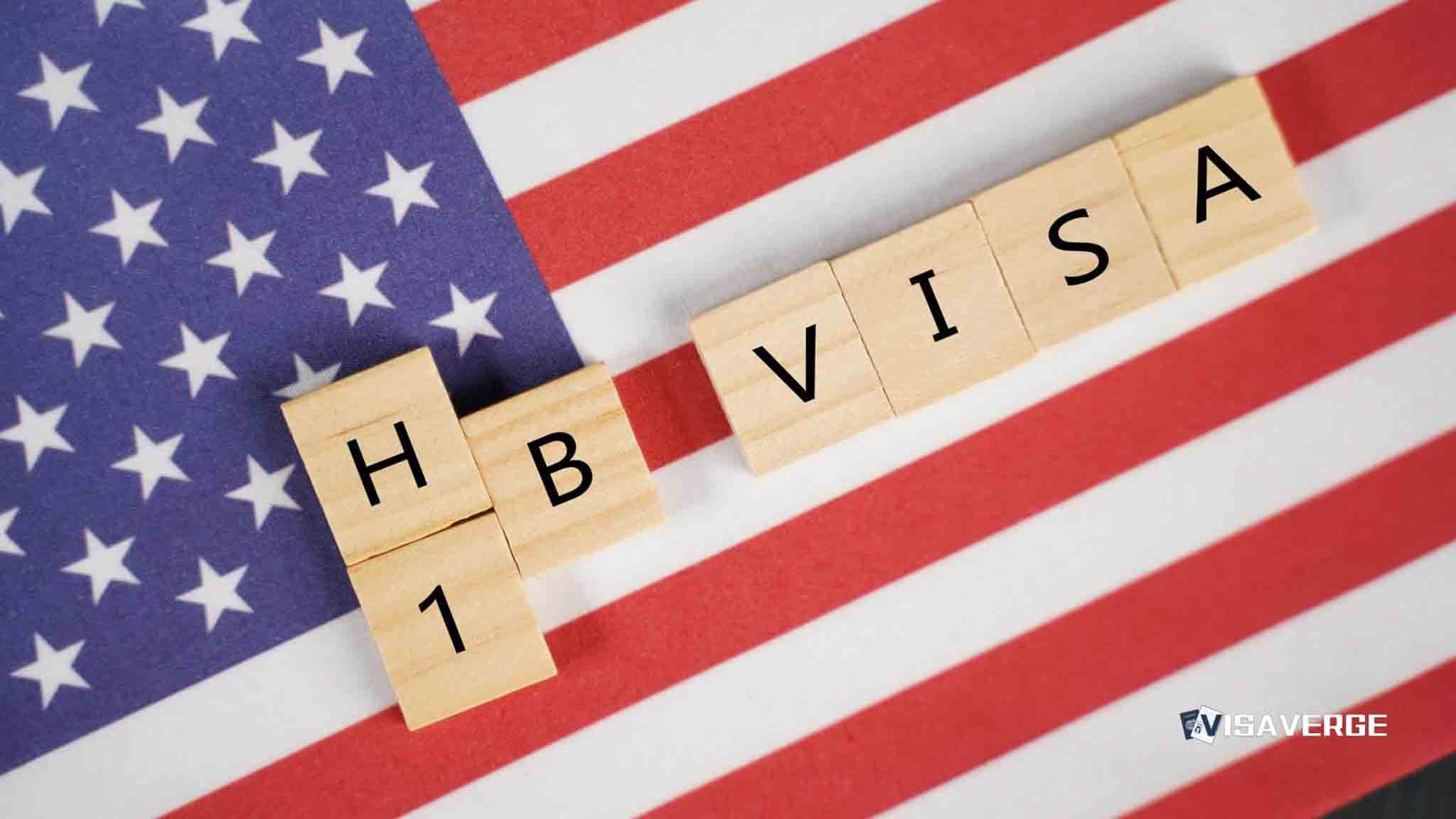

The Department of Homeland Security has finalized a wage-weighted H-1B selection rule that replaces the pure random lottery with a “4-3-2-1” weighted selection, becoming effective February 27, 2026. The change will apply to the FY-2027 H-1B cap registration cycle, the first cap season under the rule.

DHS and U.S. Citizenship and Immigration Services commonly describe the rule as “Weighted Selection Process for Registrants and Petitioners Seeking to File Cap-Subject H-1B Petitions.” DHS and USCIS say the aim is prioritizing higher-paid, higher-skilled positions and protecting U.S. workers’ wages and working conditions.

How the weighted selection works

Each unique H-1B registrant remains placed into a single selection pool. USCIS will enter that single registrant into the pool multiple times based on the prevailing-wage wage level assigned to the specific job and worksite.

- The rule uses the same four prevailing-wage levels currently used for H-1B prevailing-wage and compliance purposes.

- Assigning a wage level to the offered wage determines whether the registrant receives 1, 2, 3, or 4 entries in the selection pool.

- Employers and workers are expected to focus more tightly on wage-level determinations because that is what drives the weighting.

The “4-3-2-1” multiplier table

| Wage Level | Multiplier (entries in selection pool) |

|---|---|

| Level IV | 4 |

| Level III | 3 |

| Level II | 2 |

| Level I | 1 |

The multiplier increases selection probability for higher-paid positions. USCIS will use the prevailing wage level that corresponds to the job’s occupation, geographic area, and duties.

Counting rule and duplicate filings

The rule retains a core feature of the current process: each unique beneficiary is counted only once in the cap selection process, even if multiple registrations are filed for that beneficiary.

- The weighted multiplier applies to that single-counted registration entry.

- The mechanics are designed to avoid increasing cap chances through duplicate filings for the same person.

- Employers should coordinate where multiple entities might file registrations for the same worker to avoid unnecessary duplication that does not increase odds.

Expected impact on selection probabilities

DHS/USCIS materials and analyst summaries indicate the weighted approach:

- Substantially increases selection probability for Wage Levels III and IV versus the previous equal-chance lottery.

- Decreases selection probability for Wage Level I compared with the old random lottery.

USCIS provided modeled estimates showing material percentage shifts by wage level. In short:

- Beneficiaries with offered wages in Levels III and IV will have a greater chance of selection.

- Beneficiaries in Level I will have the lowest weighted chance.

- Small employers and those offering lower wages may see reduced selection probabilities compared with the old lottery.

USCIS guidance on H-1B prevailing wage levels is available at prevailing-wage levels.

Practical steps employers should take

Analysts recommend employers prepare now for the FY-2027 registration season and the February 27, 2026 effective date. Key actions include:

- Obtain and document accurate prevailing wage determinations for each position and worksite.

- Document the wage-level determinations (I–IV) that map the offered wage to the multiplier.

- Maintain contemporaneous records tying job duties, SOC code, worksite, and wage to the wage level used for registration and later petition.

- Coordinate internally and with third parties to avoid duplicate filings for the same beneficiary.

Employers may consider:

- Increasing offered wages, or

- Ensuring wage-level documentation supports a higher wage level,

because those steps may materially increase selection odds. Analysts also note that budgeting and workforce planning may shift as companies assess how wage levels map to 1–4 entries.

Compliance, recordkeeping, and coordination implications

The wage-level emphasis raises enforcement stakes at both registration and petition stages.

- Employers should expect heightened scrutiny of wage-level determinations and related documentation.

- Proper recordkeeping will be important to defend the wage level used at registration and to support later petition filings.

The beneficiary-duplication rule will affect employer coordination, particularly where multiple entities might file for the same worker. Employers should plan and communicate to avoid unnecessary duplicates that provide no advantage.

Important: The rule is effective February 27, 2026, and the FY-2027 H-1B cap registration season will be the first test of the new 4-3-2-1 weighting.

Coordinate with all parties to prevent two or more entities from filing for the same beneficiary; duplicates won’t improve odds and can waste time, money, and trigger extra scrutiny.

Policy debate and potential litigation

The selection equity debate is likely to intensify as the effective date approaches.

- DHS and USCIS frame the higher-wage weighting as protecting U.S. workers’ wages.

- Critics argue it disadvantages early-career and entry-level H-1B roles and smaller employers that cannot match large employers’ wages.

- Opponents have signaled constitutional and statutory challenges, arguing wage level is an imperfect proxy for skill.

Litigation could delay implementation or alter the rule’s application, but DHS set February 27, 2026 as the effective date in the final rule publication. The FY-2027 cap registration season will reveal whether the 4-3-2-1 weighting reshapes who is selected and which jobs are most likely to move forward.

DHS has introduced a wage-weighted ‘4-3-2-1’ multiplier for H-1B selections, effective February 2026. This system replaces the random lottery, giving higher-paid roles (Levels III and IV) significantly better odds of selection. The reform aims to safeguard U.S. labor conditions but faces potential legal challenges from those arguing it hurts entry-level recruitment and smaller firms. Employers are advised to begin rigorous wage-level documentation immediately.