Documentation

Latest in Documentation

Judge Orders Unsealing of Records in Maryville Tennessee Case of Diego Alberto Hernandez Garcia

A Tennessee federal court has unsealed documents revealing that ICE allegedly violated a stay of removal during the deportation attempt…

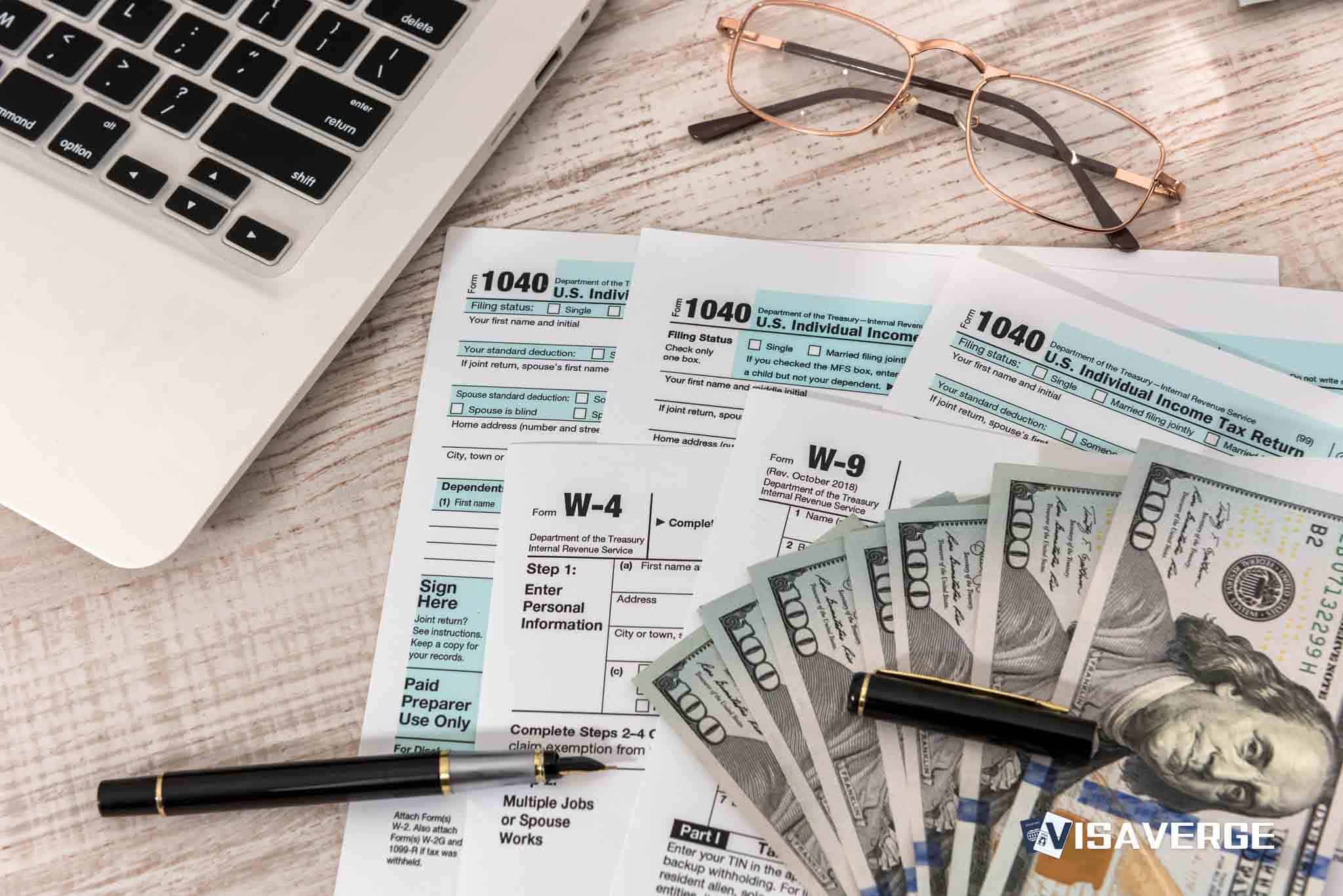

IRS Ends Paper Refund Checks and Pushes Direct Deposit Under Executive Order 14247

Starting in 2026, the IRS will make electronic direct deposit the default for tax refunds, ending most paper checks. This…

DOL Pauses Some PERM Processing Ahead of Government Shutdown January 30, 2026

A potential government shutdown on January 30, 2026, could suspend Department of Labor PERM processing. While USCIS stays open, the…

US Guidance Revises Change of Status (cos) and H-1B 60-Day Grace Period

The FY 2027 H-1B cap season introduces wage-weighted selection rules effective February 27, 2026. This update covers essential registration timelines,…

H-1B Workers Face New Rules After 60-Day Grace Period Ends I-94

The FY 2027 H-1B cap season kicks off in March 2026 using the beneficiary-centric model. Employers and workers must act…

FAA and TSA Advance 14 CFR Part 108 to Digital Flight Rules (dfr) Bvlos

The FAA is standardizing BVLOS drone flights under Part 108, expanding weight limits to 1,320 pounds and requiring TSA security…

House Panel Okays Bill for Digital Pilot Certificates

H.R. 2247, approved by a House Committee, authorizes the use of digital pilot and medical certificates for FAA and TSA…

U.S. Expands Requirements Under Canada-U.S. Visa and Immigration Information-Sharing Agreement, Expanded Data Sharing, Making America Safe Again

The U.S. and Canada have expanded their immigration data-sharing agreement to include biometrics for permanent residents. Under DHS Secretary Kristi…