USA

Latest in USA

Korea Battery Industry Association Meets Ministry as U.S. Visa Issuance Stalls

South Korea meets with tech giants to resolve U.S. visa hurdles and immigration frictions threatening semiconductor and battery manufacturing investments.

Senate Bill 1247 Pushes E-Verify as Idaho Labor Department Weighs Rules

Idaho lawmakers advance three bills to mandate E-Verify usage for employers, ranging from public contractors to a universal mandate for…

Texas Governor Greg Abbott and Ron Desantis Freeze H-1B Visas, Squeezing Health Care

Texas and Florida governors freeze H-1B hiring at public universities, creating staffing crises for medical and STEM programs amid broader…

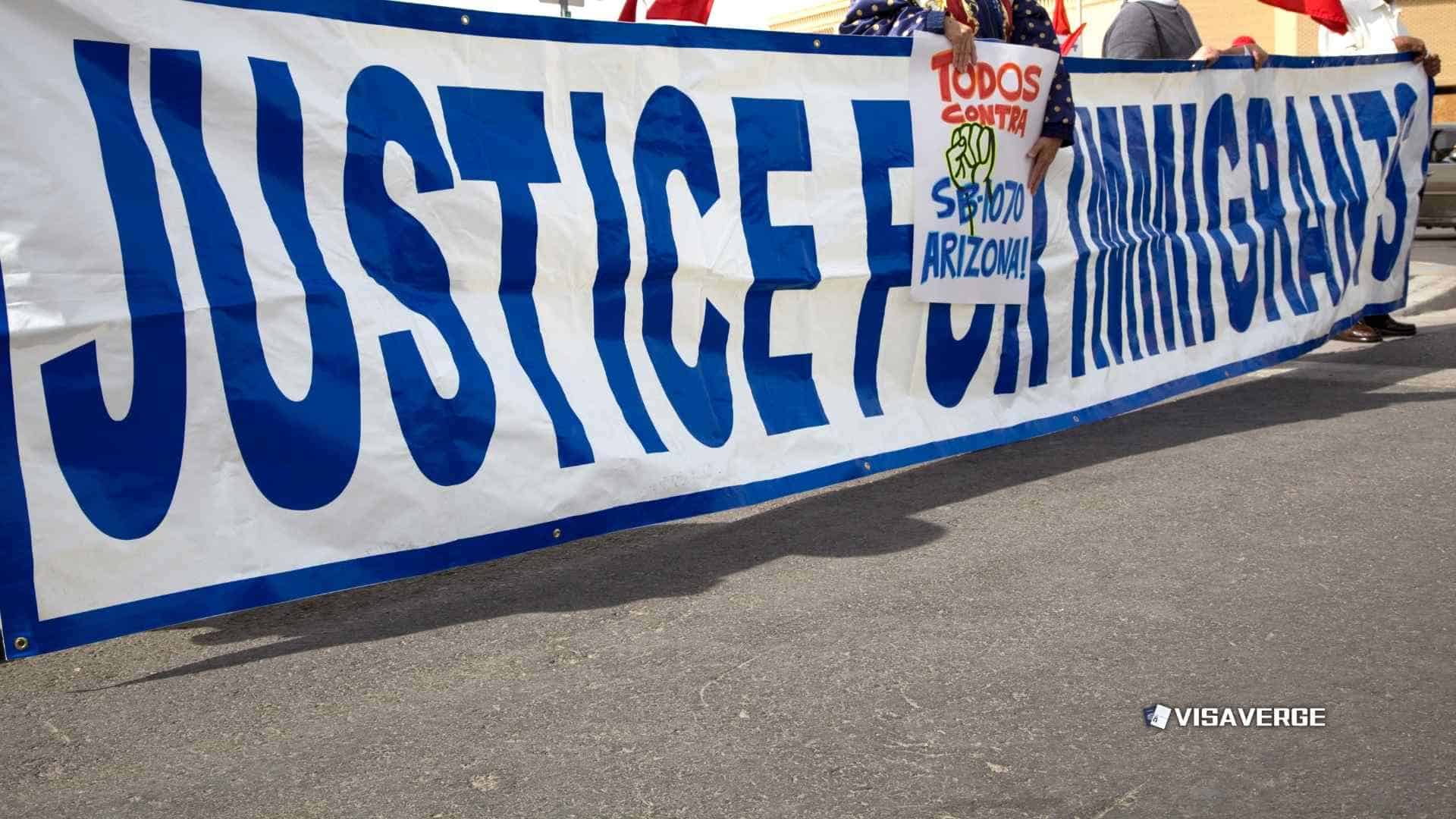

Usccb Issues Special Pastoral Message Condemning Mass Deportation

U.S. Catholic bishops issued a rare pastoral message condemning mass deportations and a 'climate of fear,' calling for dignity-based immigration…

Advocates Challenge CBP Policy Pressuring Children to Self-Deport

Advocates sue to stop a CBP policy using cash incentives and fines to pressure unaccompanied minors into self-deportation, alleging due…

Trump Promises Stronger Border Security in State of the Union as Concern Grows

Trump touts 'most secure border' in SOTU address amid record-low immigration approval and public concern over mass deportation tactics.

White House Considers Executive Order to Force Banks Collect Passport Data

Trump administration weighs requiring banks to verify customer citizenship, raising legal concerns over privacy and executive authority for current account...

House Committee Considers Ban on Masks for Police and Immigration Agents

Congressional talks on DHS funding stall over a proposed mask ban for federal agents, pitting accountability demands against officer safety…