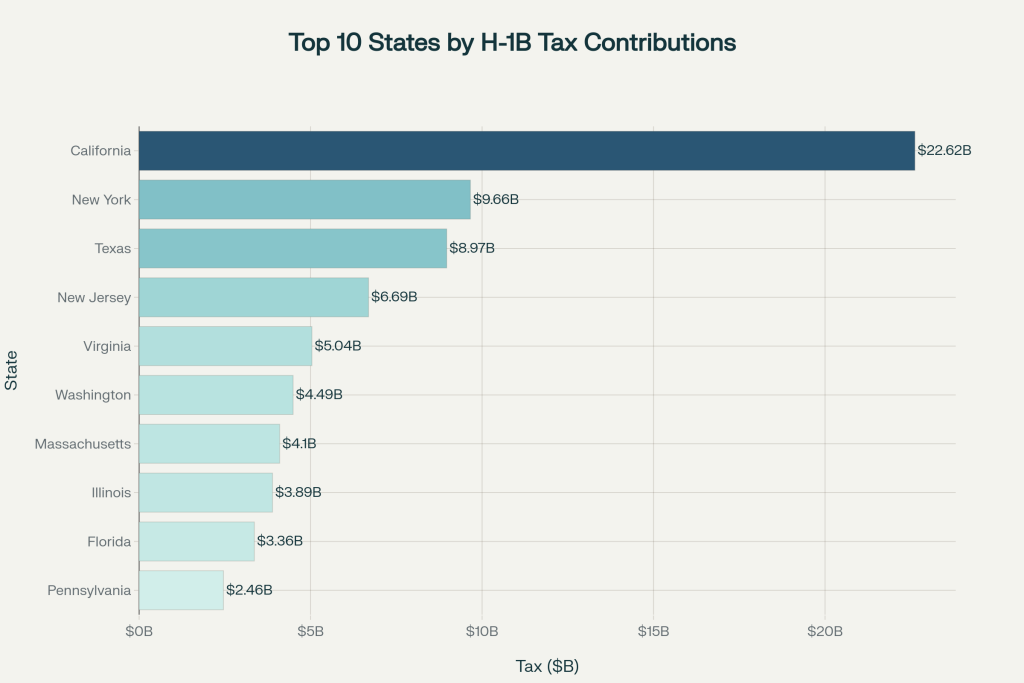

California stands as the single largest beneficiary of H-1B tax contributions, receiving an estimated $22.62 billion annually from approximately 480,000 H-1B visa holders residing in the state. This represents nearly 18% of all H-1B tax revenue and reflects California’s position as home to Silicon Valley and numerous technology companies that heavily utilize the H-1B program. H-1B holders in California contribute $13.61 billion in federal income tax, $3.51 billion in Social Security tax, $0.82 billion in Medicare tax, and $4.68 billion in state income tax.

New York ranks second with total H-1B tax contributions of approximately $9.66 billion annually from an estimated 210,000 H-1B workers. The state’s concentration of financial services, technology, and consulting firms drives high H-1B utilization, particularly in the New York metropolitan area, which had more than 55,000 H-1B approvals in fiscal year 2023—more than any other metro area in the country.

Texas contributes $8.97 billion annually despite having no state income tax. The state’s 240,000 H-1B workers still pay substantial federal income taxes ($6.80 billion), Social Security taxes ($1.76 billion), and Medicare taxes ($0.41 billion). Texas benefits from major technology hubs in Dallas, Austin, and Houston, which have attracted significant H-1B talent in recent years.

New Jersey adds $6.69 billion in annual H-1B tax revenue, with its 150,000 H-1B workers concentrated in pharmaceutical, technology, and financial services industries. The state’s proximity to New York City and Philadelphia makes it attractive to companies seeking skilled workers.

Virginia contributes $5.04 billion annually from 120,000 H-1B visa holders, many employed by federal contractors, cybersecurity firms, and consulting companies serving the Washington, D.C. area. Washington State generates $4.49 billion annually despite having no state income tax, driven by major technology employers in the Seattle metropolitan area.

Massachusetts, Illinois, Florida, and Pennsylvania round out the top ten states, contributing $4.10 billion, $3.89 billion, $3.36 billion, and $2.46 billion respectively. Massachusetts benefits from its concentration of biotechnology, healthcare, and technology firms, while Illinois draws H-1B workers to Chicago’s financial services and technology sectors.

Regional Distribution

The geographic distribution of H-1B tax contributions reflects broader patterns of economic activity and industry concentration across the United States. The top ten states collectively account for approximately $71.28 billion, or about 56% of total H-1B tax contributions. The remaining 40 states and the District of Columbia contribute the other $56.83 billion.

Metropolitan areas show even greater concentration. San Jose, California (Silicon Valley) has one of the highest H-1B approval rates per 100 workers, with approximately three approvals per 100 workers in fiscal year 2023. The Washington, D.C. metro area and San Francisco Bay Area each had more than 30,000 H-1B approvals in 2023. These concentrated urban centers generate disproportionate tax revenue from H-1B workers compared to rural areas.

Economic Impact Beyond Tax Revenue

Consumer Spending and Local Business Support

H-1B visa holders contribute significantly to the U.S. economy beyond their direct tax payments. According to the Stilt study, H-1B workers spend an average of $2,130.65 per month, totaling approximately $25,568 per person annually. Across all H-1B visa holders, this represents $76.70 billion in annual consumer spending.

Importantly, 74% of this spending, or approximately $57.10 billion annually, goes directly to local businesses within their communities. This includes spending at restaurants, supermarkets, retail stores, and service providers, creating a multiplier effect that supports American jobs and businesses. In California alone, H-1B workers spend an estimated $13.7 billion annually at local businesses.

The average local spending per H-1B visa holder amounts to $1,588 per month. This consistent consumer demand helps sustain employment for U.S. workers in retail, hospitality, and service industries, contradicting narratives that H-1B workers primarily send money abroad.

Business Investment and Job Creation

H-1B visa holders also invest in U.S. businesses and entrepreneurship. The average H-1B worker invests approximately $4,025.09 annually in American businesses, representing 3.4% of their income. Collectively, H-1B visa holders contribute more than $12 billion in business investments each year.

Research demonstrates that H-1B visa holders create jobs for U.S.-born workers rather than displacing them. A 2011 study by the Partnership for a New American Economy and the American Enterprise Institute found that every additional H-1B visa awarded to a state translates into 1.83 jobs for native-born workers over the following seven years. Based on this multiplier effect, H-1B visas awarded between 2010 and 2013 were projected to create more than 700,000 jobs for U.S.-born workers by 2020.

California alone was projected to gain more than 118,000 new jobs for U.S.-born workers from its 64,000 H-1B visa awards during 2010-2013. Texas would gain almost 81,000 new jobs, while states like Pennsylvania, Michigan, Virginia, Washington, North Carolina, and Florida each expected job creation exceeding 20,000 positions.

An independent analysis by Regional Economic Models, Inc. (REMI) estimated that increasing the H-1B cap would create 227,000 new jobs in 2014 and reach 1.3 million jobs by 2045. The same study projected that H-1B expansion would increase national personal income by $13.7 billion in 2014 and up to $146 billion by 2045.

Industry-Specific GDP Contributions

Academic research examining the relationship between H-1B visa approvals and industry-specific GDP demonstrates positive and statistically significant correlations. A thesis analyzing 20 NAICS industries from 2010 to 2022 found that a 1% increase in H-1B visa approvals leads to a 0.07% increase in industry GDP. This effect was particularly strong in Finance and Insurance, Healthcare, Information, Professional/Scientific/Technical Services, and Real Estate sectors.

The Information sector, which includes computer scientists and software developers, has been especially impacted by H-1B workers. Research by Bound et al. (2015) found that immigration raised the output of IT goods by 1.9% to 2.5%, and firms in the IT sector earned substantially higher profits as a result of access to H-1B talent. The industries with the highest number of H-1B approvals—Manufacturing, Information, and Professional/Scientific/Technical Services—also demonstrate the highest industry-specific GDP.

H-1B Program Statistics and Trends

Application and Approval Patterns

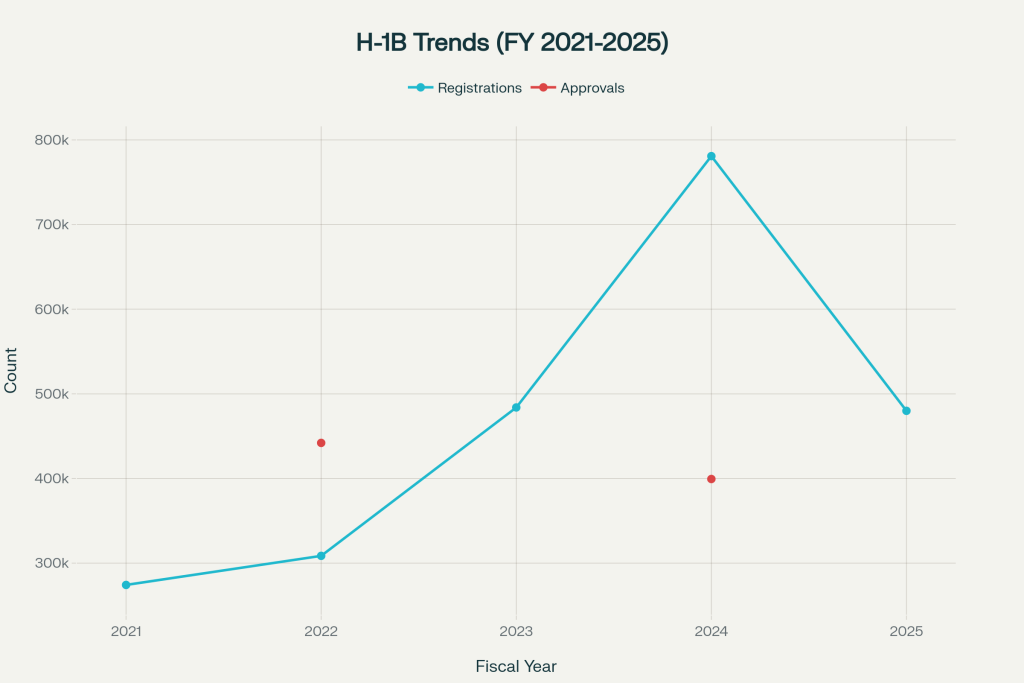

The H-1B program has experienced significant fluctuations in recent years. Fiscal year 2024 saw 780,884 total registrations with 758,994 eligible registrations, representing a dramatic spike from previous years. However, FY 2025 registrations dropped to 479,953 total with 470,342 eligible, a 38.6% decrease compared to FY 2024.

In FY 2024, USCIS approved 399,395 H-1B petitions, a 3% increase from the previous year. The peak approval year was FY 2022, with 442,043 applications approved. Since 2013, the majority of approvals each year have been for renewal applications rather than initial employment. In FY 2024, approximately 65% of approved applications (258,196) were renewals, while 35% (141,207) were new applications.

The annual cap for new H-1B visas remains at 65,000 for the regular cap, plus an additional 20,000 for holders of advanced degrees from U.S. institutions, for a total of 85,000 cap-subject visas. However, certain employers are exempt from this cap, including universities, nonprofit research organizations, and government research organizations. Approximately 130,000 temporary migrant workers receive new H-1B visas each fiscal year when including both cap-subject and cap-exempt employers.

Demographic Composition

India is overwhelmingly the top country of birth for H-1B workers, accounting for approximately 71-73% of all H-1B approvals in recent years. In FY 2023, roughly three-quarters of approved H-1B applications went to workers born in India. China is the second-most common birthplace, representing approximately 12% of H-1B workers approved in recent years. No other country accounts for even 2% of H-1B approvals.

The educational attainment of H-1B workers has increased significantly over time. The share of H-1B workers whose highest degree is a master’s degree increased from 31% in 2000 to 57% in 2021. Conversely, the share with only a bachelor’s degree as their highest credential decreased from 57% to 34% during the same period. This trend reflects the competitive nature of the H-1B lottery and the preference given to advanced degree holders.

Salary Trends and Occupational Distribution

H-1B worker salaries have risen substantially over the past two decades. The median planned salary for H-1B applicants increased from approximately $69,000 in fiscal year 2006 to $80,000 in fiscal year 2016 (in 2016 dollars). By 2024, average H-1B salaries had climbed to between $118,100 and $130,000 depending on the data source.

These salaries often exceed those of comparable U.S. workers in similar occupations. The 2016 median H-1B salary of $80,000 was higher than the median salary of $75,036 for U.S. workers in computer and mathematical occupations. Among top employers, Facebook (now Meta) planned to pay an average salary of $140,758 on 1,107 H-1B applications in 2017, the highest average among the top 30 companies. Apple planned to pay $138,563 on average, while Google planned $131,882.

Computer-related occupations dominate H-1B utilization. In FY 2022, 66% of approved H-1B beneficiaries worked in computer-related occupations. The share of IT workers in the H-1B program grew from 32% in FY 2003 to over 65% in recent fiscal years. Among computer and math occupations, the foreign share of the U.S. workforce grew from 17.7% in 2000 to 26.1% in 2019.

Top Employers and Industry Concentration

H-1B visa usage is highly concentrated among a small number of employers. In 2022, the top 30 H-1B employers hired more than 34,000 new H-1B workers, accounting for 40% of the 85,000 new visas available under the annual cap for cap-subject companies. Amazon topped the list in both 2021 and 2022, hiring 6,400 new H-1B workers in 2022 and nearly 6,200 in 2021.

Other major technology companies feature prominently among top H-1B employers. Google and Meta together hired over 3,100 new H-1B workers in 2022. Meta employs so many H-1B workers that it has declared itself an “H-1B dependent” firm in government filings, meaning more than 15% of Meta’s total U.S. workforce consists of H-1B workers.

India-based IT consulting firms also rank among the largest H-1B employers. Cognizant Tech Solutions had 21,459 applications approved in FY 2016, the most of any company. India-based firms Infosys (12,780 approvals) and Tata Consultancy (11,295 approvals) ranked second and third.

In higher education, nearly 3 out of every 100 faculty members currently hold H-1B status. Approximately 40,600 higher education faculty work with H-1B visas in the U.S., with 83% at doctoral institutions and 57% at R1 research universities. An estimated 11,000 postdoctoral researchers also hold H-1B visas.

Policy Changes and Economic Implications

Recent Fee Increases

In September 2025, the Trump administration implemented a dramatic policy change by imposing a $100,000 fee on each new or renewed H-1B petition. This fee represents a substantial financial burden for employers, particularly small and mid-sized businesses. The proclamation appeared to apply to new H-1B applications from outside the United States, though subsequent guidance created confusion about whether it also applied to renewals and workers already in the country.

The economic rationale behind this fee was questioned by policy analysts. H-1B visa holders and their families contribute an estimated $86 billion annually to the U.S. economy, including $24 billion in federal payroll taxes and $11 billion in state and local taxes. Supporters of the H-1B program argue that the $100,000 fee could drive skilled workers and companies to relocate operations overseas, ultimately harming the U.S. economy.

Labor Market Impacts

The economic impact of H-1B workers on native-born American workers remains contested. Research indicates that H-1B workers in computer-related occupations may have modestly suppressed wages for U.S. computer scientists. One study estimated that absent the influx of foreign-born computer scientists enabled by the H-1B program, U.S. computer scientists would have earned between 2.6% and 5.1% more in 2001.

However, other research finds more complex effects. A study examining firms that won additional H-1B visas found that winning an additional H-1B petition means a decline in employment of 1.5 other workers on average. These effects suggest some degree of worker substitution, though the magnitude varies by industry and firm characteristics.

On the positive side, studies consistently show that H-1B workers create complementary employment opportunities. The job creation multiplier of 1.83 jobs per H-1B visa suggests that the program generates net positive employment effects for U.S.-born workers. States receiving more H-1B approvals experience greater job growth overall.

Fiscal Considerations

From a purely fiscal perspective, H-1B visa holders represent a net positive contribution to government revenues. With total tax contributions exceeding $147 billion annually and minimal use of public benefits (H-1B holders generally cannot access most federal assistance programs), these workers subsidize government services used primarily by citizens and permanent residents.

The $27.10 billion in annual FICA tax contributions is particularly significant given that most H-1B workers will never collect Social Security or Medicare benefits. Only H-1B workers who eventually adjust to permanent residency and work in the U.S. for at least 10 years (40 quarters) become eligible for Social Security benefits. Those who return to their home countries forfeit these contributions entirely.

Comparisons with unauthorized immigrant tax contributions provide additional context. A Yale Budget Lab study estimated that unauthorized immigrants paid $66 billion in federal taxes in 2023, roughly $43 billion in payroll taxes and $22 billion in individual income taxes. While this represents substantial revenue, the per-capita contribution from H-1B workers significantly exceeds that of unauthorized workers due to higher average salaries and full tax compliance.

Future Outlook

The H-1B program faces ongoing policy debates about its size, administration, and economic impact. The annual cap of 85,000 new visas has remained largely unchanged since 2004, despite significant growth in demand. Between 1991 and 2022, the number of H-1B visas issued quadrupled, yet the cap has not been increased to match employer demand or economic growth.

Reform proposals range from expanding the program to facilitate greater access to global talent, to restricting it to protect American workers from wage competition. The implementation and subsequent modification of the beneficiary-centric selection process in FY 2025, which reduced gaming of the lottery system through multiple registrations, demonstrates ongoing administrative evolution.

The concentration of H-1B approvals in technology and IT services sectors raises questions about program design. While these industries drive innovation and economic growth, critics argue that the program should be better distributed across industries with genuine labor shortages rather than serving as a cost-reduction tool for tech companies.

Conclusion

H-1B visa holders make substantial and measurable contributions to the U.S. economy through their tax payments and economic activity. With annual tax contributions totaling approximately $147.57 billion—including $85.03 billion in federal income taxes, $27.10 billion in FICA taxes, and $35.43 billion in state and local taxes—these temporary workers represent a significant revenue source for federal, state, and local governments. Their $76.70 billion in annual consumer spending and $12 billion in business investments further amplify their economic impact.

State-level analysis reveals that California, New York, and Texas are the primary beneficiaries of H-1B tax contributions, collectively receiving over $41 billion annually. The geographic concentration reflects broader patterns of technology industry clustering and economic development, with metropolitan areas like Silicon Valley, New York City, and Seattle serving as major H-1B employment centers.

Perhaps most notably, H-1B workers contribute $27.10 billion annually to Social Security and Medicare—programs from which most will never benefit unless they achieve permanent residency. This represents a net fiscal transfer from temporary foreign workers to U.S. citizens and permanent residents, challenging narratives about immigrants burdening public resources.

The evidence demonstrates that H-1B visa holders are not merely filling labor shortages but actively subsidizing government programs, supporting local businesses, creating jobs for U.S.-born workers, and driving economic growth across multiple industries and regions. As policymakers debate the future of the H-1B program, these fiscal and economic contributions merit serious consideration alongside labor market concerns and wage effects.