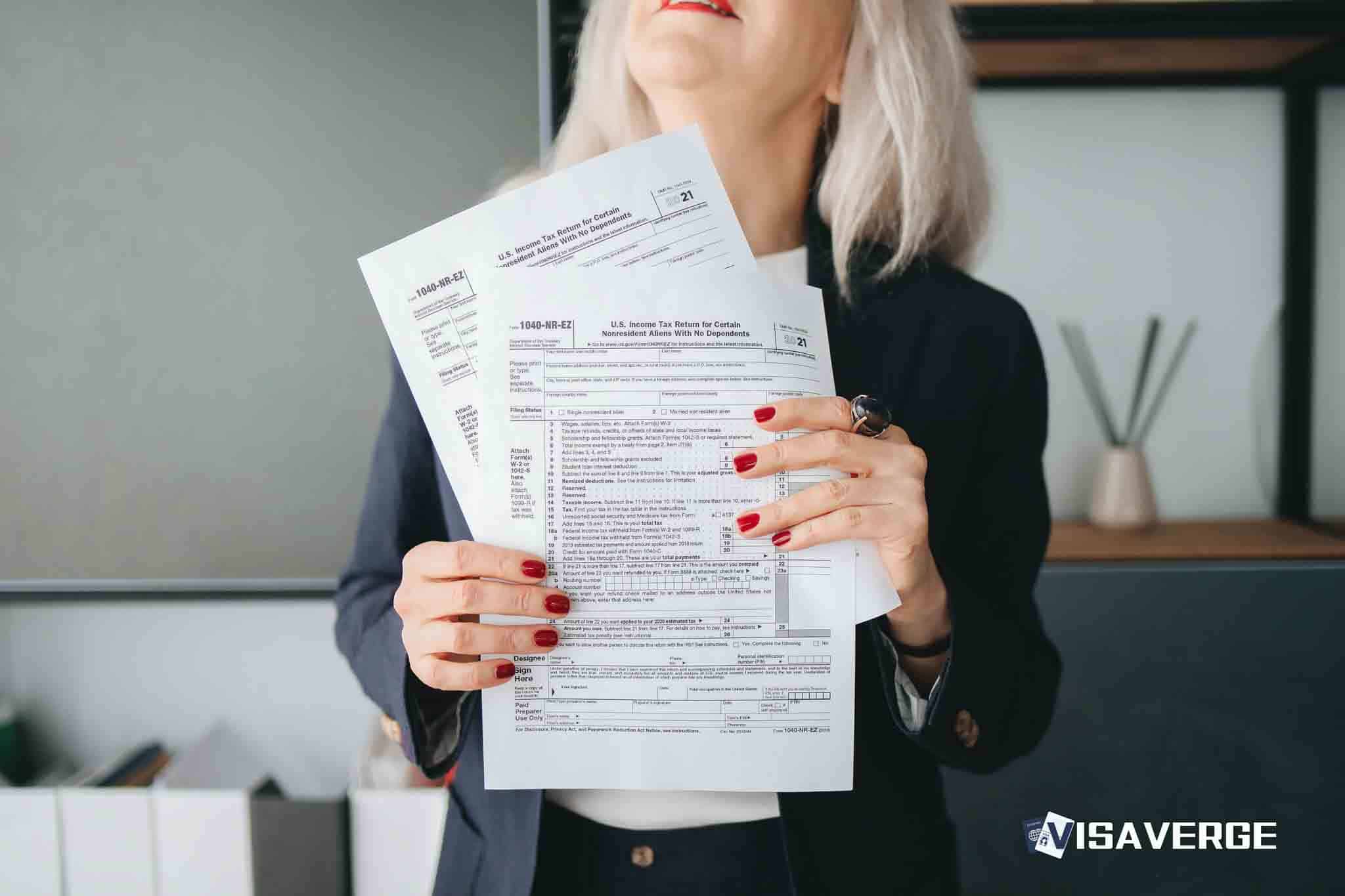

U.S.-India Tax Treaty and 401(k) Withdrawals: Key Facts for Indian Residents

Indian residents do not get treaty tax relief on U.S. 401(k) withdrawals and face a 30% U.S. withholding tax. Early withdrawals incur penalties. India taxes withdrawals normally but allows foreign…