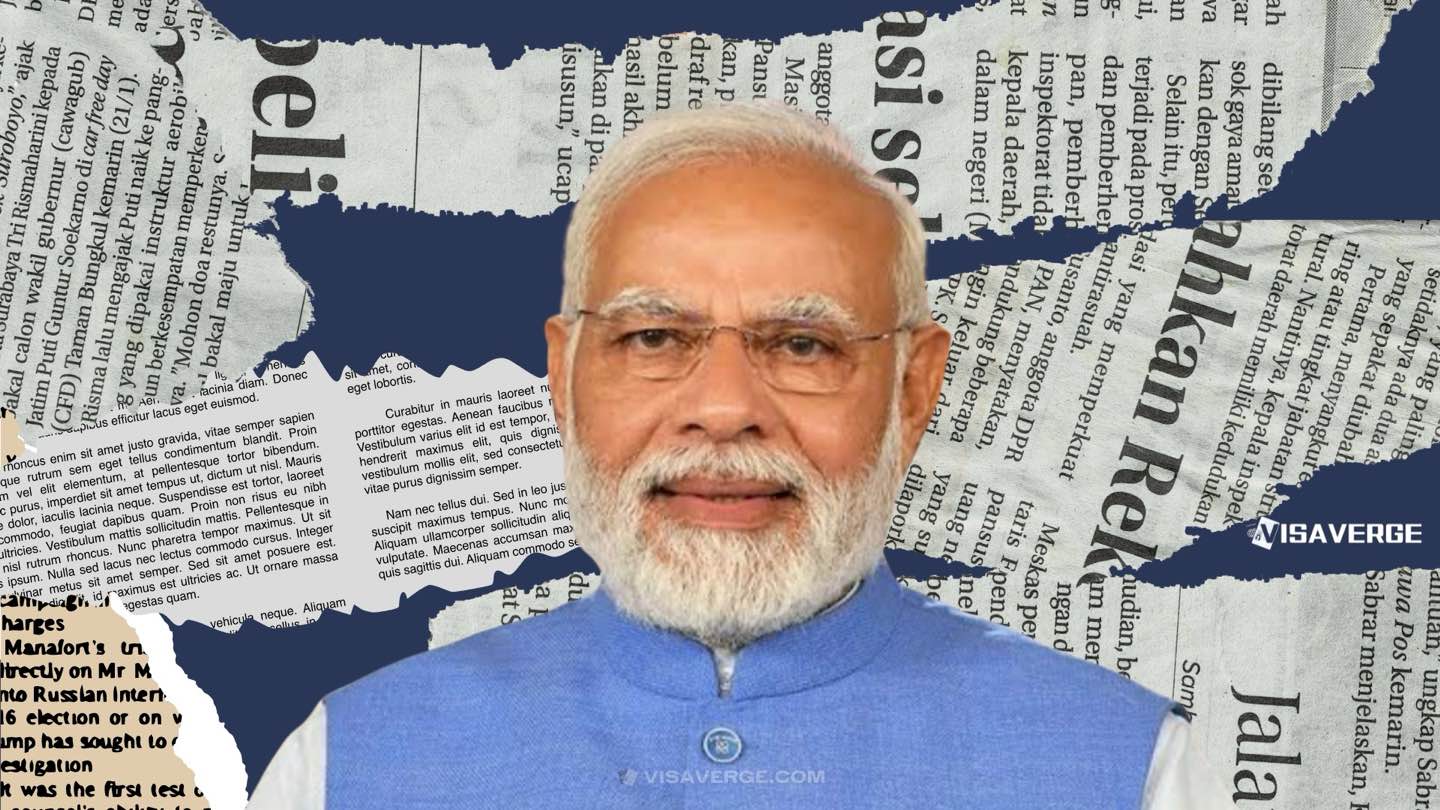

Prime Minister Narendra Modi announced sweeping income tax relief and broad GST rate cuts that take effect on September 22, 2025, marking what the government calls GST 2.0. In a national address on September 21, he said the combined measures will lead to an estimated ₹2.5 lakh crore in annual savings for people across the country.

The changes include making income up to ₹12 lakh tax-free and a major rewrite of GST slabs to two main rates—5% for essentials and 18% for most goods and services—plus a special 40% slab for luxury and sin goods. The government framed the rollout as a “GST Bachat Utsav (Savings Festival),” and urged the public to support ‘Swadeshi’ goods to build self-reliance.

Key headline measures

- Income tax: Up to ₹12 lakh is now tax-free, benefiting the middle class, neo-middle class, and low-income households.

- GST rate overhaul:

- 5% for essentials and many previously 12% items.

- 18% for most goods and services (replacing most 28% items).

- 40% special slab for luxury and sin goods (pan masala, tobacco, aerated drinks, high-end cars, yachts, private aircraft).

- Estimated annual savings: ₹2.5 lakh crore nationwide.

- Start date: September 22, 2025 (changes take effect on invoices and filings from this date).

Income tax changes and household impact

The expansion of the zero-tax threshold to ₹12 lakh is designed to put more money in the hands of:

- Salaried workers

- Small business owners

- Low-income households

Benefits and effects:

- Clear increase in take-home pay for many.

- Lower compliance pressure and simpler rules for taxpayers.

- Faster refunds and simpler filing promised by the government.

GST rate changes — what shifts and why it matters

This is the biggest GST remap since 2017. Officials say the GST Council — representing Centre and States — has reached consensus to ensure a stable rollout.

Major shifts:

- Items previously at 12%: ~99% move to 5%.

- Most items previously at 28%: move to 18% for regular goods and services.

- 40% applied to luxury and sin categories (some tobacco products to remain under existing compensation cess until further notice).

Household items seeing major changes:

- NIL GST: UHT milk, pre-packaged paneer, Indian breads.

- 5%: Soaps, shampoos, toothbrushes, toothpaste, tableware, bicycles, many packaged foods (namkeens, sauces, pasta, chocolates, coffee, preserved meat).

- 18%: Electronics like TVs (>32″), air-conditioners, dishwashers; cement.

- 5% for core construction inputs: marble, granite blocks, sand-lime bricks, bamboo flooring.

Overall, 375 items see reduced GST rates, including medicines and insurance.

Consumer and retail effects

- Lower bills for daily needs; big-ticket purchases become more affordable.

- Retailers expected to display discounts on eligible items during the GST Savings Festival so consumers see price drops on shelves and invoices.

- Promised improvements: digital filing, faster refunds, simpler registration, and return filing — all aimed at reducing compliance headaches for small firms and startups.

Economic rationale and sector impacts

The Finance Ministry calls this a growth push. Expected outcomes:

- Boost in consumption and manufacturing as prices fall.

- Demand rise in electronics, FMCG, construction sectors.

- MSMEs benefit from easier filing, lower compliance costs, and improved cash flow via faster refunds.

Independent analysis (VisaVerge.com) suggests a simpler two-rate structure could reduce disputes and aid planning for thin-margin businesses.

Political and social framing

Prime Minister Modi characterized the reforms as a “double bonanza” and tied them to rising incomes and social mobility:

- He highlighted that 25 crore people have moved out of poverty over the last 11 years, forming a “neo-middle class.”

- He urged pride in ‘Swadeshi’ products, arguing that buying Made in India items strengthens local jobs and supply chains.

Finance Minister Nirmala Sitharaman led the GST Council’s rate rationalization, with officials arguing states will benefit from a wider tax base as demand rises.

Policy changes overview (concise)

- Income tax: Up to ₹12 lakh tax-free; standard e-filing procedures apply above this threshold.

- GST slabs: 5%, 18%, and a 40% special slab for luxury/sin goods.

- Items affected: 375 items with reduced GST.

- Compliance improvements: Digital filing, faster refunds, simpler registration and returns.

- Retail: Mandatory clear display of revised prices and festival-linked discounts.

Practical steps for businesses and individuals

Important actions to complete before September 22, 2025:

- Update ERP, billing, and point-of-sale systems with the new GST rates so invoices from September 22 reflect the correct tax.

- Train sales and finance teams on:

- Display rules for discounts tied to the GST Savings Festival.

- Documentation needed for refunds and claims.

- Review contracts, quotes, and pricing issued before the change to avoid disputes over inclusive versus exclusive pricing.

For individuals:

– Those with income above ₹12 lakh continue standard e-filing; employers will adjust TDS to reflect the new exemption.

– Maintain basic income records even if within the new zero-tax bracket.

Impact on specific groups

- Residents and families: Lower costs for school supplies, toiletries, packaged foods, and consumer durables.

- Migrant workers: Cheaper staples for families back home; reduced cost of electronics helps access to education and work tools.

- Companies (including foreign-owned): Need rapid re-labeling, price-list updates, staff briefings, and testing of digital filing changes.

- Procurement managers: Can renegotiate contracts to pass tax savings onto buyers.

- State governments: Will monitor revenues; GST Council committed to continued oversight and possible adjustments.

Warnings, monitoring, and expert commentary

Watch for collection shifts and state revenue impacts. While simplification wins praise, experts urge careful monitoring and possible compensation adjustments if collections dip during transition.

Other expert views:

- Consumer groups: Broadly welcomed relief on essentials and medicines.

- Industry bodies (electronics, FMCG, construction): Expect a demand bump.

- Tax professionals: Welcome fewer slabs and fewer classification disputes, but advise tight documentation and early adoption of digital tools.

Expected macro effects

- If the projected ₹2.5 lakh crore in annual savings flows into consumption, investment, and debt repayment, the economy could see higher factory utilization and potential hiring in consumer-facing sectors.

- The 40% luxury/sin slab is intended to offset revenue loss from lowered rates on essentials and general goods, but fiscal watchers will track whether it balances the budgetary impact.

Further information and official resources

For official notifications, rate details, and updates on return filing, the government directs taxpayers and businesses to the Official GST portal.

This Article in a Nutshell

On September 21, 2025, Prime Minister Narendra Modi announced sweeping tax reforms effective September 22, 2025: income up to ₹12 lakh will be tax-free and GST will be reconfigured into three slabs — 5% for essentials, 18% for most goods and services, and a 40% slab for luxury and sin items. The changes affect around 375 items with many moving from 12% to 5% and most 28% items to 18%. The government projects annual savings of ₹2.5 lakh crore and promises improved digital filing, faster refunds, and simpler registration. Businesses must update billing systems and train staff, while states will monitor revenue implications as consumption patterns evolve.