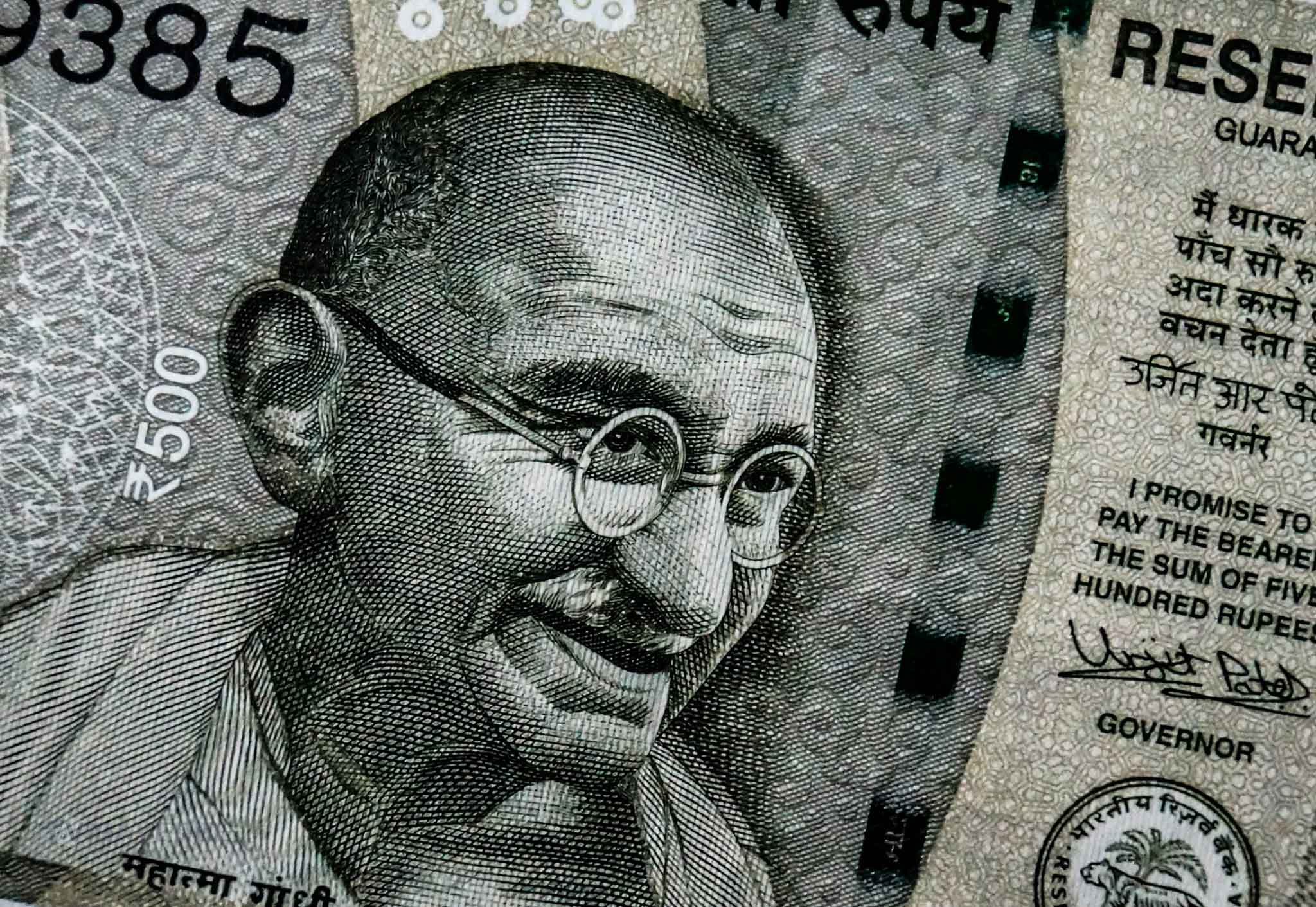

(UNITED STATES) Indian IT firms are bracing for a sharp increase in hiring costs in the United States 🇺🇸 after a new H-1B Visa Fee took effect on September 21, 2025. The policy adds a one-time $100,000 surcharge to each new H-1B petition, leaving renewals and existing H-1B holders untouched for now. Ratings agency Crisil says the fee could shave 10–20 basis points off operating margins, and expects many companies to pass 30–70% of the added cost to clients through price resets, contract tweaks, or revised delivery models.

Crisil’s projection reflects how the fee lands squarely on new hires. In the short term, the immediate shock may be muted because extensions and current workers remain exempt. But for fresh U.S. placements, the math changes fast, especially for large Indian IT firms with major exposure to the American market.

The U.S. accounts for roughly 53% of revenue across the top players, and international business overall makes up about 96% of their sales mix. That concentration means pricing decisions and project economics tied to the H-1B route will ripple through financial results far beyond a single quarter.

Policy window, mechanism and uncertainty

The timing adds to contract uncertainty. The policy is currently set for 12 months, through September 20, 2026, with the option to extend. Agencies have not finalized the payment mechanism or clarified all edge cases, including how the fee will apply to potential waivers.

Officials also have yet to publish standards for any national interest waivers, which the policy says may be available. For now, companies must plan as if the surcharge will apply to new H-1B petitions filed within the window, then adjust once agencies issue instructions.

Important: Agencies are expected to issue payment and waiver instructions as the policy beds in, which could narrow open questions around cap-exempt filings and employer changes.

Policy details and open questions

- The $100,000 fee applies only to new H-1B petitions filed on or after September 21, 2025.

- It does not apply to renewals, existing H-1B holders, or petitions filed before the effective date.

- The fee is a one-time charge for each new petition, not a recurring, annual payment.

- The policy runs for 12 months, with a possible extension.

- Agencies have not confirmed the payment process or the handling of certain case types.

- Waivers tied to national interest may be possible, but rules are pending.

These details matter for both staffing and sales teams. If a project needs a new H-1B employee onsite in the U.S., the fee would apply under the current terms. If the role can be filled by an existing H-1B worker or a U.S. hire, the surcharge would not apply. Deal teams will now weigh those choices alongside client deadlines and service-level commitments.

According to analysis by VisaVerge.com, the fee’s design focuses pressure on initial employment moves rather than on retaining current foreign workers, which could drive more “stay-in-place” staffing, internal transfers, or offshore-first delivery in the near term.

Industry impact: pricing, delivery models, and talent decisions

Crisil expects 30–70% of the new cost to be passed to clients. That range reflects how competitive dynamics shape who pays. In new deals, providers may try to price in part of the surcharge up front. In renewals, providers might seek mid-cycle adjustments if the contract involves new H-1B onboarding. Where clients resist, firms may rebalance work toward offshore centers, nearshore hubs, or local U.S. hiring to avoid triggering the fee.

Several structural trends support Crisil’s view:

- Declining dependence on H-1B visas: From 2017 to 2025, H-1B headcount at top Indian IT firms—TCS, Infosys, Wipro, HCL—fell from 34,507 to 17,997, a roughly 9% annual decline. Firms have built deeper offshore delivery, added nearshore capacity, and hired more local staff in the U.S.

- Rising visa cost share: Traditional visa costs of $2,000–$5,000 were a sliver of employee expense (0.02–0.05%). With the new fee, if new H-1Bs remain around 35% of approved H-1B employment, overall visa spend could approach 1.0% of total employee cost. If the share of new H-1Bs falls, visa costs may land in the 0.3–0.6% range.

- Revenue exposure: Heavy U.S. revenue reliance means the fee’s impact is concentrated in the market where many Indian IT firms run their largest, most complex programs.

Providers with modest margins face harder choices. Even a 10–20 basis point hit can push companies to:

- Cut costs elsewhere

- Adjust staffing pyramids

- Shift delivery to locations with lower total cost

Possible tactical responses include splitting projects into offshore-heavy phases, reserving onsite roles for U.S. hires or current H-1B holders, and pushing for shorter, more flexible contracts that allow faster repricing if the policy extends past September 2026.

Talent pipeline and student choices

The policy could affect the talent pipeline. For many international students, the H-1B route after a U.S. degree is a key draw. Higher employer costs and added uncertainty may nudge students to consider Canada, Europe, or Asia for study and work—particularly in fields where remote and hybrid delivery work well.

Over time, that shift could shrink the pool of graduates ready for U.S. roles tied to specialty occupations. For workers:

- Current H-1B employees and those up for extensions are shielded for now.

- New graduates abroad hoping for a first H-1B placement face tougher odds unless employers can justify the surcharge or route them through offshore roles first.

- Some graduates may start careers in India or other locations and seek U.S. roles later if the fee ends or waivers apply.

Client and procurement implications

Clients will see more proposals that mix onsite, nearshore, and offshore staffing to spread risk. Expect:

- Tighter scrutiny of roles that truly require physical presence in the U.S.

- Greater use of cost-sharing clauses, repricing triggers, and explicit rules on when new H-1B hiring is permitted within a project.

- Procurement teams revisiting vendor mixes—firms heavily reliant on new H-1B staffing may bid higher, while those with large local benches or strong offshore delivery may price more competitively.

This will intensify competitive pressure in segments like application development, cloud migration, and managed services—areas where scope can shift across borders without degrading quality.

Operational unknowns and conservative planning

Some operational questions remain unresolved:

- Whether certain cap-exempt employers (universities, nonprofit research groups) will face the surcharge for new hires.

- How change-of-employer petitions will be treated when the worker is outside the U.S. at filing.

Until agencies publish guidance, legal and compliance teams will likely build conservative playbooks that assume broad application to new first-time H-1B petitions during the effective period.

Timing and strategic hedging

Timing matters. If the policy sunsets on September 20, 2026 without extension, firms might delay some new H-1B hiring to avoid the surcharge. But delaying carries risks:

- Demand spikes could crowd the next filing cycle.

- Rules could extend.

Many firms will hedge by designing delivery plans with switchable routes—using current H-1B holders now, hiring locally where possible, and keeping offshore teams ready to scale.

What to watch next

In the months ahead, watch for three signals:

- Disclosures from major Indian IT firms on pricing and margin guidance; mention of pass-through rates near 30–70% will indicate client receptiveness.

- Hiring patterns in the U.S.; a tilt toward local recruitment and nearshore centers would confirm a shift away from new H-1B use during the fee window.

- Student application trends for U.S. graduate programs in tech and engineering; a dip would hint at a slower future pipeline for specialty roles.

For official baseline information on H-1B classifications and program rules, consult the U.S. government’s H-1B overview at USCIS H‑1B Specialty Occupations.

VisaVerge.com reports that agencies are expected to issue payment and waiver instructions as the policy beds in, which could narrow the open questions around cap-exempt filings and employer changes.

Key takeaway

For now, the fee’s narrow scope—only new petitions, not renewals—keeps existing teams stable. But each new U.S. role must clear a steeper cost hurdle. In a sector defined by tight contracts and global delivery, that single change is enough to reset playbooks for Indian IT firms and their clients across the Atlantic. Firms with strong offshore depth, diversified client portfolios, and the ability to move work across time zones will likely absorb the shock better. Those that rely on frequent new H-1B onboarding may need to adjust fast or accept margin compression.

This Article in a Nutshell

A new H-1B visa policy effective September 21, 2025 imposes a one-time $100,000 surcharge on each new H-1B petition filed during a 12-month window ending September 20, 2026. Renewals and existing H-1B holders are excluded, but agencies have not yet clarified payment mechanisms or waiver standards. Ratings agency Crisil warns the fee could shave 10–20 basis points off operating margins and expects firms to pass 30–70% of the added cost to clients through price resets, contract terms, or delivery-model shifts. Heavy U.S. revenue exposure (about 53%) and near-total international sales mix (96%) mean pricing and staffing choices will ripple across results. Firms may respond by prioritizing offshore delivery, hiring locally in the U.S., reworking contracts, or using current H-1B employees to avoid the surcharge. The policy could also influence international student choices and long-term talent pipelines. Companies and clients should monitor agency guidance on payment and waivers and prepare conservative staffing and procurement playbooks.