Understanding Capital Assets and Tax Treatment of Gains and Losses

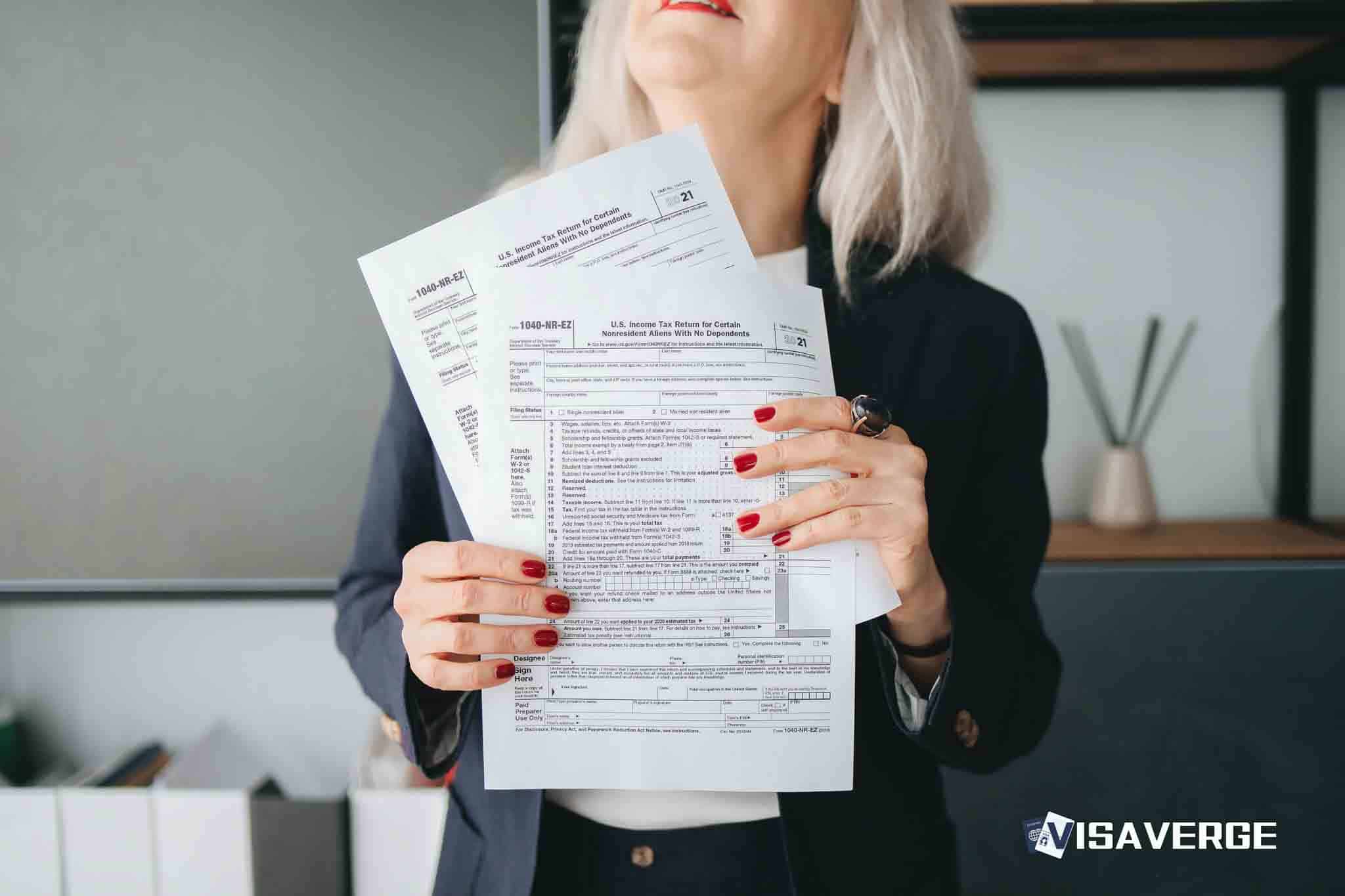

U.S. immigrants must report capital asset sales, including cryptocurrency gains, using IRS forms 8949 and 1040. Capital gains receive favorable tax rates compared to ordinary gains, which are taxed as…