Finance Act 2025 Tightens Income-Tax Act 1961 Section 2(15) on Charities

India's Income-tax Act requires trusts to apply 85% of income to charitable goals and follow strict registration and…

Sai Sankar is a law postgraduate with over 30 years of extensive experience in various domains of taxation, including direct and indirect taxes. With a rich background spanning consultancy, litigation, and policy interpretation, he brings depth and clarity to complex legal matters. Now a contributing writer for Visa Verge, Sai Sankar leverages his legal acumen to simplify immigration and tax-related issues for a global audience.

www.visaverge.com

India's Income-tax Act requires trusts to apply 85% of income to charitable goals and follow strict registration and…

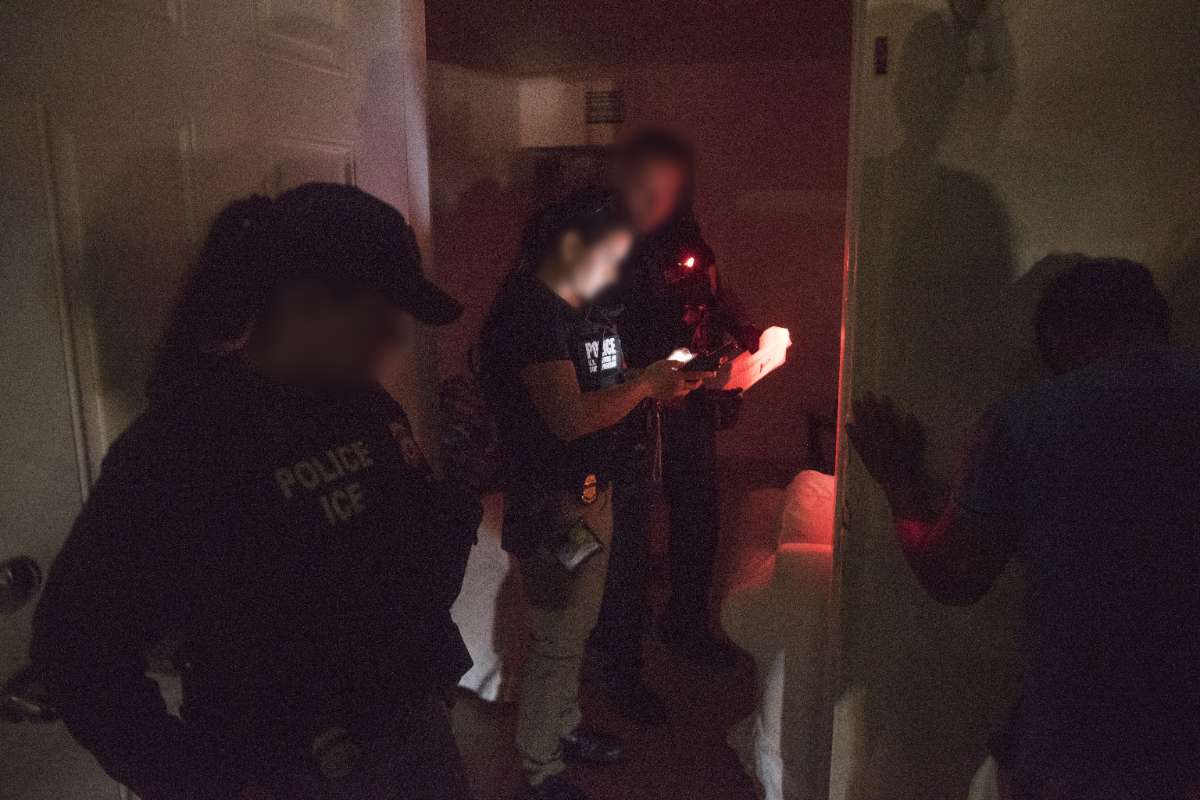

Columbia student Elmina Aghayeva was arrested on campus by DHS and released after mayoral intervention; she now faces…

Columbia student Elmina Aghayeva was detained by DHS over a visa dispute and released following intervention by NYC’s…

The DOL and DHS are raising H-1B wage standards and implementing a wage-weighted lottery for FY 2027, prioritizing…

The UK enters fast-track talks with the U.S. to shield exporters from a new 15% global tariff, aiming…

Finance Act 2025 clarifies Section 2(22)(e) deemed dividends, emphasizing a shareholder-centric approach to prevent litigation and tax disguised…

U.S. visa delays and strict policies are triggering a mental health crisis and 'visa limbo' for Indian families,…

Global Entry suspended amid government shutdown; TSA PreCheck remains active after DHS reversal. International travelers face longer lines…

The detention of a Colombian Congresswoman’s son in Louisiana sparks debate over ICE enforcement discretion and the detention…

Tech workers adopt side businesses as insurance against layoffs, while visa holders must navigate strict legal limits on…

Get weekly visa policy updates, processing time alerts, and expert analysis delivered to your inbox.