Knowledge

Boost your visa and immigration Knowledge with our comprehensive guides, FAQs, and expert insights to navigate complex legal landscapes with ease.

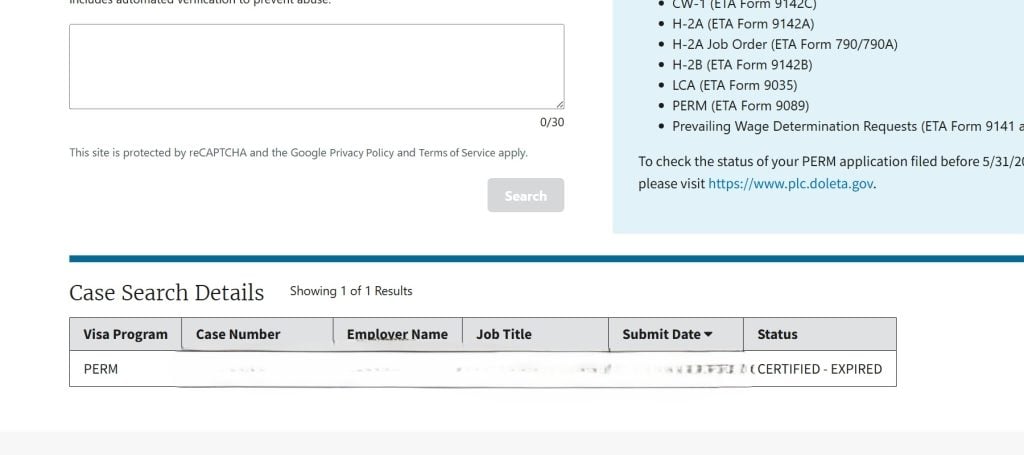

PERM Status Shows “Certified – Expired” After I-140 Approval: What It Means

The 'Certified - Expired' label on a PERM application merely signifies the end of its 180-day validity period. As long as the I-140 was filed within this window, the expired…

Harvard University Free Data Science Courses Open Through June 17, 2026

Harvard’s new seven-course online series offers free training in Data Science and AI foundations. Running through June 2026,…

Extend H-1B Visa Beyond Six-Year Limit with Green Card Steps

New H-1B rules for 2025-2026 emphasize merit-based selection and higher fees. Workers nearing their six-year limit must rely…

Digital Nomad Visas in 2026: Which Countries Are Becoming More U

The 2026 remote work environment provides U.S. citizens with diverse visa options abroad, provided they meet income and…

Understanding Weekly Year and Fiscal Year for U

This 2026 tax guide details the differences between calendar and fiscal years for individuals and businesses. It highlights…

Guide Explains U.S. Citizen, Real Estate, India Purchase Rules

U.S. citizens buying property in India, Australia, or the UK must comply with local ownership laws and U.S.…

Guide Clarifies Uniform Capitalization Rules Unicap Internal Revenue Code

The UNICAP rules under IRC §263A require many U.S. businesses to capitalize production and resale costs into inventory.…

Tax Filing Season 2026 Requires Forms for International Students, Nris

The 2026 U.S. tax season requires international students and NRIs to file specific forms like 8843 and 1040-NR.…

After-Tax vs Pre-Tax Return Comparisons: Why the Money You Keep Matter…

Most taxpayers must file 2026 returns by April 15, 2027. For globally mobile individuals, focusing on after-tax returns…

Compliance First, Tax Filing, on Time Required for Nonresident Students

Filing U.S. taxes is an essential immigration compliance step. Noncitizens must file required forms, like Form 8843 or…