Documentation

Latest in Documentation

Colorado Must Share Medicaid Data with Immigration Authorities

A federal ruling permits CMS to share limited identifying Medicaid data from Colorado with immigration authorities. Although clinical records are…

DHS Ends Temporary Protected Status for Yemen

The U.S. government is terminating Yemen’s TPS designation. The termination triggers a 60-day window from the date of Federal Register…

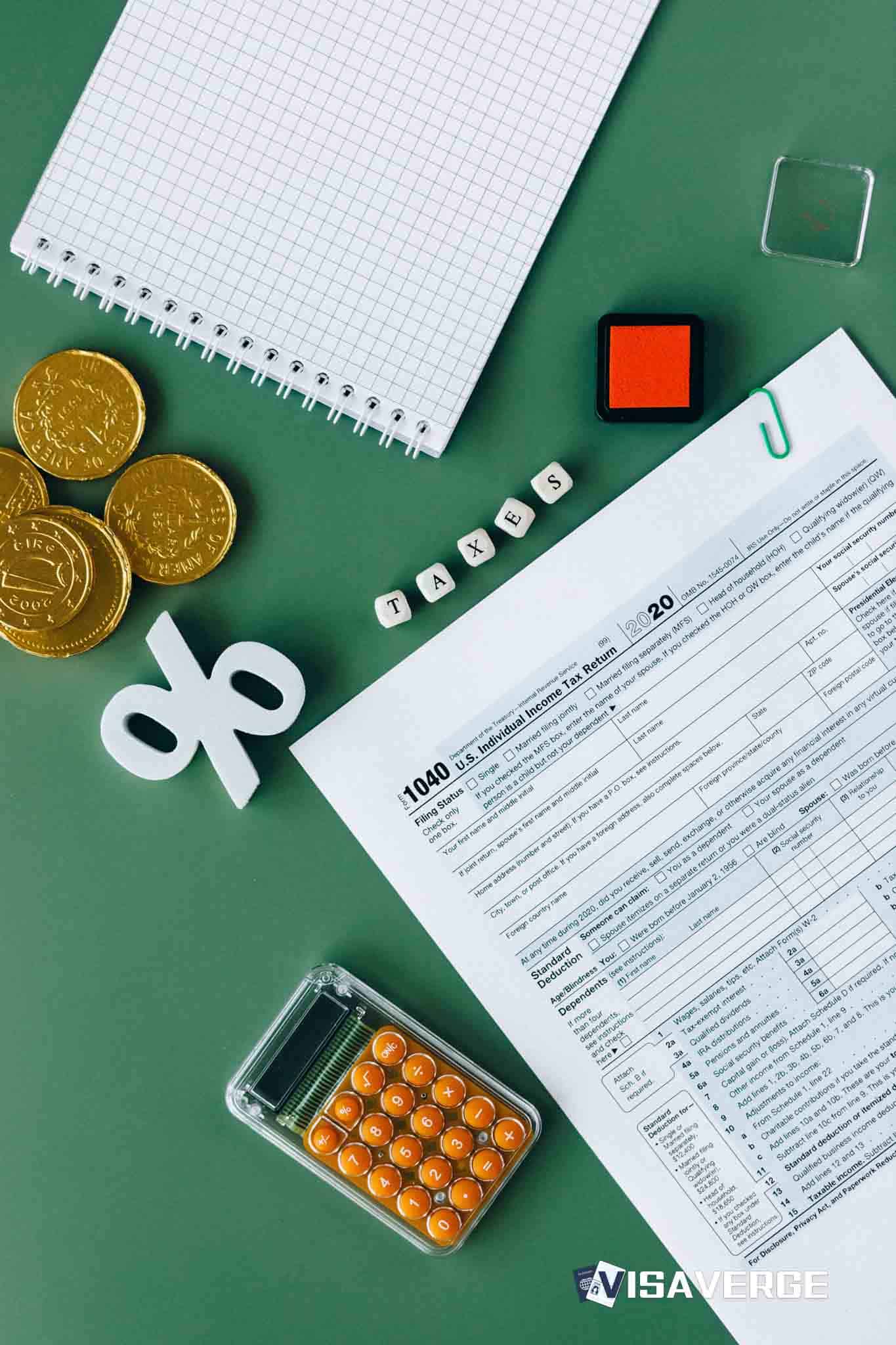

Immigrant Taxpayer Data Shared with DHS in Privacy Breach

The IRS has admitted to improperly sharing confidential taxpayer information with DHS/ICE, violating federal privacy statutes. This breach affects thousands…

Mayor Laredo Slams Newton with Bold Executive Order

Newton, Massachusetts, has implemented an executive order limiting how city resources assist federal civil immigration enforcement. Key restrictions include banning…

Missouri Bills Could Require Proof of Legal Status to Send Money Abroad

New Missouri legislation seeks to block foreign money transfers unless senders prove legal immigration status. Targeting licensed providers like Remitly…

1040 vs 1040nr: International Students Warned About IRS Penalties for Tax Filing Mistakes

The 2026 tax filing guide for international students outlines how to avoid common pitfalls like using Form 1040 instead of…

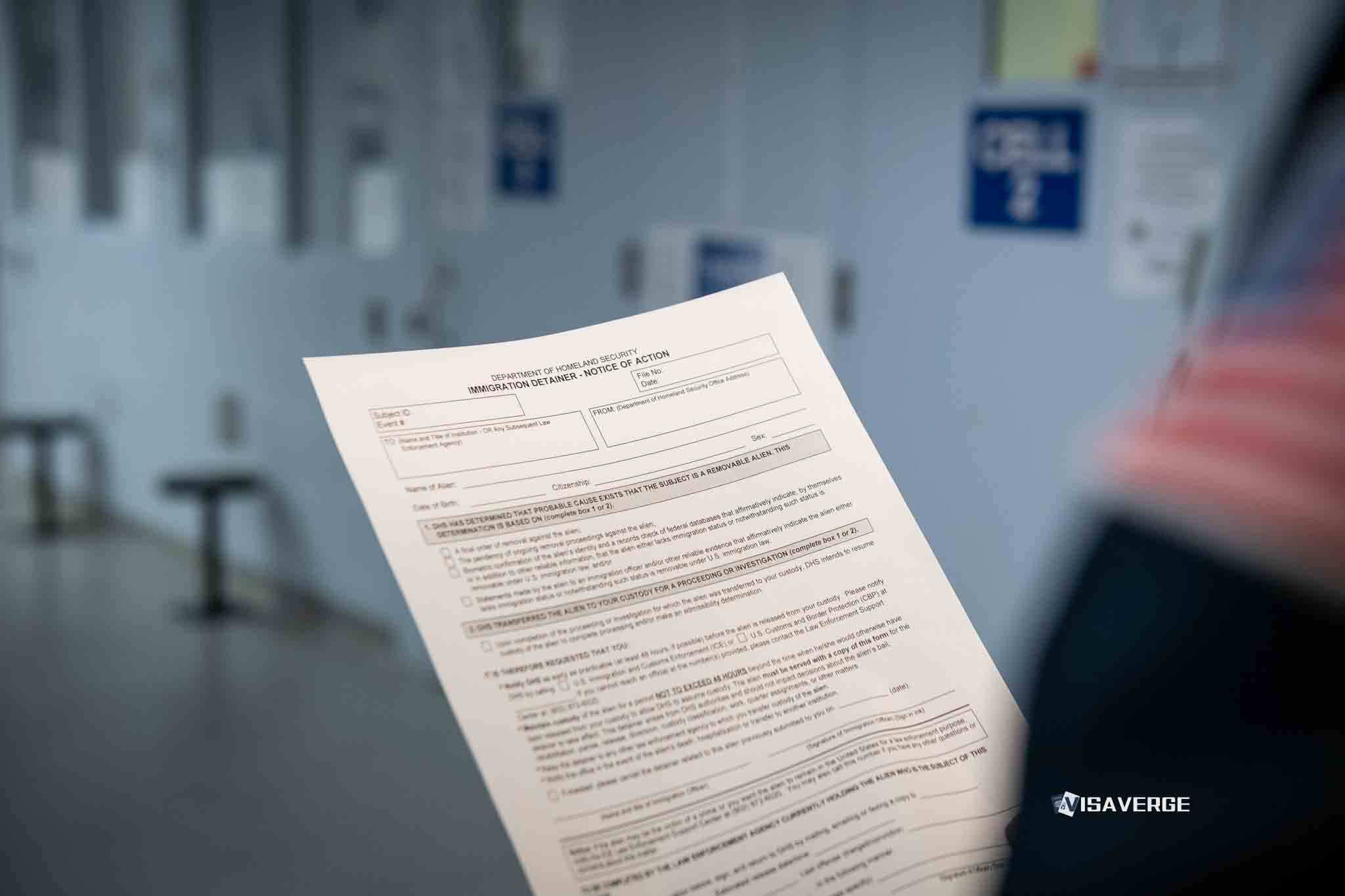

ICE Accused of Forging Signature in Detention of Irish National Seamus Culleton

Irish national Seamus Culleton is at the center of a diplomatic dispute after being detained by ICE in Texas. His…

New Income Tax Draft Rules Insert Rule 166 to Define Return as Defective

The Indian government has proposed Rule 166 to standardize what makes a tax return 'defective.' This is vital for cross-border…