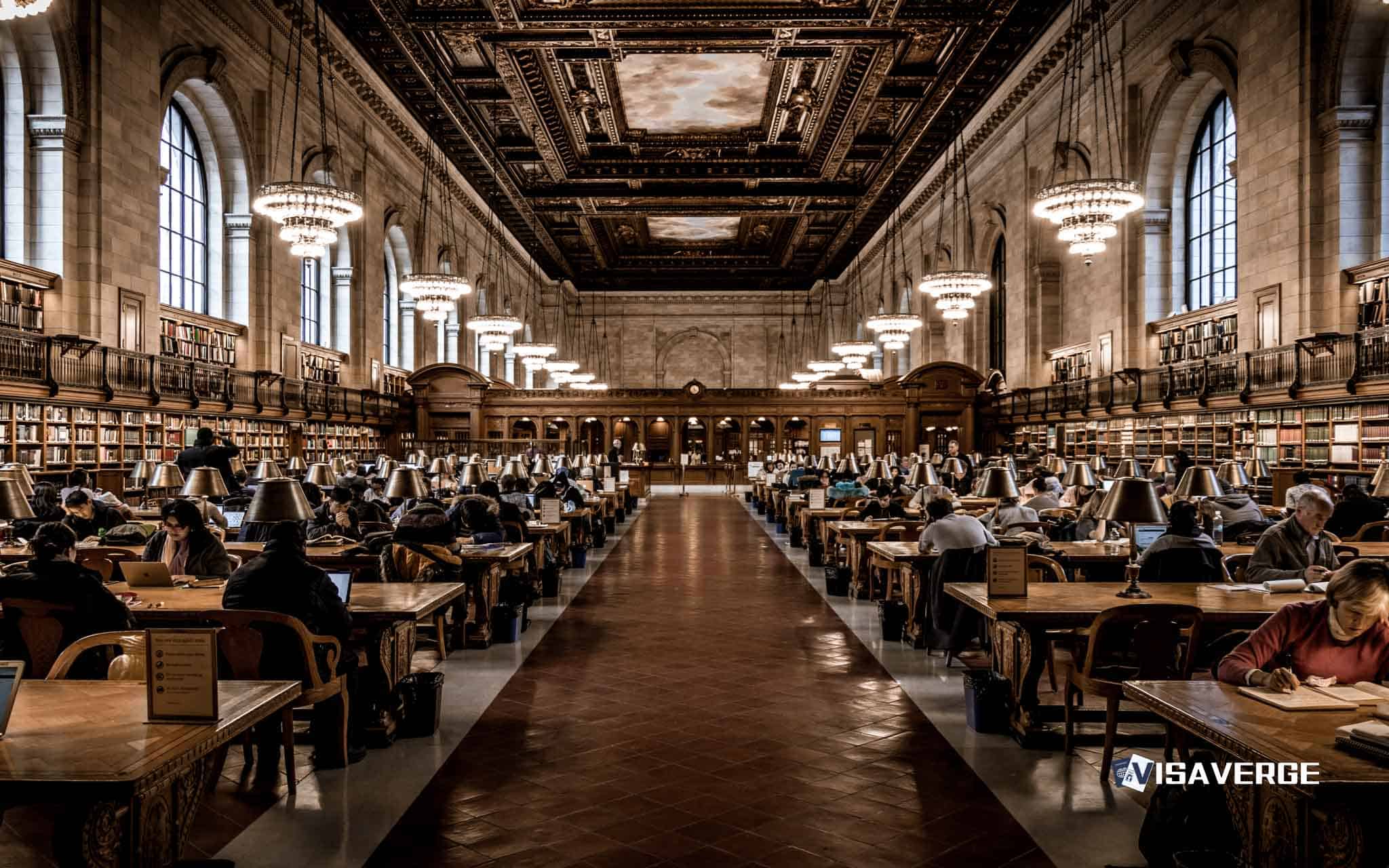

Knowledge

Boost your visa and immigration Knowledge with our comprehensive guides, FAQs, and expert insights to navigate complex legal landscapes with ease.

Filing U.S. Taxes for NRIs and International Students: A Guide

International students (F-1, J-1, M-1) must file Form 8843 annually; those with U.S. income file Form 1040-NR. State returns may apply. Timely, correct filing preserves refunds and avoids immigration complications.

From F-1 to H-1B: A Practical Guide for U.S. Employment

New rules add a $100,000 fee for new H-1B petitions starting September 21, 2025, and shift selection toward…

H-1B Payroll and Tax Deductions: Real-World Case Studies Explained

H-1B hires often see lower take-home pay because mandatory federal, state, FICA taxes, and benefit elections reduce gross…

F-1 FICA Tax Refund: Exemption Rules and How to Claim

F-1 students are generally exempt from FICA during their first five calendar years as nonresident aliens. If payroll…

SSN vs ITIN for Non-Residents: Who Qualifies and Why It Matters

Choose SSN if authorized to work; choose ITIN if you must file U.S. taxes but aren’t SSN-eligible. SSN…

Understanding the SSA, SSN, and Employee Benefits in the U.S.

The SSA issues SSNs that link wages to retirement, disability, and survivor benefits and support immigration checks. F-1…

Applying for an SSN as an F-1 Student or H-1B Worker

F-1 students (with CPT/OPT or on-campus jobs) and H-1B employees must apply in person with Form SS-5 and…

Wealthy Foreigners Paid Weekend Safaris to Kill Civilians in Sarajevo

The documentary Sarajevo Safari alleges foreigners paid to shoot civilians during the 1992–1996 Sarajevo siege, naming routes through…

Indian Tax Residency 2025: 182/60-Day Rules and Update Implications

Greater 2025 coordination among India, Canada and the U.S. is increasing automated cross‑border tax notices. Migrants must file…

U.S.–Canada SSA: Totalisation, Detachment Rules, and Benefit Portability

Since August 1, 1984, the U.S.–Canada Totalisation Agreement prevents double pension deductions, uses a 60‑month detachment rule, and…