USA

Latest in USA

ICE Detained Unaccompanied Minor from Bridgeway Shelter and Lost Him

(MINNEAPOLIS, MINNESOTA) — Parents and children in the United States generally have a right to family unity protections and to…

Department of Homeland Security Uses SAVE America Act to Verify Voter Eligibility

The House-passed SAVE America Act requires citizenship proof for voting but awaits Senate action; it focuses on verification, not targeting…

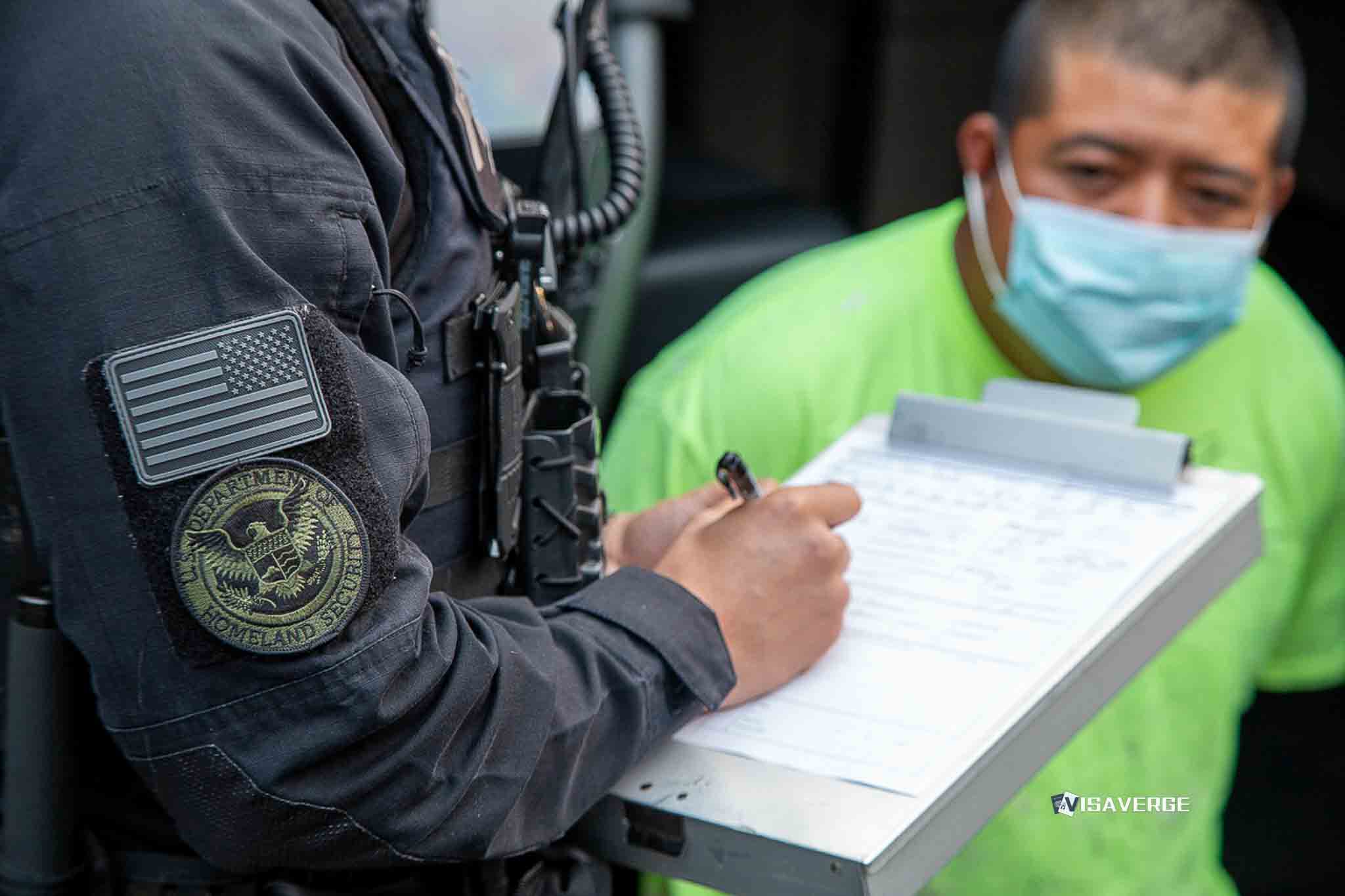

Operation Midway Blitz Expands Warrantless Arrests at DHS

Legal defense strategies emerge as Operation Midway Blitz continues in Chicago, focusing on challenging warrantless arrests and securing bond for…

Department of Homeland Security Expands Re-Vetting of Green Card Refugees

New DHS policy triggers re-screening and potential detention for refugees who haven't adjusted to permanent resident status within one year…

LA Council Opposes HUD-Funded Housing Rule Tying SAVE Verification to Consent Form

HUD proposes mandatory citizenship verification for all housing residents, ending self-certification and potentially impacting mixed-status families.

New Bill Aims to Limit Trump Administration ICE Warehouses and Detention Centers

Federal court restores surprise ICE inspections as 'warehouse' detention expands, shifting the oversight battle to local zoning and court-ordered transparency.

Department of Homeland Security Can Pause Work Permits for Asylum Applications

DHS proposes reforming asylum work permits, including a 365-day wait period and a potential pause on new issuances to manage…

Reform UK Pledges UK Deportation Command in Operation Restoring Justice

Reform UK proposes an 'ICE-style' Deportation Command and changes to settlement rights, highlighting the ongoing tension between enforcement and due…